5 Coins to Buy as US House Committee on Financial Services Pushes Senate to Pass ‘Clarity Act’

The crypto market is at a turning point. The Digital Asset Market Structure Clarity (CLARITY) Act is a new trigger in Washington as price action swings on technicals and ETF speculation. Recently proposed by the House Financial Services Committee, the bill might change U.S. digital asset regulation. This push yields a clear takeaway for investors: tokens with strong fundamentals, growing adoption, and unique narratives are likely to benefit the most. As regulatory clarity draws closer, here are the best coins to buy right now.

Why the Clarity Act Push Matters for Crypto

The U.S. House Committee on Financial Services, led by Republican French Hill, has urged the Senate to pass the CLARITY Act, which establishes rules for digital asset trading and oversight.

The goal:

- Create a federal framework that distinguishes commodities, securities, and payment tokens.

- Prevent heavy-handed models similar to China’s CBDC control systems.

- Ensure the U.S. remains competitive in the global digital finance sector.

Crypto investors and builders have operated under fragmented guidance, facing lawsuits and enforcement-first tactics for years. If passed, the CLARITY Act could unlock institutional capital, encourage compliant innovation, and provide the foundation for a sustainable bull market. This backdrop makes now the ideal time to look at the best coins to buy before clarity and capital converge.

Little Pepe (LILPEPE): Meme Culture Meets Real Utility

Among new tokens, Little Pepe (LILPEPE) is capturing attention as a low-cap play with massive upside. Still priced at under $0.005 in presale, it offers early investors exposure before its planned launch at $0.003 and beyond.Unlike older meme coins that rely purely on hype, LILPEPE is positioning itself as the first Layer-2 blockchain tailored for memes, complete with:

- Zero buy/sell tax and near-zero fees.

- Sniper-bot resistant contracts for fairer launches.

- A meme-only launchpad, designed to scale its Layer-2 ecosystem

- A certified audit plus a strict vesting schedule for long-term stability.

The presale has already raised over $25 million, with 15.5 billion tokens sold, a sign of retail excitement and whale interest. As meme tokens become a cultural driver in crypto, LILPEPE is standing out by blending meme energy with infrastructure-level utility.A regulated environment will lend legitimacy to tokens like LILPEPE, enabling them to expand into centralized listings and institutional-backed products. With parallels to Dogecoin’s explosive rise in 2021, many see LILPEPE as the next 100x meme coin with real staying power. This cycle, LILPEPE stands as one of the best coins to buy before broader market recognition sends prices surging.

Ethereum (ETH): The Institutional Anchor

Ethereum remains the go-to asset for institutions, powering most of the stablecoin economy and DeFi ecosystems. With $172 billion in stablecoins circulating on Ethereum and strong ETF inflows from BlackRock and Fidelity, ETH has proven itself to be digital infrastructure rather than just a token.

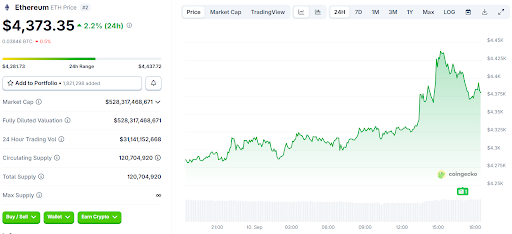

Ethereum Price Chart | Source: CoinGecko

Ethereum Price Chart | Source: CoinGecko

Technically, ETH is consolidating near $4,300, with analysts eyeing a breakout above $4,540 that could propel it to $6,000 in the short to medium term. Ethereum will likely benefit from regulatory certainty as the default Layer 1 for compliant tokenization if the CLARITY Act passes. For investors seeking stability with upside, ETH remains one of the best coins to buy in any regulatory environment.

