Best Crypto Investment 2025: Pepeto vs Blockdag Vs Layer Brett Vs Remittix and Little Pepe

In this head-to-head we put Pepeto (PEPETO) up against Blockdag, Layer Brett, Remittix, and Little Pepe using simple yardsticks, team intent and delivery, on-chain proofs, tokenomics clarity, DEX and bridge readiness, PayFi rails, staking, and listing prep, so you can act on facts, not hype, and decide confidently before the next leg higher catches you watching from the sidelines.

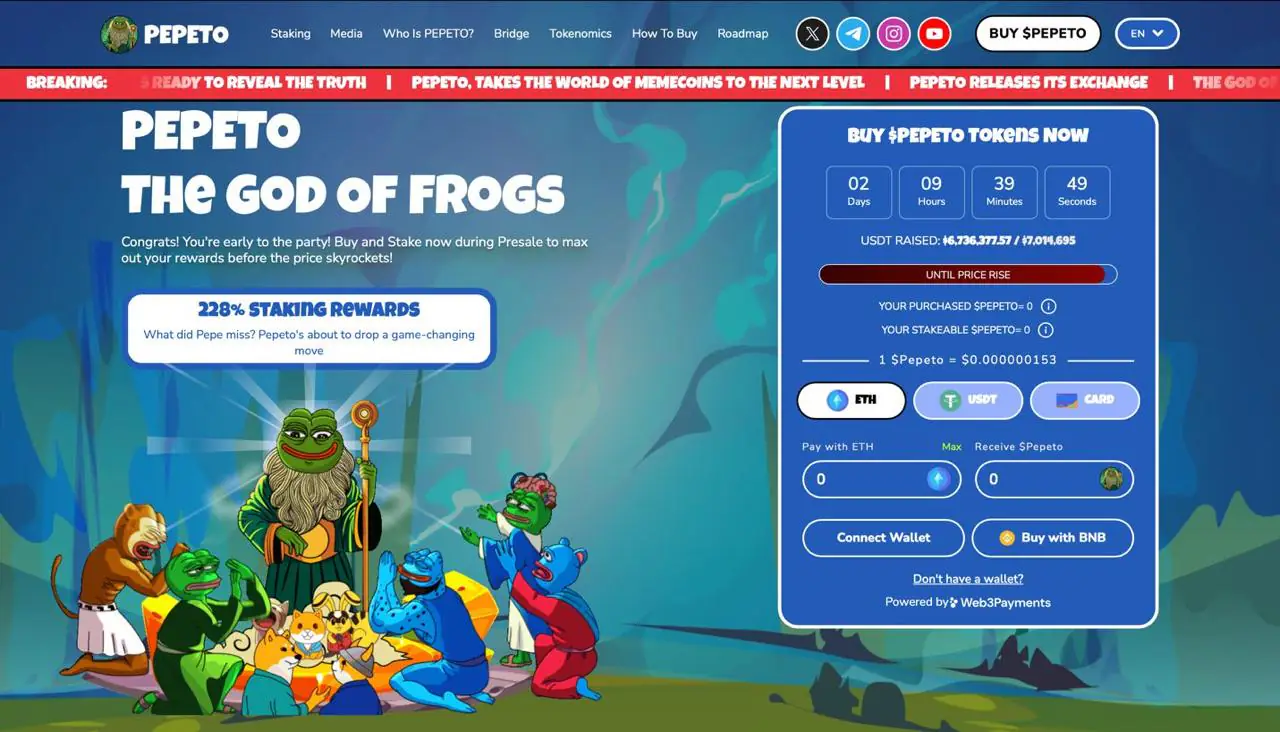

Pepeto’s Utility Play: Zero-Fee DEX, Bridge, And StrongPotential

Pepeto treats the meme coin playbook like a platform brief, not a joke. The team ships fast, polishes details, and shows up weekly, aiming for staying power rather than a momentary pop. A hard-capped design anchors PepetoSwap, a zero-fee exchange where every trade routes through PEPETO for built-in usage instead of buzz.

Already 850+ projects have applied to list, fertile ground for volume if listings follow. A built-in cross-chain bridge adds smart routing to unify liquidity, cut extra hops, and reduce slippage, turning activity into steady token demand because every swap touches PEPETO.

Pepeto is audited by independent experts Solidproof and Coinsult, a trust marker reflected in more than $6,7 Million already raised in presale. Early momentum is visible.

The presale puts early buyers at the front of the line with staking and stage-based price increases, and that line is getting long. Utility plus purpose, culture plus tools, the combo that tends to run farther than hype alone.

