Q2 Market Insights: Bitcoin regains dominance in risk-averse environment, ETFs remain critical to market structure

Author:Coinbase & Glassnode

Compiled by: Felix, PANews

Crypto markets are experiencing a major correction as we head into the second quarter of 2025. Amid heightened macro uncertainty, investor sentiment has turned defensive, with funds flocking to high-cap assets such as Bitcoin. Despite the pressure on the altcoin market, core infrastructure continues to strengthen, on-chain fundamentals remain strong, and institutional interest remains stable through ETF channels and platform development.

This report, produced jointly by Coinbase and Glassnode, focuses on market structure, position trends, and key indicators in a complex and rapidly evolving environment. The following is the essence of the report:

Crypto Market Pullback Highlights Defensive Positioning

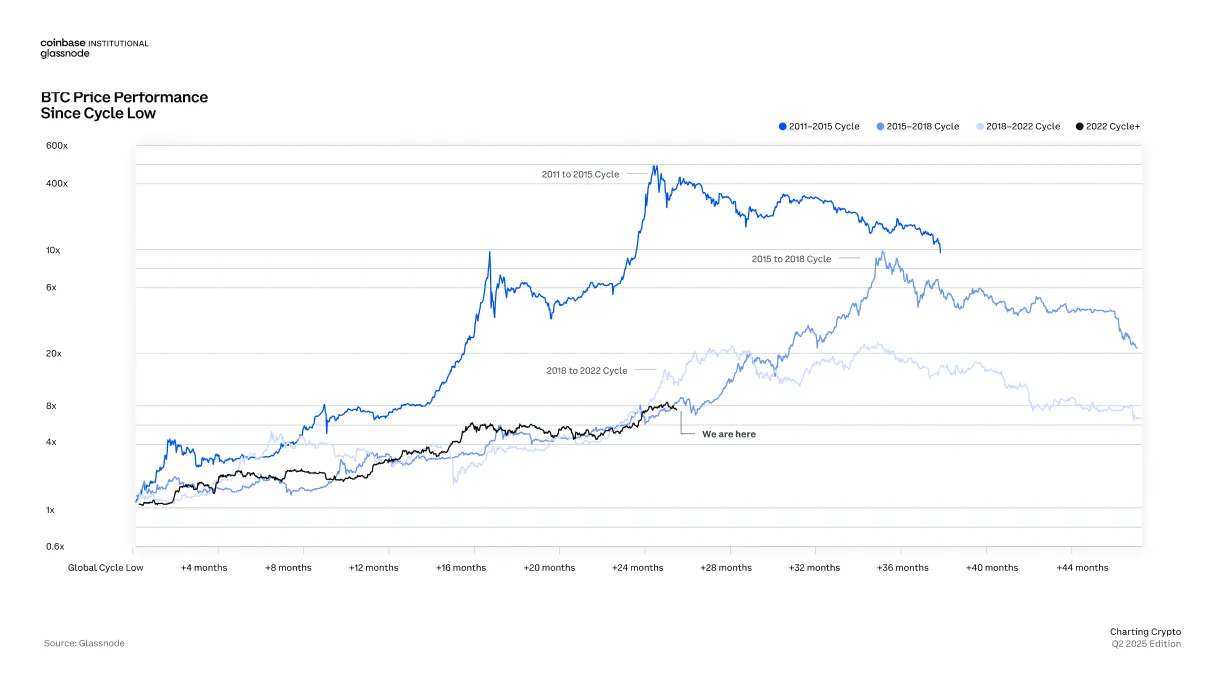

Bitcoin 's cycle in 2022 and beyond is different from previous trends, and the recovery process is slower against the backdrop of macro uncertainty

Investor sentiment has changed dramatically since the beginning of 2025. Growing concerns about a potential US recession, fiscal tightening, and global trade frictions have triggered risk aversion in the digital asset market. Excluding BTC, the total cryptocurrency market cap is $950 billion, a sharp drop of 41% from the high of $1.6 trillion in December 2024 and a 17% drop from the same period last year. Venture capital inflows have fallen back to the levels of 2017-2018. Both Bitcoin and the COIN50 index have fallen below their 200-day moving averages. This suggests that the current correction may extend until mid-2025.

