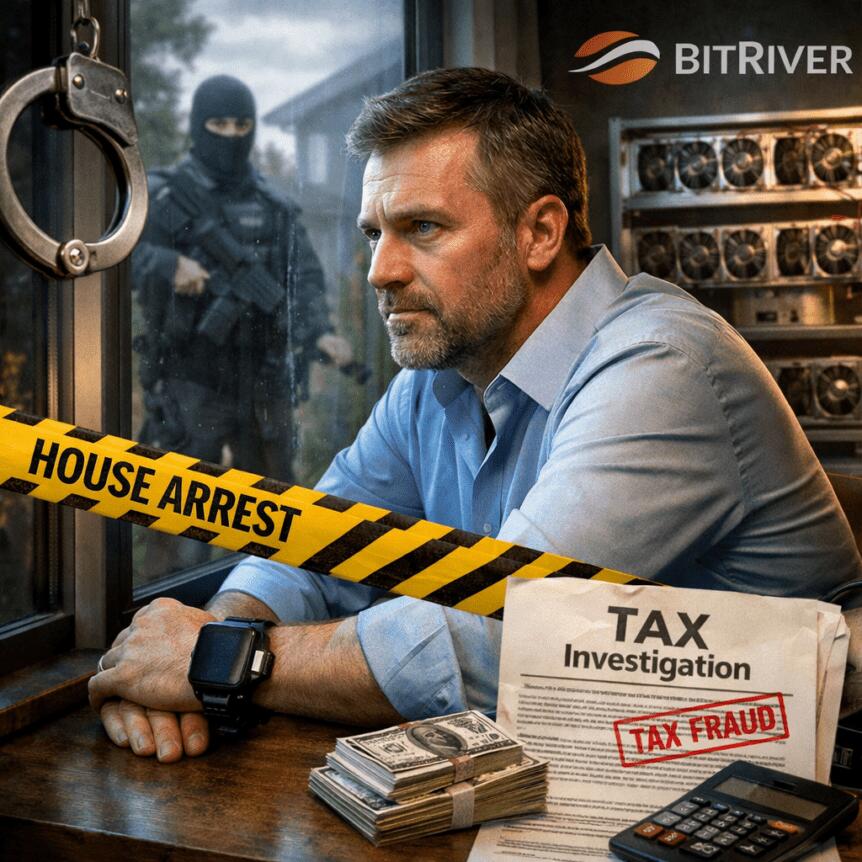

BitRiver CEO Reportedly Under House Arrest Amid Tax Evasion Charges

The Zamoskvoretsky Court in Moscow has reportedly ordered BitRiver CEO Igor Runets to remain under house arrest amid tax evasion charges. Local outlets RBK and Kommersant reported that Runets was detained on January 30 and faces three counts for allegedly concealing assets to evade taxes. The court documents, cited by the outlets, indicate that Runets was charged on January 31 and placed under house arrest the same day. A narrow window remains for a potential appeal before the measure becomes fully enforceable on February 4. Cointelegraph reached out to Runets for comment as the case unfolds, underscoring the brisk pace of developments in a sector already shaped by sanctions and regulatory scrutiny. The developing story adds another layer to BitRiver’s fraught trajectory in a landscape where crypto mining in Russia intersects with geopolitical risk and energy considerations.

Key takeaways

- Detention and charges: Runets was detained on January 30 and charged on January 31 with three counts related to concealing assets to evade taxes; a house-arrest order was issued on the same day, with enforcement set to begin on February 4 unless an appeal changes the outcome.

- Regulatory backdrop and sanctions: BitRiver has weathered sanctions from the US Treasury in mid-2022, reflecting ongoing geopolitical risk surrounding crypto mining in Russia and the wider energy-intensive sector.

- Client exodus and cost-cutting: By late 2024, BitRiver reportedly initiated cost reductions and scaled back operations, with salary delays affecting staff as the firm faced mounting financial pressures.

- Litigation in the new year: In early 2025, Infrastructure of Siberia filed two lawsuits against BitRiver, alleging non-delivery of equipment after payment under a contract, signaling continued creditor friction as the case progresses.

- Wealth and profile: Bloomberg’s 2024 reporting placed Runets’ net worth at roughly $230 million, illustrating the personal scale of potential risk and the stakes for the founder amid legal scrutiny.

Tickers mentioned: $BTC

Market context: The case sits within a broader framework of regulatory scrutiny of crypto mining in Russia, ongoing sanctions regimes, and the volatility of multinational energy- and infrastructure-intensive mining operations. The outcome could influence financing, partnerships, and operational strategy for Russian miners in the near term.

Why it matters

The Runets case crystallizes the legal and regulatory crosswinds facing Russia’s prominent crypto-mining operators. BitRiver’s prominence—built on large-scale data centers in Siberia that provide crypto mining services to other entities—made it a high-profile target for authorities seeking to enforce asset disclosures and tax compliance. If the court’s decision stands, it could further constrain management decisions in the near term and complicate negotiations with suppliers, lenders, and energy providers who remain sensitive to compliance risk in the sector.

