Bitcoin Crash Sparks Largest Liquidation in Crypto History – $19B Gone and Counting

There’s no way to sugarcoat what happened in the cryptocurrency markets since Friday evening. Bitcoin’s price, for example, took one of its most painful nosedives in recent history, dumping from over $122,000 to $105,000 on some exchanges and even to as low as $101,000 on others.

The altcoins were obliterated as well, with massive double-digit price drops from the majority of them. Here’s what we know so far.

Valuermarket’s report classified the event as the “largest single-day liquidation in the history of digital assets.” The initial numbers of $250 million in an hour and $900 million on a 24-hour scale when BTC had dipped to $117,000 pale in comparison to what happened next.

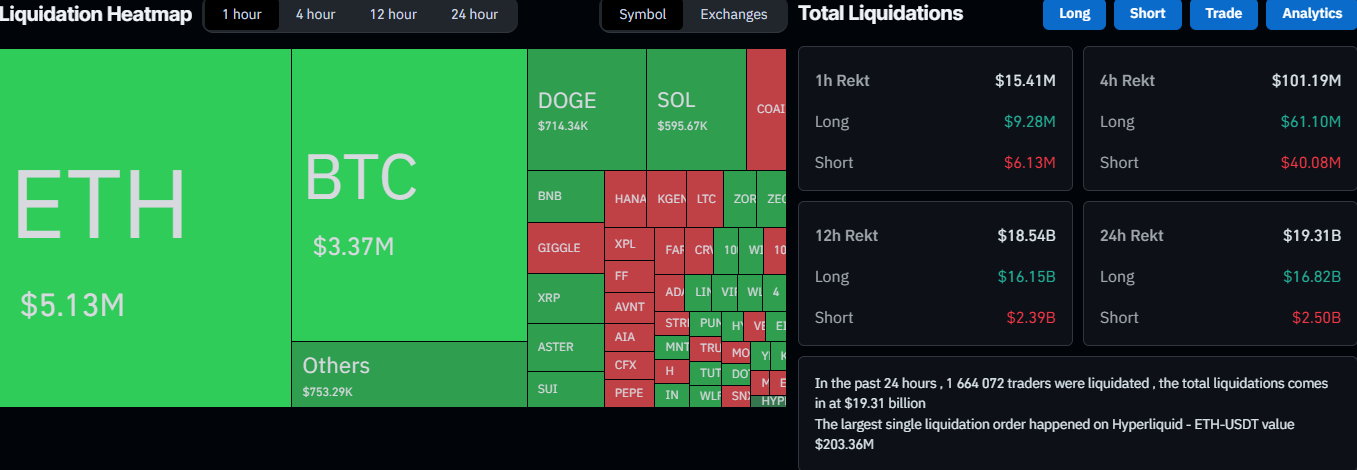

Data from CoinGlass shows a violent picture of $19.30 billion wrecked in the span of a day. Naturally, longs represent the lion’s share, with nearly $17 billion. However, the crypto market’s minor recovery attempt since then has also harmed some short traders, with $2.5 billion in such liquidations.

The number of wrecked traders is off the charts as well. It typically remains around 200,000 during a bad liquidation event, but has now skyrocketed to over 1,660,000. That’s more than 1.6 million traders.

Liquidation Data from CoinGlass

Liquidation Data from CoinGlass

The most obvious reason for this calamity was Trump’s actions on Friday evening when he threatened China with a new set of substantial tariffs after saying that Beijing had been lying for a long time.

The losses on Hyperliquid alone account for a big portion of the entire wipe-out. After all, the single-largest liquidation occured on Hyperliquid, with over $200 million gone on a ETH-USDT pair.

Despite the majority of traders in losses, there are some that made significant profits. According to MLM, one whale closed 90% of their BTC short and fully closed their ETH short, profiting around $200 million in just a day.

The post Bitcoin Crash Sparks Largest Liquidation in Crypto History – $19B Gone and Counting appeared first on CryptoPotato.

You May Also Like

TROPTIONS Corporation Announces Strategic Partnership with Luxor Holdings to Bridge Real-World…

Wanxiang A123 Unveils World’s First Semi-Solid-State Immersion Energy Storage System, Redefining Safety Standards