Bitcoin regains dominance amid risk-off environment

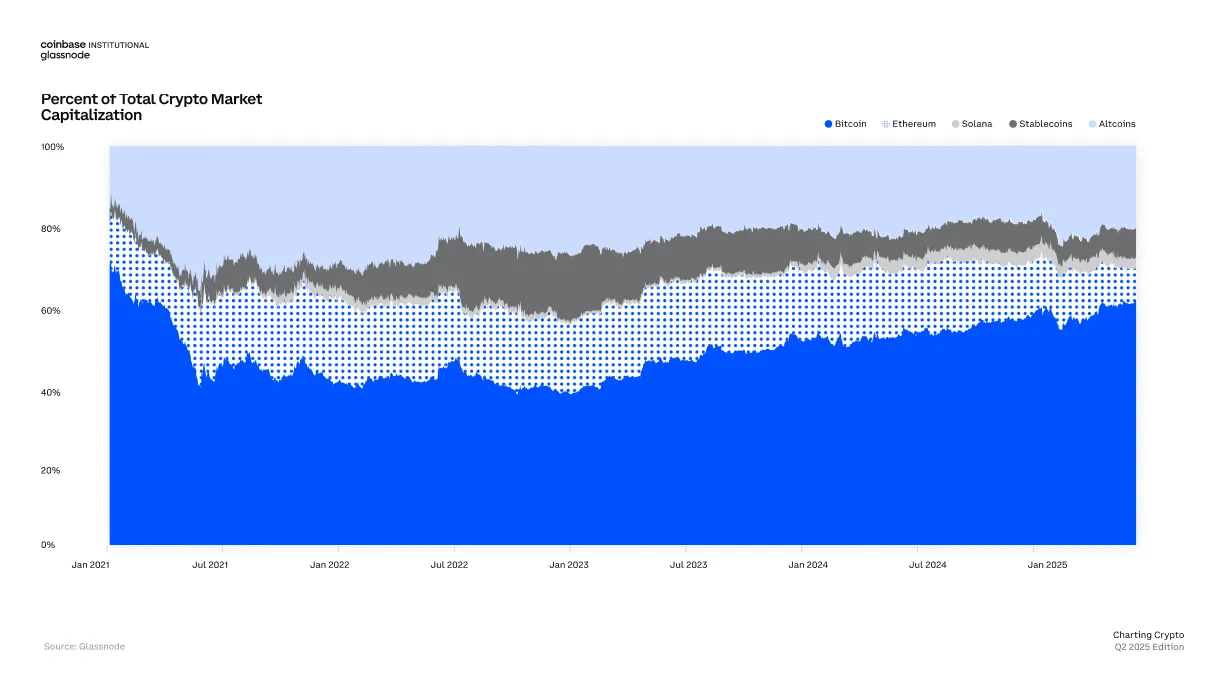

Bitcoin dominance rises to 63% , highest level since early 2021 as investors turn to high-trust assets

During times of turmoil, capital moves to perceived quality assets — and Bitcoin benefits from this. Bitcoin currently accounts for 63% of the total crypto market cap, its highest level since early 2021. Meanwhile, Ethereum’s share of the total cryptocurrency market cap has shrunk over the past six months, while Solana’s share has remained stable since early 2024.

Bitcoin's dominance reflects investors' preference for assets with the highest institutional accessibility and macro correlation. Despite the price drop, long-term Bitcoin holders are still accumulating, as evidenced by the reduction in liquidity supply and the sharp rise in the number of Bitcoins held at a loss, indicating renewed confidence among strategic allocators.

