Wormhole’s W token enters ‘value accrual’ phase with strategic reserve

Wormhole has moved beyond its distribution phase, initiating a new strategy. By allocating on-chain and off-chain protocol revenue to a dedicated treasury, the cross-chain protocol is creating a direct link between its commercial success and the value of its native token, W.

- Wormhole launched W 2.0 tokenomics with a new strategic reserve funded by protocol revenue.

- The upgrade introduces a 4% base yield for governance stakers and smoother bi-weekly token unlocks.

- The reserve ties W’s value directly to ecosystem growth, while changes aim to reduce market shocks and strengthen long-term alignment.

According to an announcement on September 17, the interoperability platform will begin channeling fees generated across its entire ecosystem, including its core messaging layer, the Portal bridge, and other applications, into a newly formed strategic reserve.

The Wormhole team said the treasury will be denominated in W and designed to be a permanent holder, systematically accumulating tokens to support long-term ecosystem growth.

Notably, the initiative is part of a broader “W 2.0” tokenomics upgrade and directly ties the treasury’s expansion to the protocol’s commercial performance, ensuring its war chest grows in tandem with network adoption.

Why Wormhole is reshaping W’s economics now

Nearly five years after its launch in 2020, the Wormhole has matured into one of the most widely integrated interoperability protocols, powering applications across more than 40 blockchains. With that scale comes both opportunity and pressure.

As institutions, governments, and corporations accelerate their on-chain experiments, Wormhole is positioning itself to capture value flowing across fragmented networks. A retooled W token lies at the center of that strategy, serving as the link between the protocol’s adoption curve and tokenholder incentives.

At its core, W is a capped-supply multichain asset. Of its 10 billion tokens, just under half, about 4.7 billion, are currently circulating. W carries governance rights, secures the network through staking, and directs resources toward long-term ecosystem growth.

But under the new 2.0 framework, its role is expanding. Wormhole has introduced a targeted 4% base yield for stakers who participate in governance, with the potential for higher returns tied to activity on flagship applications like the Portal bridge. Rewards are not guaranteed and remain emissions rather than revenue shares, but the design creates a more consistent incentive for users to remain engaged.

The Wormhole reserve

The most notable addition is the Wormhole Reserve. The reserve will be capitalized exclusively by on-chain and off-chain revenue generated across the Wormhole ecosystem. This includes fees from its core cross-chain messaging layer, its user-facing Portal application, and a suite of other ecosystem products.

Rather than distributing these profits, the protocol will use them to accumulate W tokens on the open market, creating a built-in, recurring source of demand that is directly correlated to network usage and adoption.

Complementing the reserve is a significant overhaul of the token’s emission schedule. According to the press release, Wormhole is abandoning its annual unlock cliffs in favor of a biweekly distribution model.

This change applies to several major token categories including Guardian Nodes, which represent 5.1% of the total supply, the Community and Launch allocation at 17%, the Ecosystem and Incubation pool at 31%, and Strategic Network Participants, who hold 11.6%.

By shifting to a linear, four-and-a-half-year vesting schedule for these groups, Wormhole intends to smooth out token releases, thereby reducing market shocks and fostering a more stable trading environment.

At the time of writing, the W token was trading at approximately $0.094, according to data referenced in the source material from crypto.news. The token also saw a price increase of more than 7.82% following the announcement.

You May Also Like

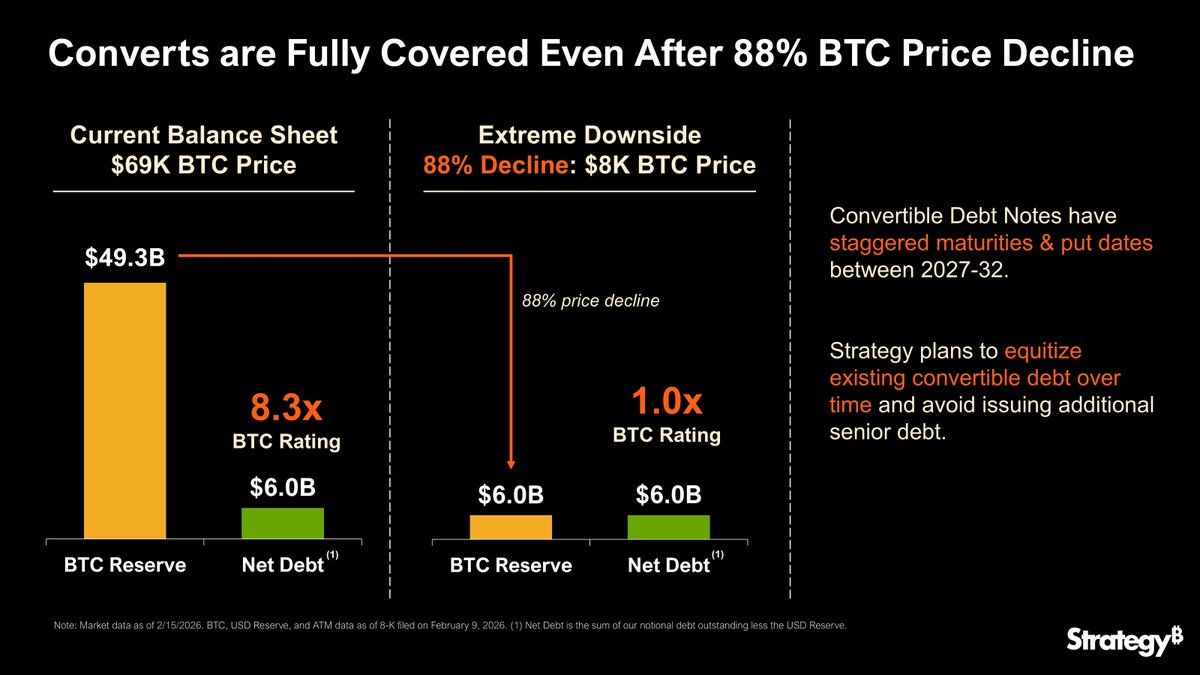

Strategy Can Fully Cover $6 Billion In Debt if Bitcoin Drops 90%, But What Happens Below That Line?

Positive Pay: Strengthening Business Security Against Check Fraud