Dogecoin (DOGE) Price Prediction: Analyst Points to a Possible Move above $1.25

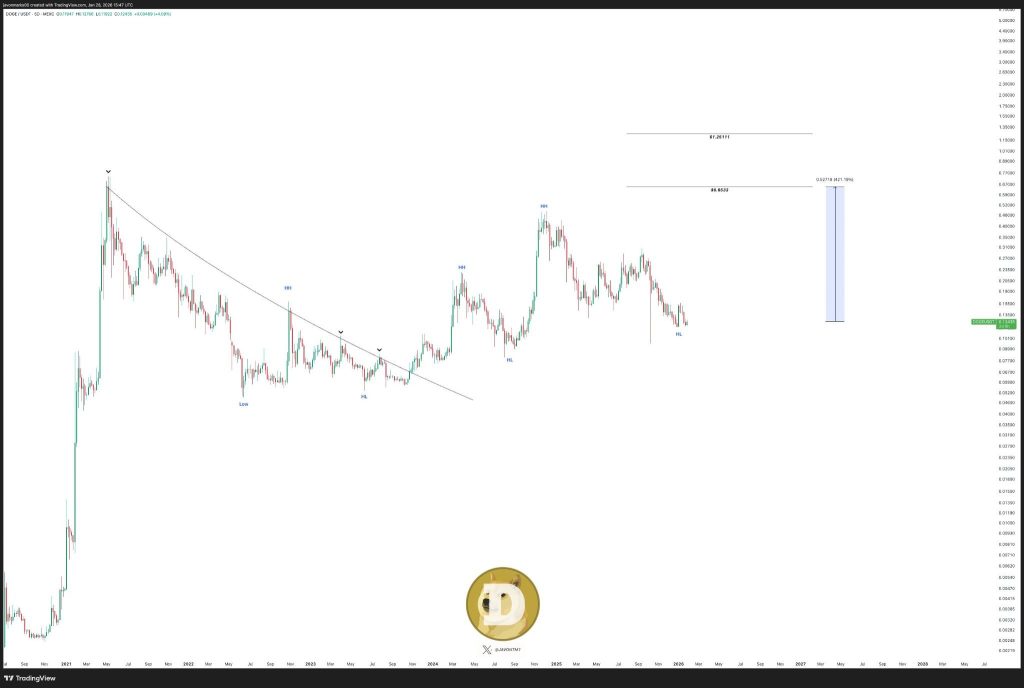

The idea behind Javon Marks’ take is pretty simple, and the chart makes it easy to follow. After spending a long time stuck under a curved downtrend that capped rallies through 2021, 2022, and much of 2023, the DOGE price finally broke above that resistance.

More importantly, it did not immediately fall back under it. That level has shifted from pressure to support, and that is what is supporting the bigger bull case.

Currently, the price of DOGE is sitting just above the $0.12 level. It is not running higher, but it is also not running lower. It is sitting in a spot where the longer-term levels are more important than the short-term movements.

DOGE Higher Lows Tell the Real Story

The strongest signal on this chart is not a single candle or spike. It is the series of higher lows forming on the right-hand side. After reaching a peak in late 2024, DOGE topped out and then retraced, but the retracement held support above the previous swing low. It’s a small detail, but it’s important.

With higher lows appearing, it’s a sign that buyers are entering the market sooner with each decline. In practical terms, it means sellers are losing control of deeper retracements.

As long as the DOGE price continues to respect these higher-low zones, the uptrend structure remains intact, even if price chops sideways for some time.

Why $0.6533 Keeps Showing Up on the DOGE Chart

Marks points to $0.6533 as the main upside target, and that level is not random. It lines up with a major historical supply zone where the DOGE price previously struggled.

From current levels, reaching that area would represent a move of more than 400%, which explains why it stands out so clearly on the chart.

Source: X/@JavonTM1

Source: X/@JavonTM1

This does not mean the DOGE price goes straight there. The chart indicates there are multiple resistance areas in between that still need to be reclaimed. But as long as price holds above the broken trendline and keeps printing higher lows, that $0.6533 zone stays relevant as a long-term magnet.

Read Also: How Much Could $1,000 in Worldcoin (WLD) Be Worth by 2027?

What Happens If DOGE Clears That Level

If the DOGE price manages to break and hold above $0.6533, the chart opens the door to a much bigger discussion. That is where the $1.25111 target comes in. It is not a near-term call, but the next logical extension if momentum fully returns and prior resistance flips into support.

For now, everything comes back to structure. The DOGE price does not need to pump tomorrow to stay bullish. It just needs to keep holding above key support and avoid breaking the higher-low sequence. As long as that happens, upside scenarios remain firmly on the table.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

The post Dogecoin (DOGE) Price Prediction: Analyst Points to a Possible Move above $1.25 appeared first on CaptainAltcoin.

You May Also Like

‘Minimum $15 Price Surge Target’ Predicted For Ripple’s XRP as Sentiment Bottoms

Fed rate decision September 2025