Beyond the consequences for BitRiver itself, the proceedings illuminate how Russia’s crypto ecosystem is navigating a shifting regulatory climate. The mid-2022 sanctions regime linked to BitRiver’s activities and the subsequent 2023 client departure by SBI—reported as halting usage of BitRiver’s infrastructure—underline how sanctions and geopolitical tensions reverberate through day-to-day operations. End-2024 reports of cost cuts and delayed salaries suggest liquidity challenges that could affect payroll, maintenance of mining capacity, and the ability to meet commercial commitments. The early-2025 lawsuits add a creditor-facing dimension to the case, illustrating how disputes over payments and delivered equipment can compound legal risk for a private operator already under scrutiny.

Looking at the broader perspective, the case underscores the persistent tension between rapid growth in private mining capacity and the robust enforcement of financial and asset reporting standards. It also highlights how individual executive-level cases can become proxies for the sector’s governance challenges, including how privately held mining ventures manage assets, liabilities, and cross-border relationships in a climate of sanctions and regulatory ambiguity. The narrative around Runets—once cited as a central figure in Russia’s crypto-mining expansion with a reported net worth around $230 million—emphasizes the high personal stakes involved when market dynamics meet legal accountability.

What to watch next

- February 4 enforcement: Whether Runets’ appeal short-circuits or delays the house-arrest order, and what the court says in any ruling or scheduling update.

- Defense statements: Any formal response or filings from Runets’ legal team that could shape the trajectory of the case or inspire a settlement framework.

- BitRiver operational updates: Any announcements about changes to mining capacity, staffing, or supplier agreements in light of the financial pressures and ongoing investigations.

- Regulatory developments: New or evolving guidance from Russian authorities on tax reporting, asset disclosure, or sanctions-related compliance for mining firms.

- Creditor actions: Developments related to the Infrastructure of Siberia lawsuits and any related settlements or judgments that could affect BitRiver’s balance sheet.

Sources & verification

- Zamoskvoretsky Court documents cited by RBK and Kommersant reporting on Runets’ detention and charges.

- RBK, coverage on Runets’ detention and three-count charge and the timing of the house-arrest order.

- Kommersant, reporting on court filings and the January 31 charge date.

- Bloomberg, 2024 profile referencing Runets’ net worth around $230 million and the broader crypto-mining context.

- US Treasury sanctions on BitRiver in mid-2022, referenced in coverage of the firm’s regulatory exposure.

- Kommersant, late-2024 reporting on BitRiver cost cuts and delayed salaries under pressure.

- Infrastructure of Siberia, early-2025 lawsuits against BitRiver alleging non-delivery of equipment after payment.

Legal pressure mounts on BitRiver founder amid tax-evasion charges

BitRiver, founded in 2017, emerged as one of Russia’s largest Bitcoin (CRYPTO: BTC) mining operators, running expansive data-centers across Siberia that provided mining services to third parties as the sector expanded. The latest legal developments, centered on its chief executive Igor Runets, place a spotlight on asset reporting and tax compliance in a business model built on high-capacity power use and complex vendor relationships. According to court documents cited by local outlets, Runets was detained on January 30 and formally charged on January 31 with three counts of concealing assets to evade taxes. The Zamoskvoretsky Court subsequently ordered him under house arrest on the same day, with the measure slated to take full effect on February 4 unless an appeal is filed or granted. The case thus enters a critical phase, and Runets’ legal team has a narrow window to respond before the period of restriction consolidates.

In the wake of the charges, Runets’ representatives have not issued a public statement, and Cointelegraph confirmed it sought comment from the parties involved. The broader context includes BitRiver’s history of external pressures, notably the US Treasury’s sanctions in mid-2022 in response to the Russia-Ukraine conflict. The March 2023 timeline also saw SBI, a prominent Japanese banking group, pull back from using BitRiver’s infrastructure, a development that underscored the fragility of cross-border partnerships amid geopolitical frictions. By late 2024, industry reporting suggested BitRiver was implementing cost reductions and delaying salaries, signaling liquidity strains that can accompany a company facing legal scrutiny and sanctions exposure.

The financial strain was compounded by a sequence of disputes that surfaced in early 2025 when Infrastructure of Siberia filed two lawsuits alleging that the company paid for equipment that was never delivered. This creditor pressure mirrors the wider challenge for mining operators trying to maintain operation while navigating regulatory risk and the volatility of energy markets, which are essential to the unit economics of crypto mining. The Bloomberg profile in 2024, which pegged Runets’ net worth at around $230 million, adds another layer to the stakes involved—where personal holdings intersect with the fortunes of a fast-growing but increasingly regulated sector. Taken together, the case paints a portrait of a high-stakes industry confronting legal accountability while attempting to preserve capacity and reliability in an environment shaped by sanctions and geopolitical headwinds.

This article was originally published as BitRiver CEO Reportedly Under House Arrest Amid Tax Evasion Charges on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

VanEck Targets Stablecoins & Next-Gen ICOs

Crypto ETF Update: This Altcoin Could 1000x by 2026