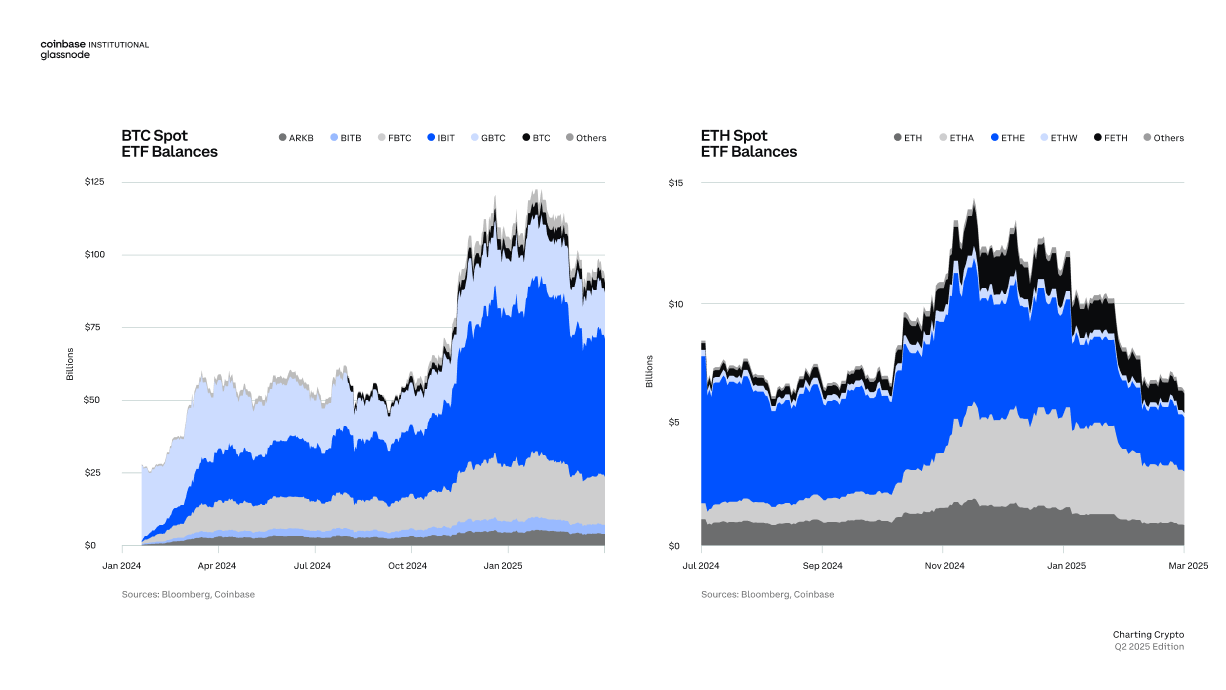

Cash ETFs remain critical to market structure

Despite recent outflows, Bitcoin and Ethereum ETFs maintain sizeable holdings, indicating continued institutional interest

ETF flows remain a key indicator of institutional investor sentiment. In the first quarter, inflows into Bitcoin and Ethereum spot ETFs were subdued but continued, with total Bitcoin ETF balances approaching $125 billion. Although funding rates in the futures market have fallen, indicating a weakening of speculative appetite, spot ETF activity reflects long-term positioning.

