Best Crypto Presales to Buy as Bitcoin Weakens at $121K

Key Points:

Bitcoin retreats from $126K ATH to $121K, dragging major altcoins lower.

Bitcoin retreats from $126K ATH to $121K, dragging major altcoins lower. Market pullback opens opportunities in emerging crypto presales.

Market pullback opens opportunities in emerging crypto presales. Snorter ($SNORT) offers Telegram-based trading with staking rewards up to 110%.

Snorter ($SNORT) offers Telegram-based trading with staking rewards up to 110%. Bitcoin Hyper ($HYPER) and Remittix ($RTX) raise millions as scalable, real-world utility plays.

Bitcoin Hyper ($HYPER) and Remittix ($RTX) raise millions as scalable, real-world utility plays.

Bitcoin is pulling back from its recent all-time high of $126K after an attempted rally on Thursday morning in the US. While $BTC was trading around $124K at the time of the stock market open, by 90 minutes into the day’s session, the value of Bitcoin had dropped to $121K.

That said, Bitcoin’s weakening creates an opportunity for smaller coins to capture a larger share of the market.

We’ve identified three crypto presales that could stand to gain massively from capital rotation out of Bitcoin, so let’s take a look at Snorter Bot ($SNORT), Bitcoin Hyper ($HYPER), and Chainlink ($LINK)

