EU may have had more leverage in U.S. trade talks, study finds

The United States leans more on the European Union for imported goods than many assume, and that reliance has deepened over time, according to a new review by Germany’s IW economic institute.

The study finds the EU now tops China for both the value and the count of product groups on which U.S. buyers depend, underscoring how closely tied the two economies have become. IW says the number of product groups where at least half of U.S. imports came from the EU climbed to more than 3,100 in 2024, up from over 2,600 in 2010.

That marks a sharp rise in categories where Europe supplies most of the goods Americans buy from abroad. The institute notes that these goods span everyday industrial staples and advanced inputs, including chemical products, electrical goods, machinery, and equipment.

von der Leyen may have had stronger position in tariff talks

The findings carry weight for policy. IW argues that European Commission President Ursula von der Leyen may have had more leverage than recognized in recent tariff talks with Washington, which resulted in a 15% baseline rate on most EU goods.

In dollars, the U.S. import value tied to those EU-supplied product groups reached $287 billion last year, nearly two and a half times the level seen in 2010. By the institute’s count, China covered 2,925 such product groups in 2024, with a combined value of $247 billion. IW says U.S. dependence on China has eased over the years amid an evident “de-risking” push, as companies and officials sought to reduce exposure to a single supplier.

Yet the EU’s durable share in many categories suggests some items will be hard to swap out quickly if trade friction flares. Products with persistently high import shares are “likely to be difficult to replace in the short term,” the institute warns, a point it says Europe should remember if tensions rise.

EU may consider export restrictions if tensions rise

As a last resort, the EU could consider export curbs on goods that are critical to the U.S. economy, IW says. Trade data alone cannot prove how essential each item is to American buyers, the authors acknowledge, but the pattern is clear enough to influence talks. The study “can be used to make it clear to the Americans that if they continue to raise tariffs, they will be shooting themselves in the foot,” co-author Samina Sultan says.

The debate over tariffs and energy financing is also playing out on a second front, as reported by Cryptopolitan. U.S. Treasury Secretary Scott Bessent said on Monday that the Trump administration would not add new tariffs on Chinese goods tied to China’s purchases of Russian oil unless European countries also levy steep duties on China and India.

U.S. won’t act alone on China tariffs without EU

“We expect the Europeans to do their share now, and we are not moving forward without the Europeans,” Bessent said when asked whether Washington would impose Russian oil-related tariffs on Chinese goods after President Donald Trump announced an additional 25% duty on Indian imports.

Bessent said he stressed in talks with Chinese officials in Madrid, discussions that also touched on trade and TikTok, that the U.S. had already moved against Indian goods, and that Trump has been pressing Europe to levy tariffs of 50% to 100% on China and India to choke off Russian oil revenue.

The Chinese side replied that oil purchases are a “sovereign matter,” he said.

He argued that “if Europe put on substantial secondary tariffs on the buyers of Russian oil, the war would be over in 60 or 90 days,” because it would cut Russia’s main source of funds. He added that the new tariffs on Indian goods over Russian oil purchases have yielded “substantial progress” in talks with New Delhi.

Get seen where it counts. Advertise in Cryptopolitan Research and reach crypto’s sharpest investors and builders.

You May Also Like

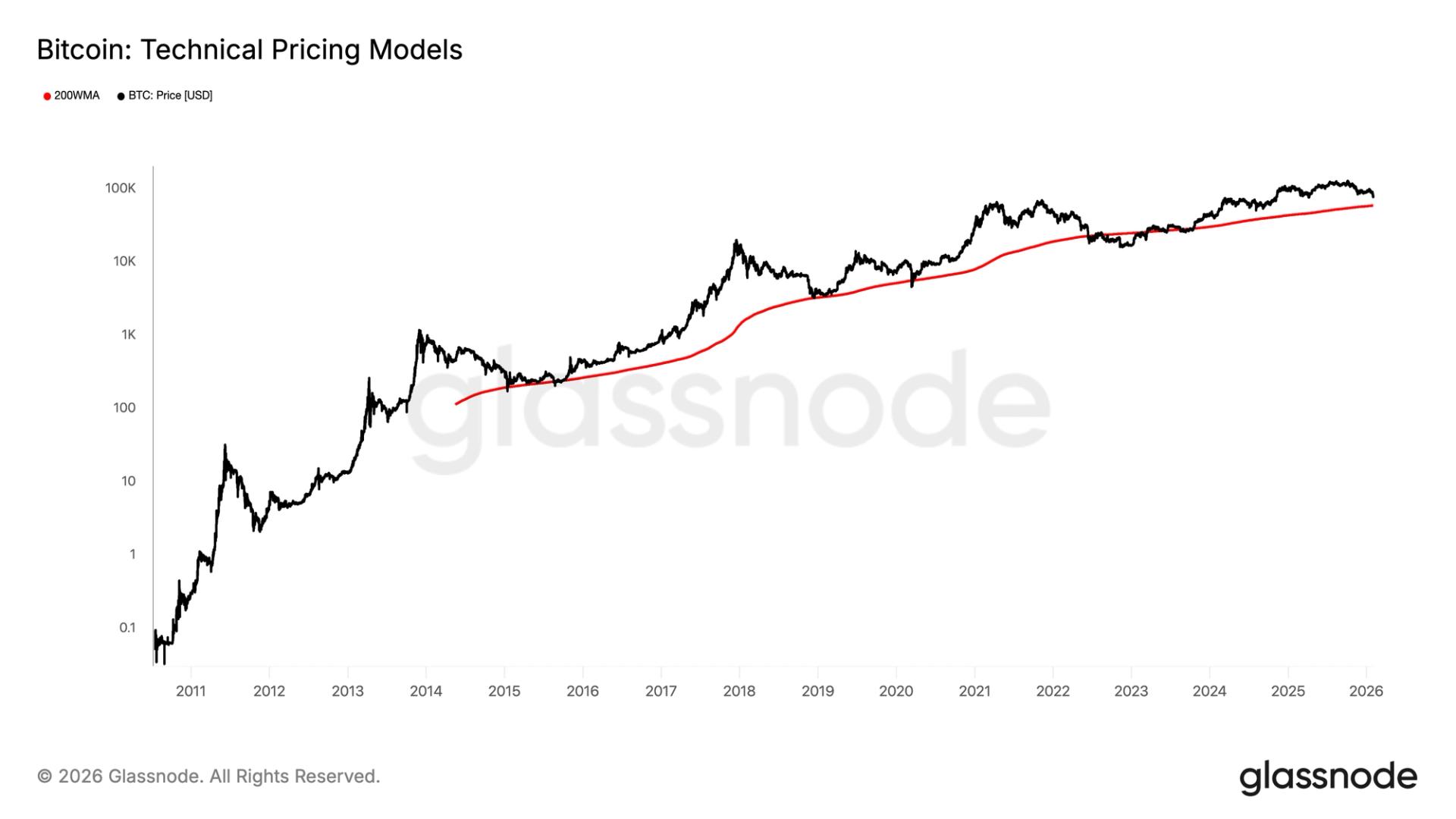

Why a $58,000 bitcoin is the key number for crypto investors right now

Copy linkX (Twitter)LinkedInFacebookEmail

Virtune AB (Publ) (“Virtune”) has completed the monthly rebalancing for January 2026 of its Virtune Crypto Altcoin Index ETP