New Crypto Projects Ready to Thrive as UK Banks Embrace Tokenized Deposits

As the banking system moves on-chain, tokens with real use cases are well placed to benefit. These aren’t just passing meme coins, but projects that combine finance, technology, and investor appeal.

What follows are three new crypto projects that could thrive as the rails of money change.

If tokenized deposits take hold, they may rank among the best presale opportunities of this cycle.

Why Tokenized Deposits Matter

UK banks are moving fast. HSBC, Barclays, NatWest, Lloyds, Santander, and Nationwide are already testing tokenized sterling deposits (GBTD) in a pilot coordinated by UK Finance.

The program will run until mid-2026 and covers everyday payments, remortgaging, and even settlement of digital assets.

The Bank of England has given its blessing. Governor Andrew Bailey has made it clear: tokenized deposits are the future, stablecoins are a risk.

This isn’t just happening in the UK. Several European banks have announced plans to launch a euro-backed stablecoin, showing the region is also moving toward digital money.

Meanwhile, in the U.S., Trump’s GENIUS Act is already reshaping the market by giving banks and institutions clearer rules for digital assets. Together, these moves highlight that tokenized finance is part of a broader global shift.

The UK’s Financial Conduct Authority won’t finish its stablecoin rules until late 2026. Until then, tokenized deposits let banks issue digital cash today, without waiting on regulators.

1. Best Wallet Token ($BEST) – Utility-Packed Token With Real Demand

Best Wallet Token ($BEST) is more than just a wallet add-on – it’s the engine of the Best Wallet ecosystem.

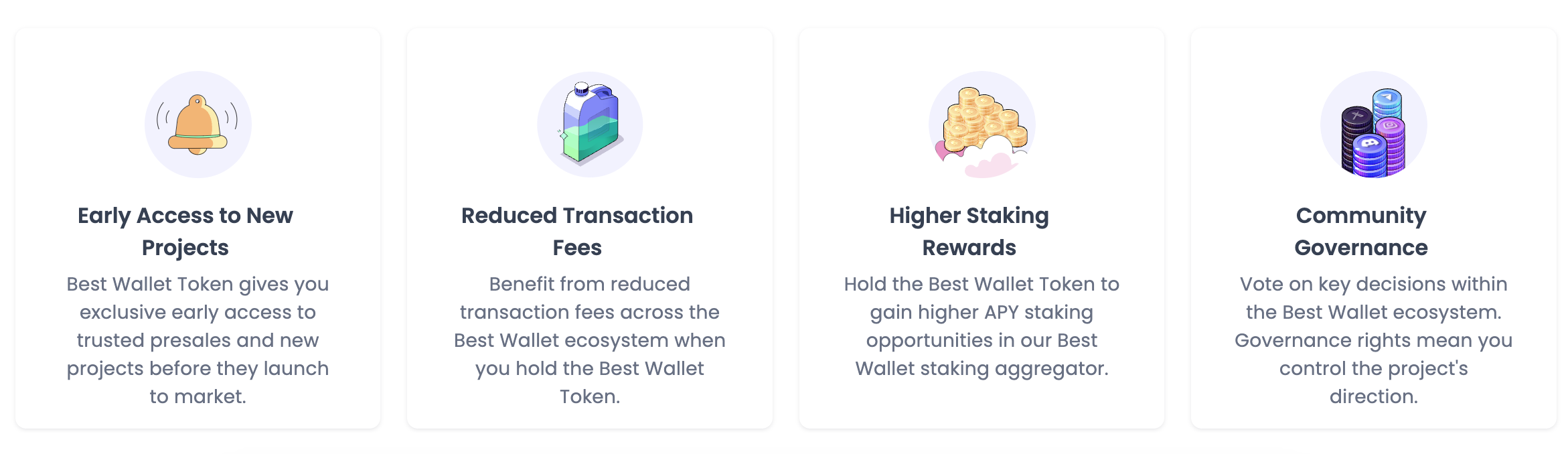

Holding the token unlocks a stack of benefits that make it central to the project’s growth. Token holders enjoy reduced transaction fees, early access to new projects, boosted staking rewards, and a real say in governance decisions.