Ripple (XRP): Banking and Payments Catalyst

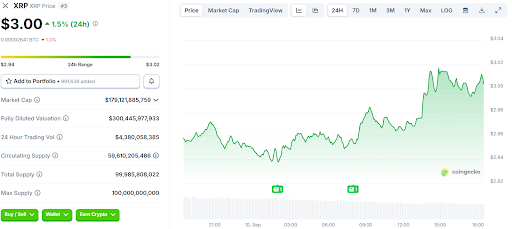

Ripple’s XRP continues to ride a wave of momentum, currently consolidating near the $3 mark. ETF speculation, expanding partnerships (like its deal with BBVA in Spain), and whale accumulation are laying the groundwork for a potential breakout toward $6.

XRP Price Chart | Source: CoinGecko

XRP Price Chart | Source: CoinGecko

A regulatory framework like the Clarity Act could cement XRP’s role as the backbone of payments and tokenized assets. That mix of compliance and global adoption makes XRP one of the best coins to buy heading into Q4 2025.

Avalanche (AVAX): Scaling for Web3 Growth

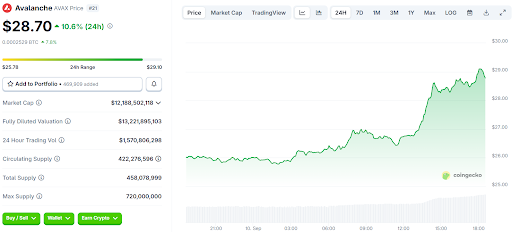

Avalanche has quietly built a strong ecosystem focused on enterprise adoption and modular blockchains. Its subnets allow for customizable, high-performance chains that can plug into regulated environments, precisely the kind of infrastructure institutions may adopt post-clarity.

Trading near the $28 range, AVAX is well-positioned for expansion, with analysts predicting targets of $ 100 or more if adoption accelerates. Avalanche’s enterprise-first approach could shine in a world of more explicit rules. AVAX ranks among the best coins to buy in September for those diversifying into infrastructure plays.

Solana (SOL): ETF Buzz Meets Institutional Demand

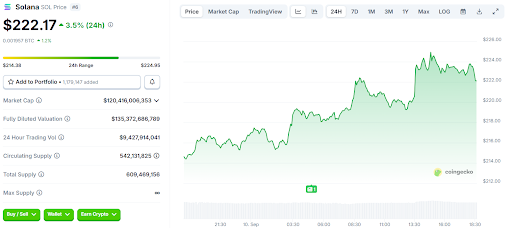

Solana’s breakout above $200 has been fueled by growing open interest and optimism around a potential Solana ETF approval. With a Nasdaq listing backed by $94 million in SOL holdings, the asset is seeing increasing credibility among institutional players.

Solana Price Chart | Source: CoinGecko

Solana Price Chart | Source: CoinGecko

The CLARITY Act could accelerate this trend by providing regulatory certainty and streamlining ETF approvals. Solana’s low fees, high throughput, and thriving NFT economy ensure it remains a magnet for retail and institutional flows. With analysts eyeing $400 targets, SOL remains one of the best coins to buy during this regulatory shift.

Positioning Ahead of the Senate’s Move

The CLARITY Act represents more than just policy; it could mark the start of a new U.S.-led crypto rally. For investors, the best coins to buy in this environment combine proven fundamentals with breakout potential.

- Ethereum and Ripple offer institutional stability.

- Avalanche and Solana deliver scalable infrastructure and adoption.

- Little Pepe provides speculative upside with the potential to become the next Dogecoin-style phenomenon, this time with real utility.

Together, these five names represent the best coins to buy as crypto enters a new era of regulation and growth. Don’t miss out on the token with the most asymmetrical upside: Join the Little Pepe presale today before listings ignite the next wave.

For more information about Little Pepe (LILPEPE) visit the links below:

Website: https://littlepepe.com

Whitepaper: https://littlepepe.com/whitepaper.pdf

Telegram: https://t.me/littlepepetoken

Twitter/X: https://x.com/littlepepetoken

]]>You May Also Like

Nvidia Partners with Former Crypto Miner Nscale for UK AI Infrastructure Project

Once Upon a Farm Announces Pricing of Initial Public Offering