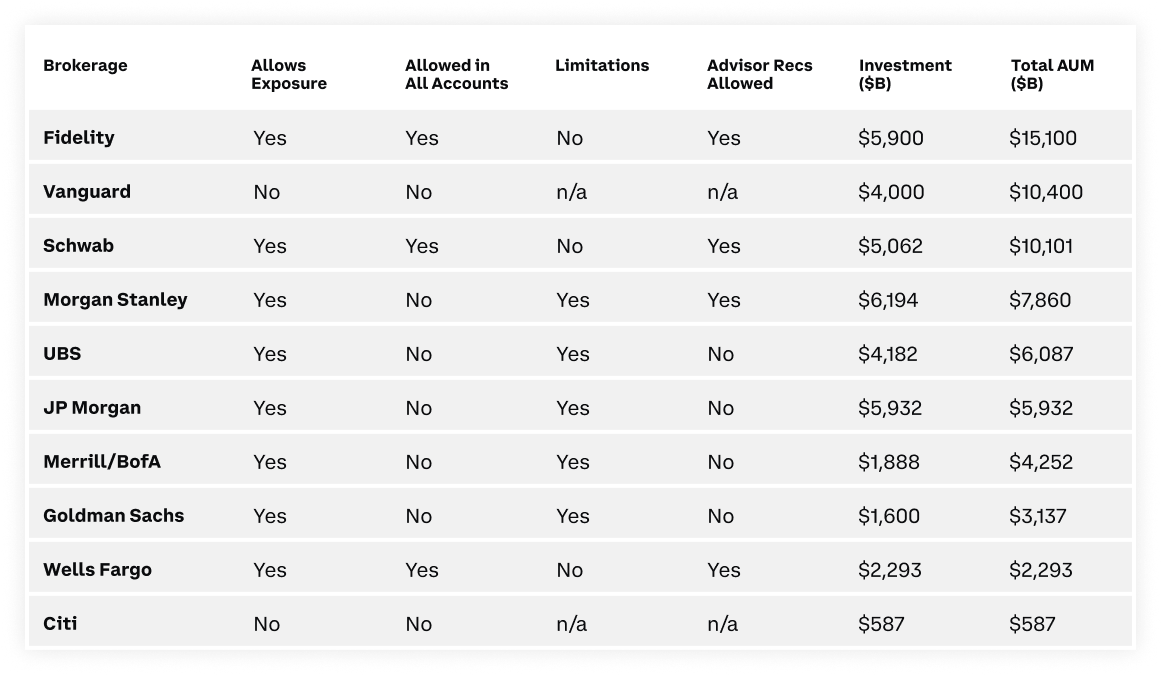

Large brokerages are still limiting clients’ investments in Bitcoin ETFs . If these platforms set a 2% Bitcoin allocation, it would mean that ETF net inflows would be 22 times that of 2024.

Notably, investment restrictions by large brokerages hint at a potential wave of demand if entry restrictions are relaxed.

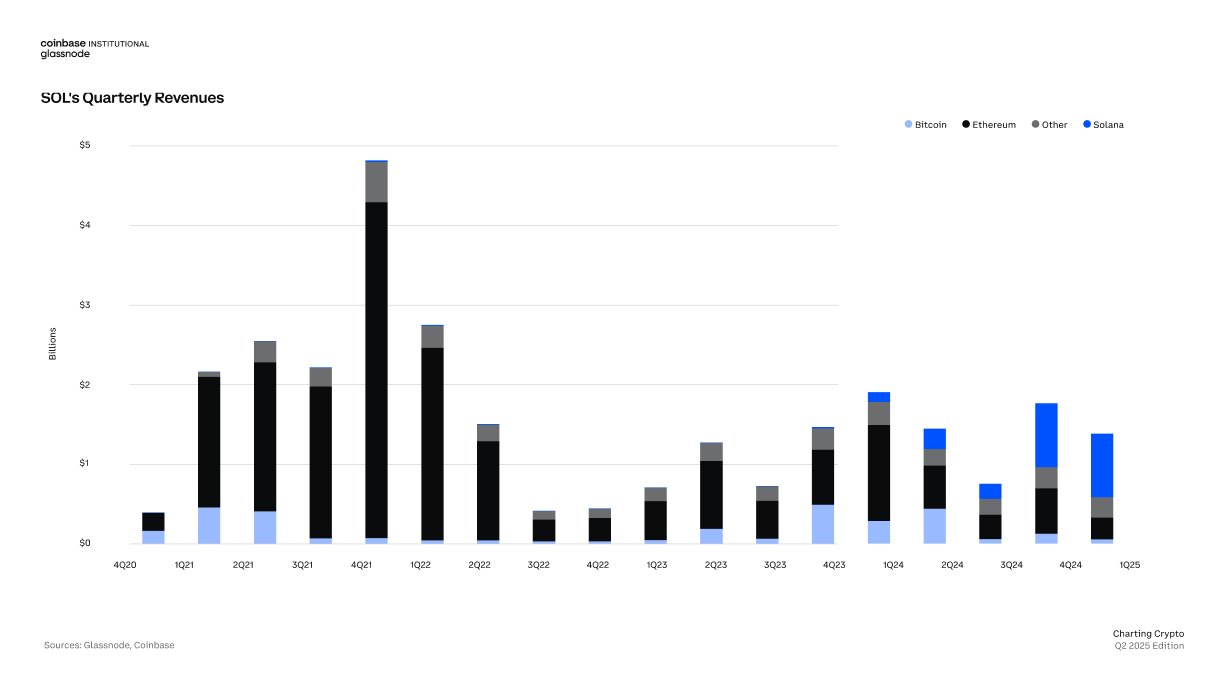

Solana revenue exceeds all other L1 and L2 platforms

Solana surpassed all other blockchains in the first quarter, with revenue exceeding that of Bitcoin, Ethereum, and other blockchains combined.

Despite the macroeconomic shocks facing the market and the turbulent negative discussions around memecoin, Solana's revenue in the first quarter still exceeded the sum of all other L1 and L2 networks. This revenue highlights the continued stickiness of ecosystem users and shows that the capital efficiency and developer activity of the Solana ecosystem remain strong.

