Crypto Executive: How Low Rates & Money Printing Will Spark BTC’s 2026 Boom

Bitcoin Price Outlook for 2026: Liquidity and Political Risks Shape Market Predictions

The cryptocurrency market anticipates significant changes in 2026 as expert forecasts range from bullish liquidity-driven growth to cautious warnings about potential downturns. With evolving macroeconomic conditions and geopolitical considerations, Bitcoin’s trajectory remains a focal point for investors and analysts alike.

Key Takeaways

- Bill Barhydt, CEO of Abra, predicts Bitcoin could rally in 2026 driven by increased liquidity from the US Federal Reserve.

- Regulatory clarity and rising institutional involvement are expected to bolster the crypto market’s strength.

- Contrasting opinions warn that 2026 may bring another bearish cycle, with Bitcoin possibly hitting a bottom around $60,000.

- The U.S. midterm elections could influence regulatory and macroeconomic factors affecting Bitcoin’s future.

Tickers mentioned: $BTC, $ETH

Sentiment: Mixed (Optimistic liquidity outlook vs. cautious bear market warnings)

Price impact: Neutral — While optimistic forecasts point toward growth, prevailing bearish sentiments suggest caution, indicating a complex market balance.

Trading idea (Not Financial Advice): Hold — Investors should monitor macroeconomic signals and political developments before taking significant positions.

Market context: The broader crypto market remains sensitive to Federal Reserve policies and upcoming U.S. political events, which could significantly influence Bitcoin’s price in 2026.

According to Bill Barhydt, CEO of Abra, Bitcoin’s potential rise in 2026 hinges on liquidity injections from the Federal Reserve. As policymakers prepare to cut interest rates and implement quantitative easing, demand for risk assets, including Bitcoin, could increase substantially. Barhydt states, “We are seeing quantitative easing light right now, and the demand for government debt is expected to fall sharply next year, which bodes well for all assets, including Bitcoin.” Such measures could fuel a bullish trend, particularly if U.S. regulatory clarity improves and institutional investors continue increasing their crypto allocations.

Abra CEO Bill Barhydt offers a forecast for BTC and crypto markets in 2026. Source: Schwab NetworkThe outlook is bolstered by the prospect of regulatory improvements in the U.S. and increased institutional investments, which could contribute to a more robust crypto environment. However, sentiment among some early Bitcoin adopters remains cautious, with concerns emerging that 2026 might still see Bitcoin experience a further downtrend, entering a bear market that could last for months or even years. These analysts warn that external macroeconomic factors, such as elections and fiscal policies, will play critical roles in shaping the asset’s performance.

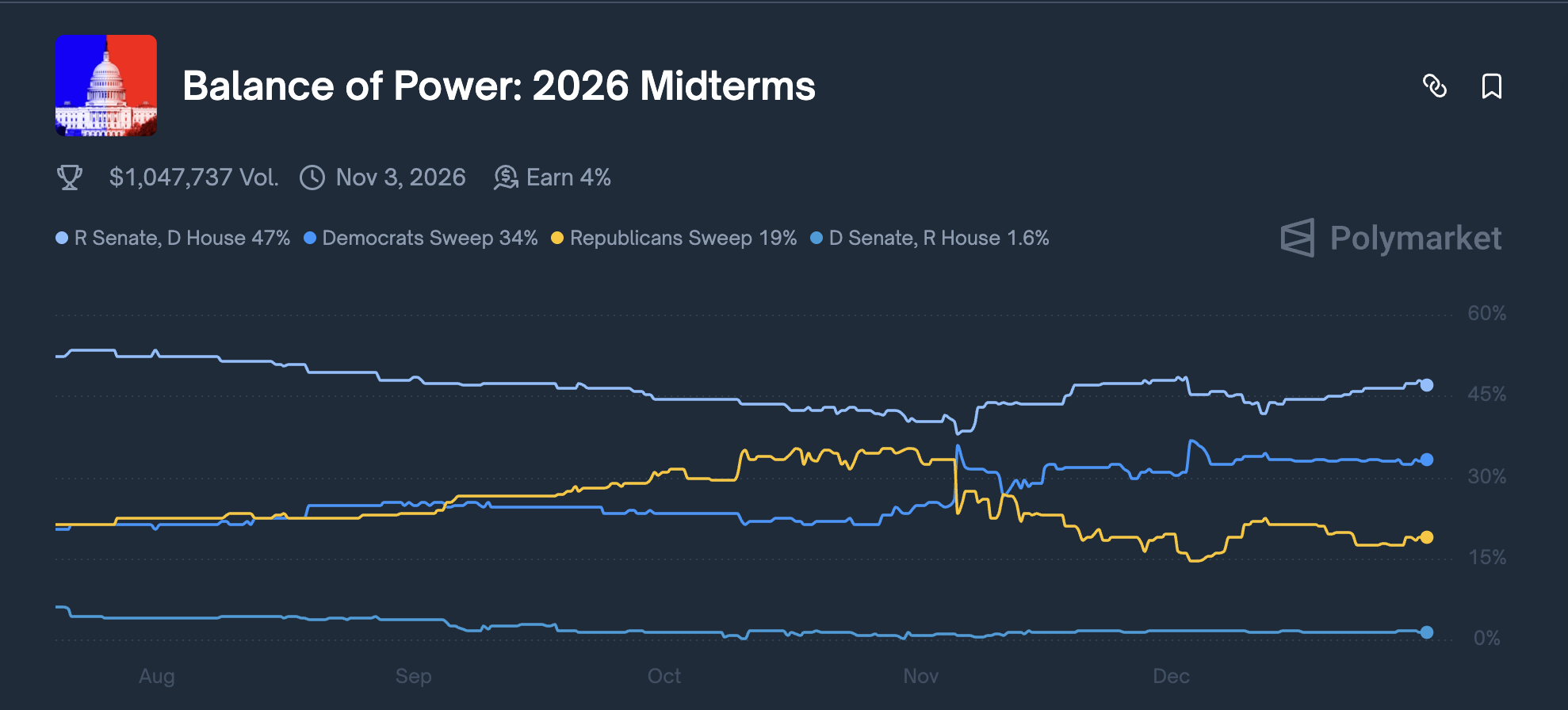

2026 US midterm elections odds. Source: Polymarket

2026 US midterm elections odds. Source: Polymarket

As the political landscape heats up ahead of the 2026 U.S. midterm elections, analysts like Michael Terpin suggest that a significant partisan shift could impact crypto regulation, potentially offsetting macroeconomic benefits from easing monetary policy. With polls indicating a low probability of a Republican sweep, the political uncertainty adds a layer of complexity to Bitcoin’s future prospects. Overall, experts agree that 2026 will be a pivotal year, shaped by liquidity policies and political developments that will determine Bitcoin’s longer-term trend.

This article was originally published as Crypto Executive: How Low Rates & Money Printing Will Spark BTC’s 2026 Boom on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

American Bitcoin’s $5B Nasdaq Debut Puts Trump-Backed Miner in Crypto Spotlight

Craft Ventures Opens Austin Office