Retail Investors Call This the $20-to-$500,000 Opportunity of the Decade

A Shifting Tide in the Meme Coin Market

The crypto headlines of recent weeks have revolved around legacy tokens, from renewed speculation around a potential Dogecoin ETF to whale-driven price swings in Shiba Inu. While these stories reignite nostalgia for 2021’s meme coin mania, many investors are asking whether the old hype can still deliver life-changing returns.

Dogecoin and SHIB continue to command massive communities, but their sheer scale has slowed growth. Both tokens face challenges in reigniting the explosive virality that once made millionaires. Amid this fading frenzy, a new contender is quietly engineering what some retail investors are calling “the $20-to-$500,000 opportunity of the decade.”

That project is Moonshot MAGAX (MAGAX), a meme-to-earn presale token combining AI-powered meme detection, decentralized rewards, and transparent tokenomics.

Why the Old Meme Stars Are Losing Their Spark

Dogecoin, the original meme asset, has long symbolized community-driven crypto. But with its market cap in the tens of billions, the law of diminishing returns weighs heavily. Even a doubling in price would no longer transform small investments into life-changing wealth.

Shiba Inu, once hailed as the “Dogecoin killer,” has faced similar headwinds. Despite ecosystem expansions into NFTs and DeFi, SHIB has struggled to maintain momentum. Trading volumes remain a fraction of their peak, and whales often control outsized influence.

Investors, particularly retail traders, are hungry for the next viral coin with asymmetric upside, one where a few dollars can unlock extraordinary potential. That’s where MAGAX steps in.

Enter MAGAX: A Meme-to-Earn Presale With AI at Its Core

Unlike traditional meme coins, MAGAX is the first AI-powered Meme-to-Earn token. Its blockchain ecosystem detects viral memes in real time using advanced AI models like GPT-4 and CLIP. Both meme creators and promoters are automatically rewarded when their content surges online.

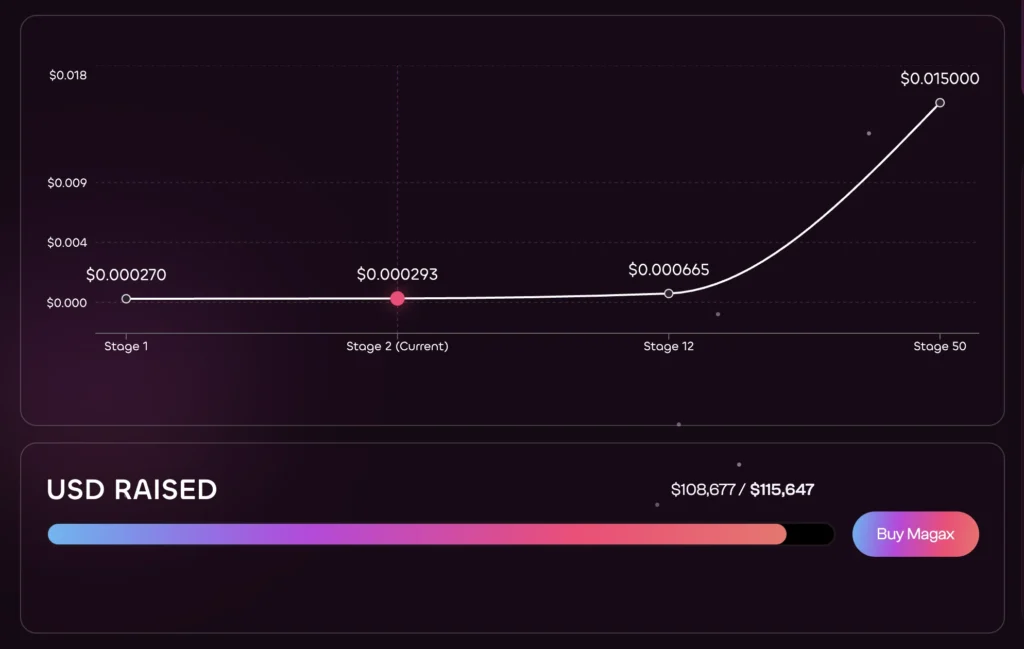

At the heart of the buzz is its Stage 2 presale, priced at just $0.000293 per token. Early investors project potential returns of 153×, fueled by MAGAX’s fixed supply, capped referral pools, and deflationary mechanics that burn tokens to maintain scarcity.

With more than $108,000 already raised toward a $115,647 milestone, momentum is building rapidly. For retail traders, this is the kind of transparent, stage-based growth curve that once made early Dogecoin and Shiba Inu backers legends.

Security and Scarcity: MAGAX’s Trust Advantage

Skepticism around meme tokens is natural, but MAGAX has taken credibility seriously from day one. Its smart contract audit, completed by CertiK, passed with flying colors, zero critical issues and full transparency across code functions.

On top of that, the project underwent an additional internal audit, using unit tests and advanced code analysis to identify vulnerabilities before launch. In an industry scarred by scams, this dual-layer approach has won MAGAX growing confidence among investors.

Scarcity also sets MAGAX apart. With a total supply of 1 trillion tokens and only 10% allocated to the presale, the staged pricing model ensures early adopters are rewarded. Later rounds climb as high as $0.015 per token, meaning today’s price represents a massive discount.

Referral Rewards and Viral Boosters: Growth Engine in Motion

MAGAX has also innovated with referral and booster systems. Early backers can share links, earning 7% in MAGAX tokens when friends invest, while those friends also earn a 5% bonus. These incentives are capped to prevent abuse, but powerful enough to drive network effects as the presale accelerates.

Combined with the AI-driven Meme-to-Earn mechanics, MAGAX is positioning itself as both an investment and a cultural movement. The token isn’t just riding on hype; it’s designed to manufacture virality by rewarding the very behavior that fuels internet trends.

Is This the New Meme Economy Blueprint?

MAGAX doesn’t pretend to be Dogecoin 2.0. Instead, it’s building a new creator-centric meme economy, where blockchain rewards flow back to the people who actually generate value: meme creators, sharers, and early adopters.

The roadmap lays out a clear path: AI virality detection, staking rewards, governance participation, fraud protection, and gamified community features. With integrations planned across Web3 platforms, MAGAX could become the backbone of a decentralized viral economy.

For retail investors, that narrative hits all the right notes, early entry, real utility, and built-in scarcity.

The Retail Investor’s Verdict

From Discord groups to Telegram chats, retail investors are buzzing that MAGAX could turn a modest $20 entry into life-changing gains. While such projections remain speculative, the math is clear: even small allocations at early presale stages carry the kind of exponential upside long gone from Dogecoin or SHIB.

The difference lies in execution. By blending AI technology, audited transparency, and deflationary tokenomics, MAGAX offers more than nostalgia; it offers a new playbook for meme-driven crypto growth.

Conclusion

As older meme tokens battle stagnation, Moonshot MAGAX has captured the narrative of what comes next. Investors are treating it not just as a presale, but as the foundation of a new meme economy, one that could transform micro-investments into generational opportunities.

Secure your MAGAX tokens today before the price moves to the next stage.

This article is not intended as financial advice. Educational purposes only.

You May Also Like

Crucial Fed Rate Cut: October Probability Surges to 94%

FCA, crackdown on crypto