1. Snorter ($SNORT) – Trade the Best Altcoins with this Telegram-Based Sniper Bot

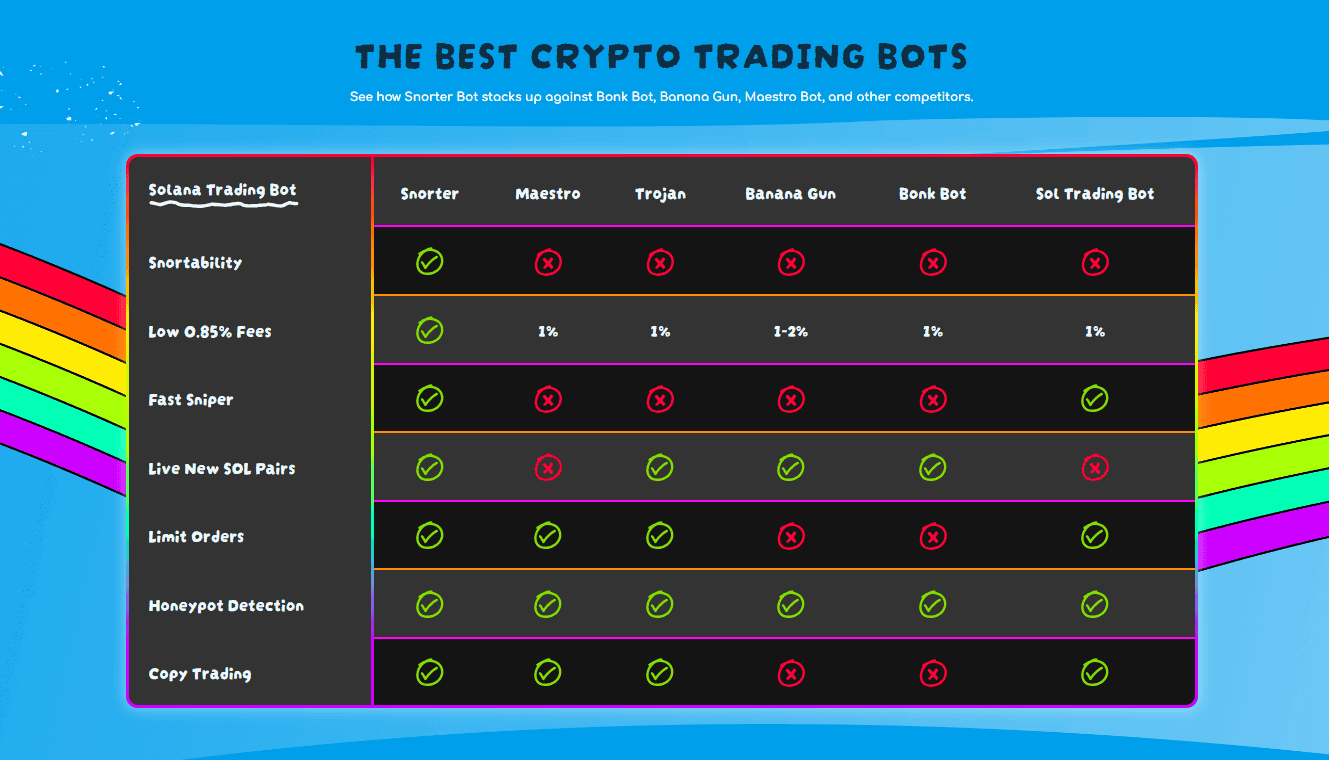

Snorter Token ($SNORT) is the official token of Snorter. This trading bot scans crypto marketplaces and identifies the best new altcoins that you can trade using a Telegram-based interface.

Check out any decentralized exchange and you’ll see that there are plenty of new altcoins popping up every moment of the day. Unlike the stock market, the crypto market runs 24/7, which means that it’s easy to miss out on a new opportunity because you’re not constantly watching every DeX out there.

The best vetted coins are then presented for you to trade using automatic buy and sell orders. Set your price, then kick back – Snorter does all of the work for you.

When Snorter releases, it’ll work with the Solana blockchain from day one. In the future, additional modules are also being developed for Ethereum, BNB, Polygon, and Base.

The Snorter bot is already quite powerful, but holding the $SNORT token unlocks an additional set of features that make it even more effective. Your transaction fees are reduced to 0.85%, and the trading cap is removed, allowing you to make unlimited daily trades.

You can also mirror trade against other wallets using $SNORT. The Snorter bot automatically monitors a wallet you nominate and executes the same trades using a high-speed RPC node, making your copy trades as profitable as possible.

The Snorter presale is coming to an end in just nine days. Buying $SNORT now will net you a price of $0.1075 per token with up to 110% in staking rewards. This is your last chance to buy $SNORT at a low price before the presale ends, so don’t delay.

Join the Snorter Token presale before Snorter’s imminent launch.

2. Bitcoin Hyper ($HYPER) – Speeding Up the Bitcoin Network With a Solana Layer-2

Bitcoin Hyper ($HYPER) addresses the scalability issues of the Bitcoin network by utilizing a Solana Virtual Machine (SVM) with zero-knowledge (zk) rollups.

While Bitcoin is a fantastic investment asset, it’s not as useful as Ethereum or Solana for processing small transactions. The network takes too long to clear and commit your $BTC transfers, and ever-climbing fees can outstrip the value of your transfer, too.

Instead of the 7-10 transactions per second that Bitcoin can usually handle, an SVM-based Layer-2 could handle thousands. The SVM also adds smart contract support, meaning you can trade NFTs, swap crypto, and run DeFi apps, all with $BTC, providing the underlying value.

The $HYPER token keeps it all ticking over. It’s the official utility token of the Bitcoin Hyper network. With it, you get cheaper crypto swaps and smart contract executions on the Bitcoin Hyper ecosystem, as well as access to the DAO and exclusive features on some dApps.

You can purchase your $HYPER now in the presale, where it’s available for $0.013095. It’s a hugely successful presale, having raised over $23M so far. If you buy in now, you can also lock in up to 51% in staking rewards per annum.

Get your $HYPER tokens today and receive up to 51% in staking rewards.

