Hedera (HBAR) Explained 2025: Technology, Tokenomics & Real-World Use Cases

Table of Contents

Table of Contents

- What Makes Hedera (HBAR) Unique?

- The Origins and Background of Hedera

- Hashgraph Technology: Beyond Blockchain

- Governance & Enterprise Partnerships

- Practical Use Cases of Hedera

- HBAR Tokenomics Explained

- Latest Hedera News & Updates

- Final Thoughts on Hedera

- FAQ: 10 Unanswered Questions About Hedera

What Makes Hedera (HBAR) Unique?

What Makes Hedera (HBAR) Unique?

Hedera represents a distributed ledger distinct from classical blockchain systems. Its Hashgraph technology enables fast, secure, and low-cost transactions with high throughput. HBAR functions as a utility token, covering fees, supporting staking, and strengthening network security. Many ask: What is Hedera? The answer: A highly scalable, public distributed ledger that goes beyond blockchain. Enterprises quickly recognize its advantages for business-grade applications.

The Origins and Background of Hedera

The Origins and Background of Hedera

Founded in 2018 by Leemon Baird and Mance Harmon, Hedera Hashgraph LLC initially developed the platform before governance transitioned to the Hedera Governing Council. This council manages upgrades and ensures network stability. Hedera aims to be enterprise-ready, serving DeFi, digital identity, supply chain, and more. The system addresses blockchain limitations through innovative consensus mechanisms, with global companies already adopting it to improve efficiency. Core principles emphasize sustainability and regulatory compliance.

Hashgraph Technology: Beyond Blockchain

Hashgraph Technology: Beyond Blockchain

Hedera uses Hashgraph, a Directed Acyclic Graph (DAG) that eliminates mining. Transactions achieve finality within seconds at minimal cost. Its consensus model, asynchronous Byzantine Fault Tolerance (aBFT), ensures resilience against failures. Parallel processing enhances scalability and energy efficiency, surpassing Ethereum and Bitcoin in performance. Hedera processes up to 10,000 TPS and consumes less energy than a Visa transaction, achieving carbon-negative status. The open-source code, governed by the Linux Foundation, fosters community contributions.

| Feature | Hedera (Hashgraph) | Bitcoin | Ethereum |

|---|---|---|---|

| Transactions per Second | 10,000+ | 7 | 30 |

| Finality | Seconds | ~60 minutes | ~6 minutes |

| Energy Efficiency | Carbon-Negative | High Consumption | Moderate Consumption |

