Official Trump Price Plummets 6% Even As Newsmax Plans TRUMP And Bitcoin Treasury

The Official Trump price plummeted 6% in the last 24 hours to trade at $5.56 as of 4:10 a.m. EST on a 48% surge in trading volume to $469.9 million.

The fall in the TRUMP price comes as Newsmax revealed plans to build a crypto treasury that includes the US president’s official meme coin and Bitcoin.

Newsmax’s plans to invest up to $5 million in the cryptos over the next year, making it the first New York Stock Exchange-listed company to hold Official Trump on its balance sheet.

CEO Christopher Ruddy says the value of Trump Coin should “track the success of the Trump presidency,” calling its performance so far “impressive”.

Trump’s pro-crypto policies have boosted the industry. He said he’d be ”crypto president” and he’s announced a slew of policies that have bolstered investor sentiment toward digital assets.

On-Chain Signals

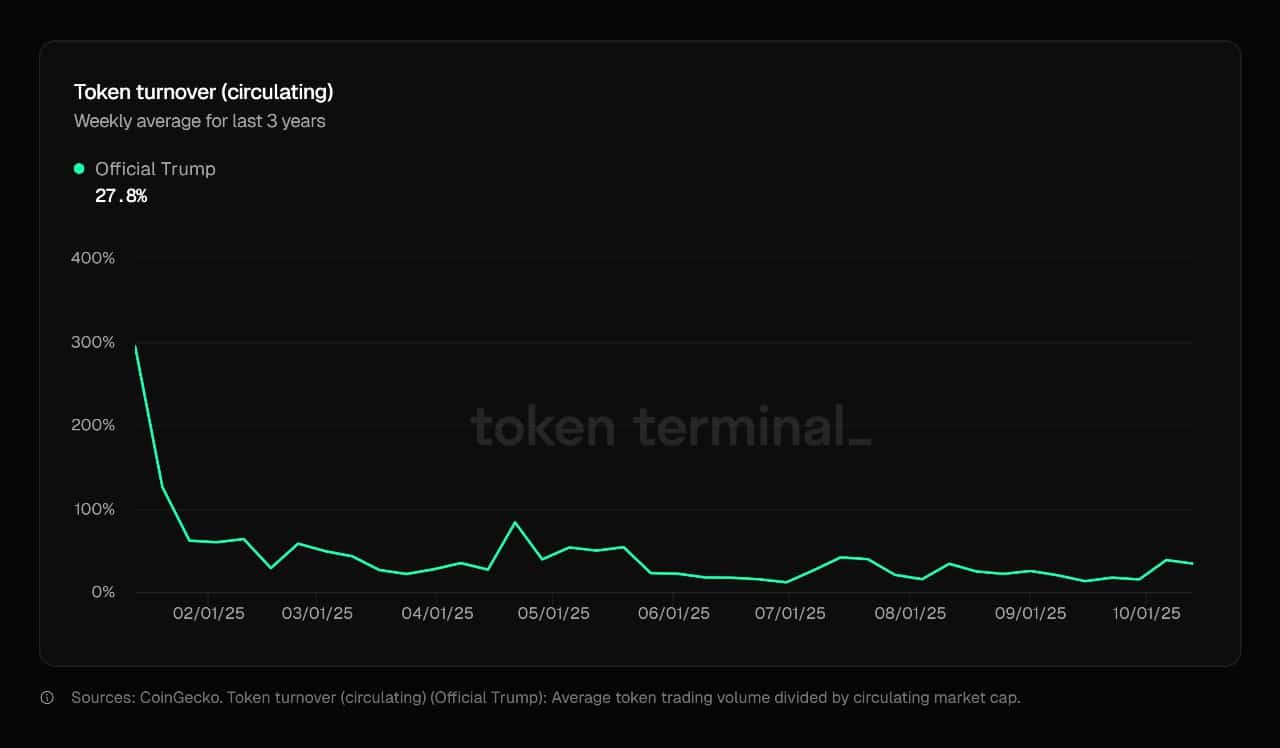

For TRUMP, on-chain signals show some increase in address activity, but overall trading remains mixed. Large holders appear to be transferring coins to cold storage, a sign of long-term faith.

The Trump coin price, however, remains highly sensitive to news flow and profit-taking, causing sharp moves both up and down.

Newsmax has stated that future crypto purchases will depend on market dynamics and strategic goals, meaning sudden price changes or major economic events could alter their buying pattern.

TRUMP coin’s circulating supply has reached over 200 million tokens, and with the Newsmax treasury entry, new institutional buying could put a steady floor under the price if market sentiment improves.

Official Trump Price Prediction

The daily TRUMPUSDT chart tells a cautious story. The coin broke out of a strong bearish channel in April, only to fall into a new “consolidation zone” near $8. The resistance level sits higher at $20, marked by several failed breakout attempts mid-year.

Since then, the price has formed a “falling curve,” suggesting sellers are in control, but the worst of the decline may be slowing.

TRUMPUSDT Analysis Source: Tradingview

The Trump coin price has been consolidating in the $8–$12 zone. The lowest support is at $1.75.

The RSI (Relative Strength Index) is at 34.33, with the yellow curve sitting at 37.65, showing that TRUMP is close to oversold levels. This hints at some buying potential if new catalysts emerge or institutional demand picks up. Still, momentum is weak, and traders are waiting for confirmation before jumping in.

If TRUMP fails to bounce near $8, it may test lower supports, with $1.75 as a last line for buyers. A sustained move above the consolidation zone could attempt to reclaim higher resistance.

If TRUMP coin can hold above $8 and attract more big buyers, a rebound towards $20 is possible. But if selling continues and support fails, a deeper drop toward $1.75 could tempt long-term accumulators looking for cheap entries.

Related Articles:

You May Also Like

![[BizSights] Malling 3.0: How retailers are upgrading your shopping experience](https://www.rappler.com/tachyon/2025/12/SIDE-BY-SIDE-1-DEC-29-2025.jpg?resize=75%2C75&crop_strategy=attention)

[BizSights] Malling 3.0: How retailers are upgrading your shopping experience

Michael Saylor Pushes Digital Capital Narrative At Bitcoin Treasuries Unconference