3. Remittix ($RTX) – Cross-Border Payments Powered by Crypto

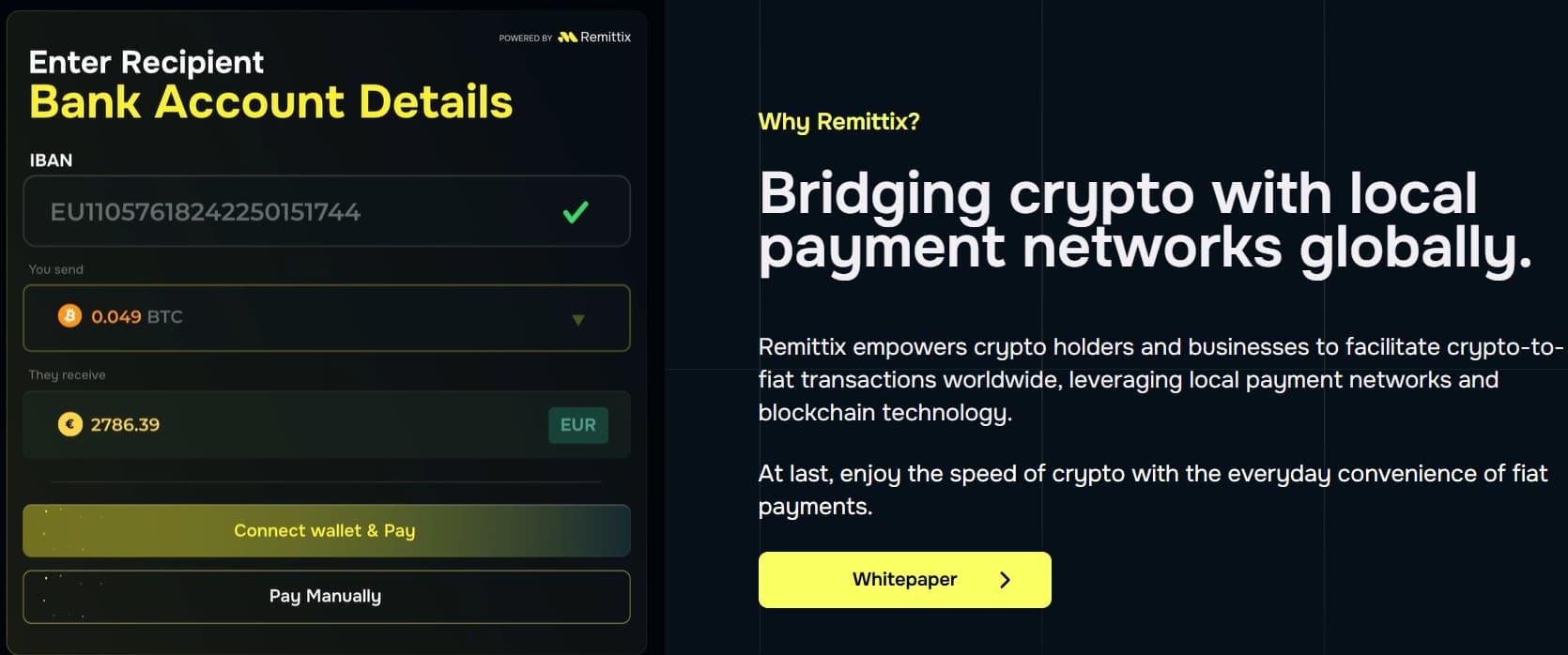

Remittix ($RTX) aims to reinvent the way cross-border money transfers work by seamlessly integrating crypto and fiat transfers, thereby significantly simplifying crypto payments in the process.

Remittix promises zero foreign exchange fees when you send money across borders using the Remittix app. It offers over 30 different currencies to choose from, as well as support for the Ethereum and Solana blockchains on release. Additional blockchains are mooted for post-release, including Ripple.

When transferring from cryptocurrency to fiat, the recipient receives a money order, just like any other bank transfer. In turn, Remittix promises to make crypto easy to spend anywhere regular fiat is accepted.

The Remittix presale is now live and has raised over $27M in token purchases so far. Unfortunately, unlike $SNORT and $HYPER, Remittix does not offer a presale staking program; however, you can purchase $RTX now for only $0.1166.

Check out the Remittix presale today.

You May Also Like

Unlocking Opportunities: Coinbase Derivative Blends Crypto ETFs and Tech Giants

Crossmint Partners with MoneyGram for USDC Remittances in Colombia