Translation for you: Pepeto is graduating from noise to usage. If listings land and on-chain activity scales, the setup favors bigger potential returns than legacy meme coins.

If any name is primed to outshine the old meme cohort in 2025, this is the one people will brag about spotting early. Serious investors won’t sit this out. Buy Pepeto now at the current price of $0.000000153, the lowest Pepeto price you will ever see again, and don’t let it pass.

Early SHIB and DOGE buyers made the right call at the right time, early. Pepeto appears to be at a similar stage now, set to lift, missing this crypto presale could mean missing the next millionaire coin.

Blockdag Reality Check: Marketing Claims vs On-Chain Proof

Before you chase the next banner, separate what’s shipped from what’s promised. BlockDAG (BDAG) talks up “10x upside,” but slogans don’t equal staying power. After the BDAG Deployment Event and a price reset to $0.0013, the question is transparency: limited independently verifiable on-chain proof for key metrics, unclear exchange-ready liquidity and post-listing unlocks, and few public engineering artifacts to audit.

The team highlights a DAG-plus-Proof-of-Work design claiming 15,000 TPS, instant payments, smart contracts, and eco-friendly operation, yet third-party tests and deep public code remain light.

Sports tie-ups (Inter Milan, Seattle Seawolves, Seattle Orcas) expand reach via NFTs, but holder utility is vague, the audit covered a narrow slice, and user reports on claims/withdrawals are mixed. Confidence now requires live releases and transparent, on-chain evidence.

Layer Brett, Remittix, Little Pepe: Sorting Signal From Noise

Layer Brett frames itself as an Ethereum Layer-2 with fast, low-fee transactions, staking, and meme energy, yet most coverage reads like paid placement, not independent review. Bold claims on throughput, fees, and cross-chain support lack third-party benchmarks; public code, audits, and traction look thin. Treat it as early stage and verify audited code, live activity, and listings before committing funds.

Remittix pitches a PayFi wallet that routes crypto to bank accounts, supporting 40+ coins, 30+ fiats, and same-day processing. Exchange access still looks tentative, licensing/compliance isn’t clear, the public audit appears limited, the team lacks third-party KYC, and early user ratings are weak, so execution risk remains high until rails and licenses are verified.

Little Pepe sells an EVM-compatible Layer-2 with low fees, quick confirmations, and a bridge to move assets in and out. The challenge is differentiation: most L2s make the same promises, and nothing shown so far looks measurably novel against Optimism, Arbitrum, or Base. Without transparent benchmarks, open documentation of its rollup design and bridge security, or demand beyond incentives, it reads like yet another copy-paste L2. Liquidity could fragment, bridge risk isn’t trivial, and any token value depends on sustained real usage, not meme momentum. Until verifiable, better tech ships, it’s more generic than groundbreaking.

Where To Invest?

Pepeto reads like a different story. The team is deliberately chasing two outcomes at once, sharp upside now and durability after, not a sugar high that fizzles. You can feel the pulse in how they ship, communicate, and keep showing up; it feels like holders are stepping into a story people will talk about in the meme coin arena. It speaks across the stack: big wallets seeking a fresh narrative with serious multiple potential, and smaller buyers who’ve waited for a clean shot at life-changing gains. If you hesitated on early Shiba or Dogecoin and swore you wouldn’t miss the next one, this is the moment to act.

On the flip side, BlockDAG has fewer live releases and little verifiable on-chain evidence so far; Layer Brett coverage still reads promotional with scarce independent benchmarks; Remittix needs clearer licensing and visible listings; and Little Pepe’s Layer-2 pitch isn’t clearly differentiated from established rollups. Ask the plain question, Which is The Best Crypto Investment 2025?, and Pepeto separates itself on delivery, openness, and intent, a meme coin engineered to surge quickly and sustain momentum. Remember, today’s Pepeto price is presented as the lowest you’ll ever see; several analysts tag it among the best crypto to buy now. It looks like the shot no sharp buyer should let go, the one that will change many lives this year.

Pepeto Media Links :

This publication is sponsored. Coindoo does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or any other materials on this page. Readers are encouraged to conduct their own research before engaging in any cryptocurrency-related actions. Coindoo will not be liable, directly or indirectly, for any damages or losses resulting from the use of or reliance on any content, goods, or services mentioned. Always do your own research.

The post Best Crypto Investment 2025: Pepeto vs Blockdag Vs Layer Brett Vs Remittix and Little Pepe appeared first on Coindoo.

You May Also Like

What Is an Uncontested Divorce and How Does It Work?

Google's AP2 protocol has been released. Does encrypted AI still have a chance?