Google Searches for Zcash Surge as ZEC Trades Above $100

Zcash ZEC $117.4 24h volatility: 56.7% Market cap: $1.93 B Vol. 24h: $736.97 M continues its price rally, accumulating nearly 300% gains in a year and over 150% gains in the last 30 days, gathering attention from different sectors, seeing Google searches for related keywords spike to local highs.

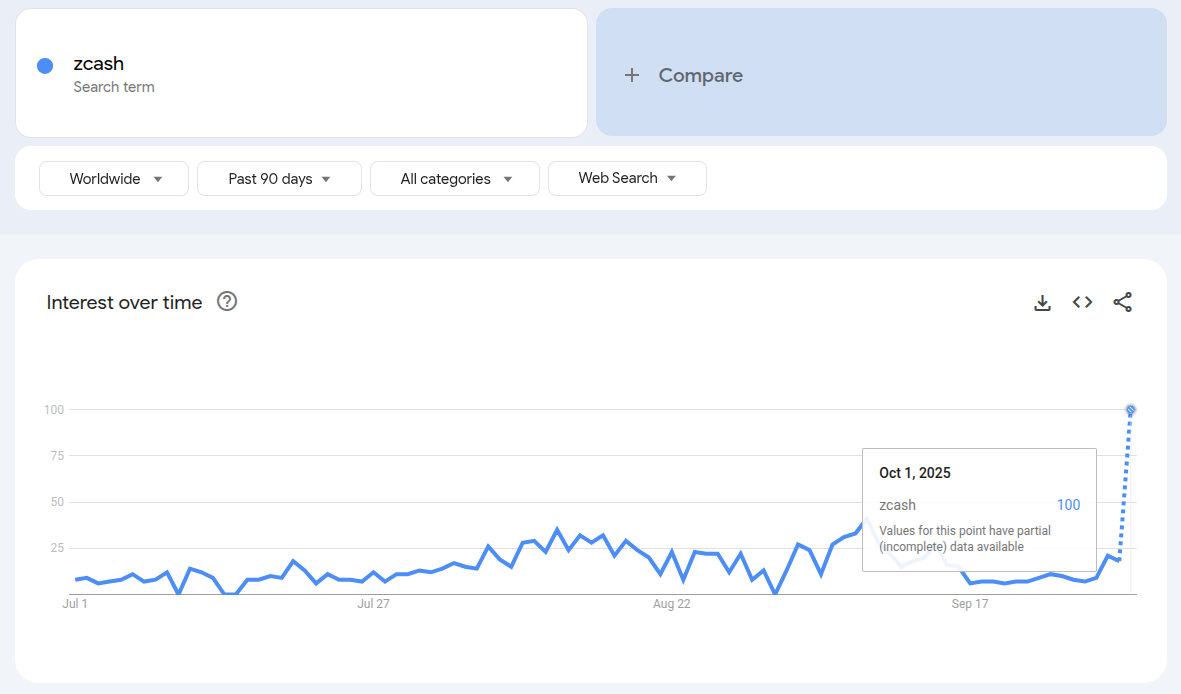

In particular, Google Trends’ interest over time data for “zcash” is about to make record highs in the last 90 days of October 1, seeking consolidation in 100 points. The previous “interest over time” high was on September 14, with 41 points. ZEC traded between $50.37 and $52.85 on this day, according to TradingView’s CRYPTO index.

Interest over time for “zcash” in the last 90 days of October 1, 2025 | Source: Google Trends

Nevertheless, Zcash is still not ranking among the most visited or the most trending cryptocurrencies in aggregators like CoinMarketCap and CoinGecko, suggesting its growth may still be going unnoticed or ignored by certain crypto communities.

Zcash is the second-largest privacy cryptocurrency by market capitalization and is deemed the most technically advanced one when getting better privacy through shielding is the goal. ZEC’s growth got some fuel when big X accounts joined known Zcash advocates and Helius co-founder Mert in promoting the solution, as Coinspeaker reported on September 25. ZEC was trading at $56.29 at that time.

When questioned about the reasons for “shilling Zcash,” Mert mentioned (i) privacy as a core mission of crypto, (ii) upcoming improvements to the protocol, (iii) a market cap comparison against Monero’s $5 billion capitalization, (iv) Zashi wallet, NEAR Intents, and research pieces marking a “Renaissance of talent,” (v) a faithful community of long-term supporters, and (vi) the need for privacy to succeed in the crypto industry.

Zcash (ZEC) Surges Past $105: A 292% Yearly Gain

As of this writing, ZEC was trading at $105.23, being CoinMarketCap’s “top gainer” of the day—beating pump.fun’s PUMP—up 41% in the last 24 hours. At current prices, the cryptocurrency is up 292.33% year-over-year, from $27.77 on October 1, 2024. Month-over-month, Zcash is up 159% from $40.5 on September 1, 2025.

Notably, the coin is not only performing well against the dollar but also against the crypto market, consistently climbing the market cap ranks, now ranked in the 64th position with a $1.70 billion capitalization. Zcash has recently passed Donald Trump’s controversial memecoin TRUMP and Filecoin.

Only two days ago, on September 29, the coin was ranked in the 76th position, outperforming 11 other cryptocurrencies in this time. A snapshot posted on X on September 22 shows a 92nd position.

Zcash market data: price, chart, capitalization rank, and daily performance as of October 1, 2025 | Source: CoinMarketCap

Privacy coins have seen an uprise in interest, evidenced by the surge for the key phrase “privacy coins” on Google Searches, reaching new all-time highs, Coinspeaker reported.

nextThe post Google Searches for Zcash Surge as ZEC Trades Above $100 appeared first on Coinspeaker.

You May Also Like

China Blocks Nvidia’s RTX Pro 6000D as Local Chips Rise

Samsung To Unveil New AI-Connected Living Lineup at CES 2026