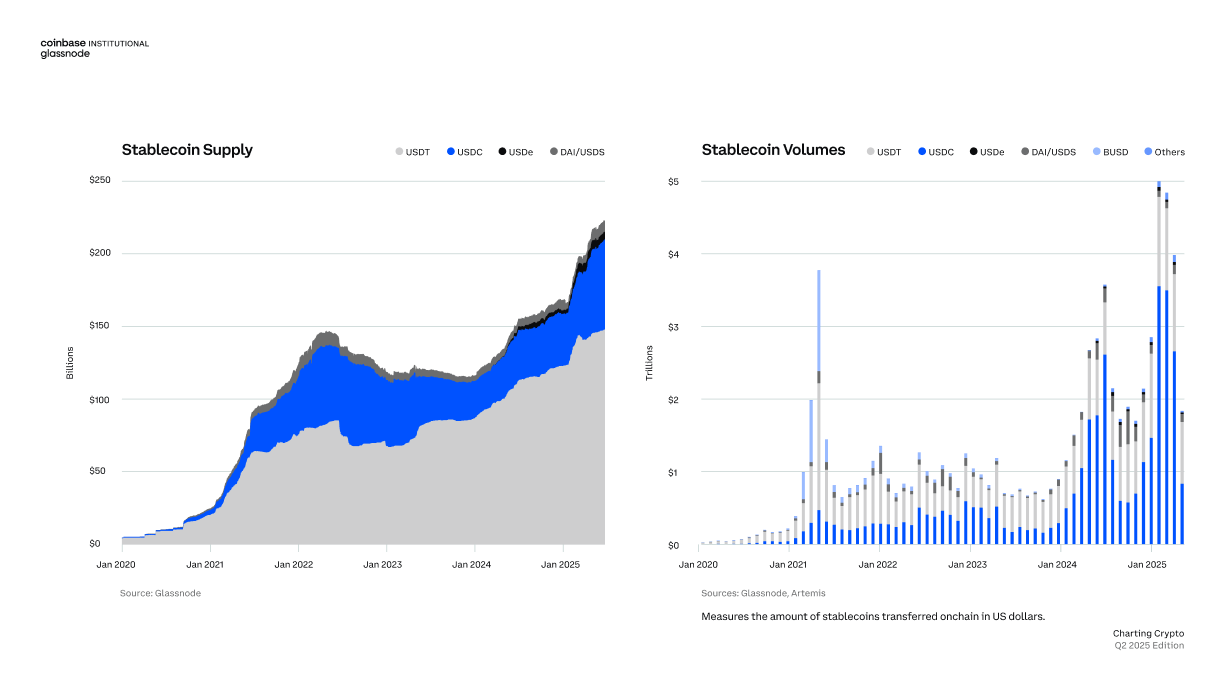

Stablecoins solidify their place as the backbone of crypto finance

Stablecoin supply and on-chain transaction volume hit record highs, highlighting their increasingly important role in global digital payments.

As a core component of the crypto-financial system, stablecoins continue to attract attention. Adjusted for inactive transactions, stablecoin trading volume hit an all-time high last quarter. With falling fees and expanding use cases (from remittances to corporate payments), stablecoins are expected to attract more institutional and retail investors in 2025, especially in high-inflation economies.

Conclusion

The report believes that the crypto market may bottom out in the middle and late second quarter of 2025, laying the foundation for the trend in the third quarter of 2025. Overall, the market will show a downward trend in the short term, and then rebound and set a new high in the second half of the year. However, if the following factors occur, the above view will be invalid:

If the Fed ends quantitative tightening, it will increase global liquidity and support the crypto market. Similarly, if major economies such as the EU or China introduce more global fiscal stimulus, it may increase the M2 money supply and push up the capital available in the market.

More worryingly, further uncertainty over the trade war could prolong negative market sentiment, while global shocks could further reduce liquidity.

Related reading: Cryptocurrency Industry Report for the First Quarter of 2025: DeFi and NFT Ecosystem Trends, CEX and DEX Market Performance

You May Also Like

The Channel Factories We’ve Been Waiting For

Gold Hits $3,700 as Sprott’s Wong Says Dollar’s Store-of-Value Crown May Slip