Flip $2,200 Into Ozak AI? Projection Models Say It Could Become a Six-Figure Bag

Crypto market enthusiasm continues rising as investors look for early-stage opportunities capable of generating life-changing returns before the next bull cycle peaks. While potential assets like Bitcoin, Ethereum, and Solana offer stability, analysts increasingly point toward asymmetric, high-ROI plays—and at the center of nearly every high-return forecast is Ozak AI (OZ).

With its intelligence engine fully active during its presale, Ozak AI is being modeled as one of the few early-cycle assets with realistic 50x–100x potential. This is why analysts now suggest that flipping a $2,200 position into Ozak AI could transform into a six-figure investment by 2026 if the project performs anywhere near its current projections.

Ozak AI Momentum

Ozak AI’s surge in popularity comes from one major differentiator—it already works. Instead of entering the market with vague roadmaps and future promises, Ozak AI launches with real-time predictive infrastructure, millisecond-level analysis, and autonomous multi-chain agents that are live and evolving today. Its intelligence core reads blockchain shifts in milliseconds, ingesting HIVE’s ultra-fast 30 ms market signals for high-resolution execution data. On top of this, SINT-powered autonomous agents scan and react across chains instantly, adjusting strategies without human input and interpreting liquidity patterns in real time.

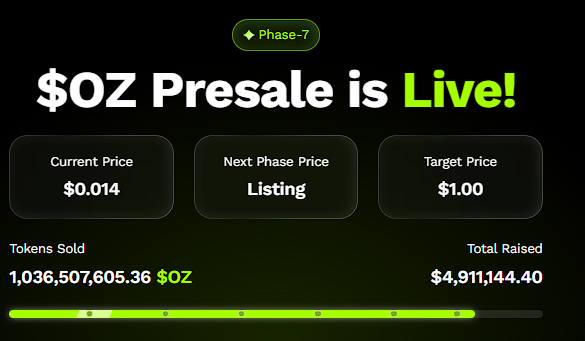

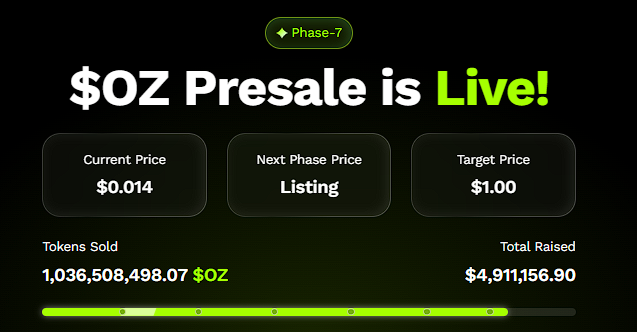

Layered beneath all of this is Perceptron Network’s massive 700K+ node architecture, which supplies Ozak AI with continuous multi-chain data. This creates a self-improving engine—one that grows sharper, faster, and more capable each day it processes information. The more the system runs, the more valuable it becomes. This compounding intelligence effect is why the Ozak AI Presale surpassing $4.9 million has generated such intense demand. It’s not a traditional presale token; it’s a functioning intelligence layer entering the market at a valuation far below what its technology implies.

Why $2,200 Could Become Six Figures

A $2,200 entry into a mature asset may generate modest returns, but an early-stage intelligence engine with exponential growth potential changes the equation entirely. If Ozak AI executes even a conservative 50x run, a $2,200 position becomes $110,000. At 75x, it becomes $165,000. At 100x—which several analysts consider plausible given its evolving AI architecture—it becomes $220,000.

The reason these projections carry weight is because Ozak AI’s upside is not tied to hype cycles alone; it’s tied to capability cycles. Each improvement in predictive accuracy increases utility. Each new integration expands its use cases. Each data cycle strengthens the engine. This creates a valuation curve driven by performance, not emotion—and that’s what makes Ozak AI’s multiplier potential so unusually high compared to most presale tokens.

Ozak AI vs Typical Early-Stage Investments

Most presale projects rely heavily on speculation. They promise utility later but offer little working infrastructure today. Ozak AI breaks that pattern entirely. With real-time predictive signals, 30 ms-level data resolution, cross-chain intelligent agents, and a constantly improving AI decision layer, it functions more like a next-generation analytics engine than a speculative token. This is the fundamental reason analysts categorize Ozak AI as an asymmetric high-ROI asset rather than a high-risk gamble.

- An early-stage token without utility can rally, but only as long as sentiment supports it.

- An early-stage token with evolving, measurable intelligence can rally because its value grows on its own.

This distinction is what places Ozak AI in the same early-phase position that previous cycle giants like Chainlink, Polygon, and Solana held before their exponential expansions—but with even more automation, speed, and predictive capability.

The 2026 Opportunity

As AI-driven blockchain systems become the fastest-growing segment of crypto, Ozak AI is positioned at the center of that movement. It isn’t a meme coin, a narrative coin, or a future-utility promise—it is an active intelligence infrastructure entering an early-phase valuation window. If adoption accelerates and its predictive engine becomes widely integrated into trading platforms, agent networks, and multi-chain automation tools, Ozak AI could quickly enter a parabolic valuation phase unlike anything traditional assets can match.

A $2,200 position is relatively small. Ozak AI’s potential is not. If current forecasts hold, flipping $2,200 into Ozak AI during its presale could become one of the highest-reward moves available heading into 2025–2026 — the kind of early-cycle positioning that turns small entries into six-figure outcomes.

About Ozak AI

Ozak AI is a blockchain-based crypto project that provides a technology platform that specializes in predictive AI and advanced data analytics for financial markets. Through machine learning algorithms and decentralized network technologies, Ozak AI enables real-time, accurate, and actionable insights to help crypto enthusiasts and businesses make the correct decisions.

For more, visit:

- Website: https://ozak.ai/

- Telegram: https://t.me/OzakAGI

- Twitter: https://x.com/ozakagi

Disclaimer: TheNewsCrypto does not endorse any content on this page. The content depicted in this Press Release does not represent any investment advice. TheNewsCrypto recommends our readers to make decisions based on their own research. TheNewsCrypto is not accountable for any damage or loss related to content, products, or services stated in this Press Release.

You May Also Like

Thyroid Eye Disease (TED) Treatments Market Nears $4.3 Billion by 2032: Emerging Small Molecule Therapies Targeting Orbital Fibroblasts Drive Revenue Growth – ResearchAndMarkets.com

Virtus Equity & Convertible Income Fund Announces Special Year-End Distribution and Discloses Sources of Distribution – Section 19(a) Notice