The design is simple: the more Best Wallet expands, the more demand for $BEST grows.

The team has also created Upcoming Tokens, a presale participation tool that only works with $BEST. It gives holders direct access to new crypto launches inside the app, cutting out scams and fake sites.

That makes $BEST not just a speculative play but a gateway to future presales.

This model connects neatly with the shift to tokenized deposits. If banks issue on-chain money, wallets that support those rails will see a surge in activity. Every new feature will loop back into $BEST, amplifying its role.

Right now, you can buy $BEST for $0.025695, with over $16.1M already raised.

You can join the $BEST presale here.

2. SUBBD Token ($SUBBD) – Where AI Meets the Creator Economy

SUBBD Token ($SUBBD) is the utility token behind SUBBD, an AI-powered content platform built for the $85B creator economy.

The project aims to fix a broken system where influencers often lose over 50% of their revenue to middlemen and platforms.

With SUBBD, creators plug into AI assistants that handle chat, editing, scheduling, and monetization. Fans get access to AI-enhanced content, avatars, and premium drops.

It’s a frictionless model designed to keep more earnings in the creator’s pocket.

The reach is already huge – over 250M followers combined across the SUBBD platform, Honny brand, and its ambassadors.

Unlike most crypto launches, the team is backed by a visible roster of doxed influencers, giving it credibility in a noisy market.

Here’s where the tokenized deposit angle comes in. Imagine bank-issued digital cash flowing directly into SUBBD subscriptions or creator tips.

No delays, no middlemen. $SUBBD could be one of the first tokens to sit at the crossroads of regulated digital banking and the creator economy.

At the moment, $SUBBD is priced at $0.056525, with more than $1.2M raised in its presale.

Check out $SUBBD crypto presale right now.

3. Remittix ($RTX) – Turning Crypto Into Real-World Payments

Remittix ($RTX) is building what it calls a PayFi network, designed to connect crypto directly to the global banking system.

The platform lets users pay crypto straight into any bank account in over 30 currencies, with same-day settlement through local payment networks. No hidden FX fees, no wire charges – what you send is exactly what the recipient receives.

The beta Remittix Wallet is already live on Ethereum and Solana, supporting swaps, storage, and remittances. The token, $RTX, fuels this system by powering transactions, liquidity, and future integrations.

With banks preparing to issue tokenized deposits by 2026, Remittix’s rails could become more important than ever.

Imagine moving from a tokenized bank balance into RTX to send instant payments worldwide.

That’s the bridge Remittix is trying to build – blending regulated digital cash with global crypto rails.

The presale has raised $26.7M so far, and you can buy$RTX for $0.1130 at the current stage. CertiK has already audited the project, and major CEX listings are in the pipeline.

You can learn more about $RTX here.

New Crypto to Watch in the Age of Digital Cash

Tokenized bank deposits are set to change how money moves, and crypto projects that can align with this shift may see outsized benefits.

$BEST powers a growing multi-chain wallet, $SUBBD fuels AI monetization in the $85B creator economy, and $RTX builds crypto-to-bank payment rails.

Each of these tokens is positioned for the new landscape of digital banking.

This publication is sponsored. Coindoo does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or any other materials on this page. Readers are encouraged to conduct their own research before engaging in any cryptocurrency-related actions. Coindoo will not be liable, directly or indirectly, for any damages or losses resulting from the use of or reliance on any content, goods, or services mentioned. Always do your own research.

The post New Crypto Projects Ready to Thrive as UK Banks Embrace Tokenized Deposits appeared first on Coindoo.

You May Also Like

Polygon Tops RWA Rankings With $1.1B in Tokenized Assets

XRP Sees Panic Selling as Glassnode Data Shows Significant Holder Losses