Governance & Enterprise Partnerships

Governance & Enterprise Partnerships

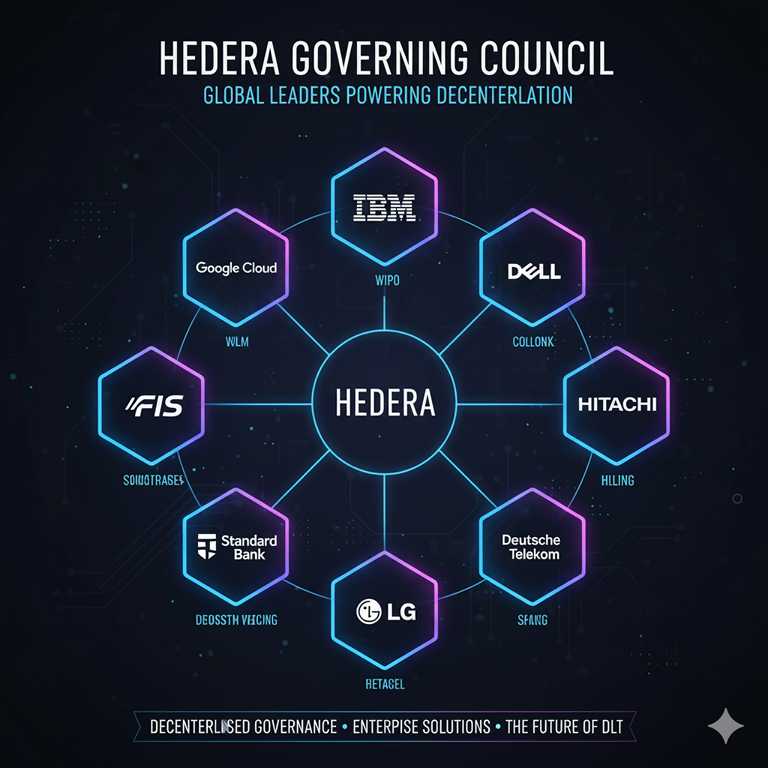

The Hedera Governing Council includes over 30 global corporations, such as Google, IBM, Boeing, Deutsche Telekom, and Standard Bank. Members manage nodes and vote on upgrades, ensuring transparent governance. Partnerships extend across supply chains, CBDCs, and ESG-tracking. By 2025, the council expanded to 33 organizations, with Mance Harmon taking over as chair. New collaborations include Arrow Electronics and Blockchain for Energy, driving innovations in tokenized assets and emission reporting.

Practical Use Cases of Hedera

Practical Use Cases of Hedera

Hedera use cases span multiple industries:

- Supply Chain: Real-time product tracking and data integrity.

- Finance: Fast settlements and stablecoin integration.

- Sustainability: Carbon and ESG data tracking.

- DeFi & NFTs: Growing Web3 applications at low cost.

- CBDCs: Pilots with central banks.

- Real Estate: Tokenized property and regulated exchanges.

HBAR Tokenomics Explained

HBAR Tokenomics Explained

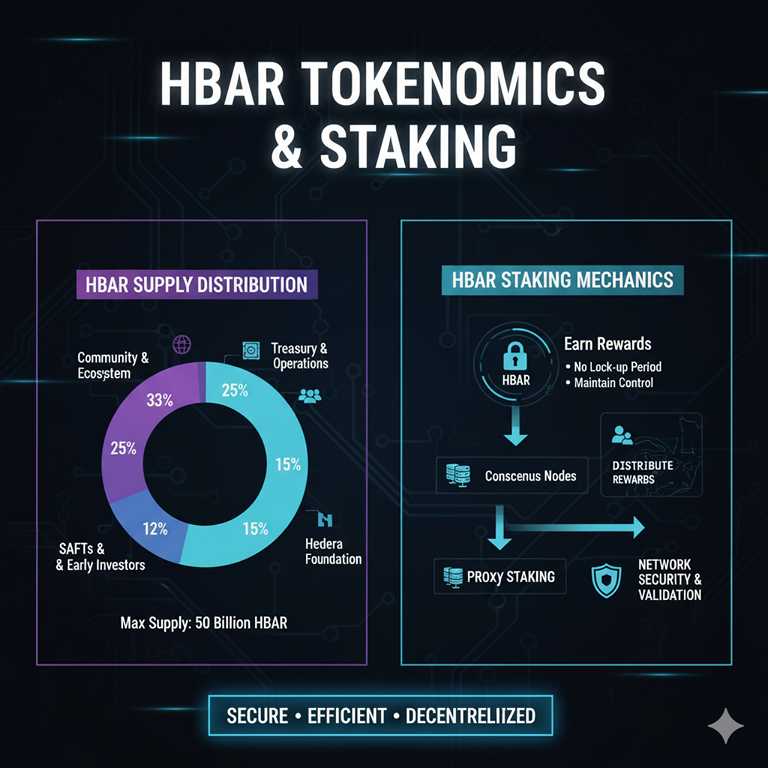

Hedera’s tokenomics includes a maximum supply of 50 billion HBAR. The token secures the network, enables staking, and covers transaction fees averaging $0.001. The Governing Council manages inflation via a controlled emission schedule. Staking rewards participants while strengthening the Proof-of-Stake model. With a fixed supply, scarcity supports long-term value. HBAR also ensures fair ordering of transactions without a centralized leader.

Latest Hedera News & Updates

Latest Hedera News & Updates

In 2025, Hedera announced new CBDC partnerships, including Swift, while its DeFi and NFT ecosystems continued expanding. The Governing Council grew with members like B4E, and upgrades such as HIP-1299 enhanced network performance. Increasing ETF speculation also boosted HBAR’s visibility among institutional investors.

FAQ: 10 Unanswered Questions About Hedera

FAQ: 10 Unanswered Questions About Hedera

]]>You May Also Like

Wormhole launches reserve tying protocol revenue to token

VanEck Targets Stablecoins & Next-Gen ICOs