PENGU price rebounds violently, Pudgy Penguins' multi-line cooperation drives market heat

Author: Nancy, PANews

The crypto market is gradually recovering after a sharp drop, and the overall sentiment is starting to pick up. Recently, whether it is the strong rebound in coin prices, the significant growth in NFT sales, or the continued expansion of the brand, Pudgy Penguins has shown strong growth momentum in multiple dimensions.

The price of the currency rebounded strongly, and NFT and peripheral toys grew in both lines

Pudgy Penguins has shown strong growth momentum recently, both in the crypto market and in the physical field.

From the perspective of the price trend, Coingecko data shows that since the launch of the token $PENGU in mid-December last year, its price has shown a short-term upward trend, but then entered a stage of continuous decline. Since the beginning of January this year, the price of $PENGU has been falling all the way, and even retreated more than 90% from the highest point. This price decline was mainly affected by the overall crypto market downturn and airdrop selling pressure. However, the price of $PENGU has shown a strong rebound recently. From the low point to now, the increase has been nearly 265.8%, and the market value has increased by nearly US$580 million, showing a strong recovery in the market.

It is worth noting that the airdrop selling pressure of $PENGU has been basically lifted. According to Pudgy Penguins' previous disclosure, the airdrop claim period of $PENGU tokens ended on February 5, and the unclaimed 12.16 billion tokens were destroyed, accounting for 13.69% of the total supply at the end of the token claim. This measure effectively reduced the circulating supply of $PENGU in the market, reduced the airdrop selling pressure, and had a positive impact on the price recovery.

At the same time, the liquidity and market visibility of $PENGU are also continuously improving. For example, in March this year, Pudgy Penguins integrated crypto payment Helio Pay and Shop Pay, supporting users to use $PENGU for payment in official stores and thousands of other Shopify stores. It has also been launched on Robinhood and Coinbase in the past two months. The further expansion of market coverage and trading channels may also be one of the important driving forces for the rise in $PENGU prices.

The performance of the NFT series also showed a similar recovery trend. According to NFT Price Floor data, the floor price of Pudgy Penguins rose by 18.43% to 11.37 ETH in the past 7 days; at the same time, the transaction volume and number of transactions also increased by 288.57% and 257.32% respectively. According to previous statistics from CryptoSlam, in the first quarter of this year, the transaction volume of Pudgy Penguins reached US$72 million, the highest in the NFT series, an increase of 13% from US$63.5 million in the first quarter of 2024.

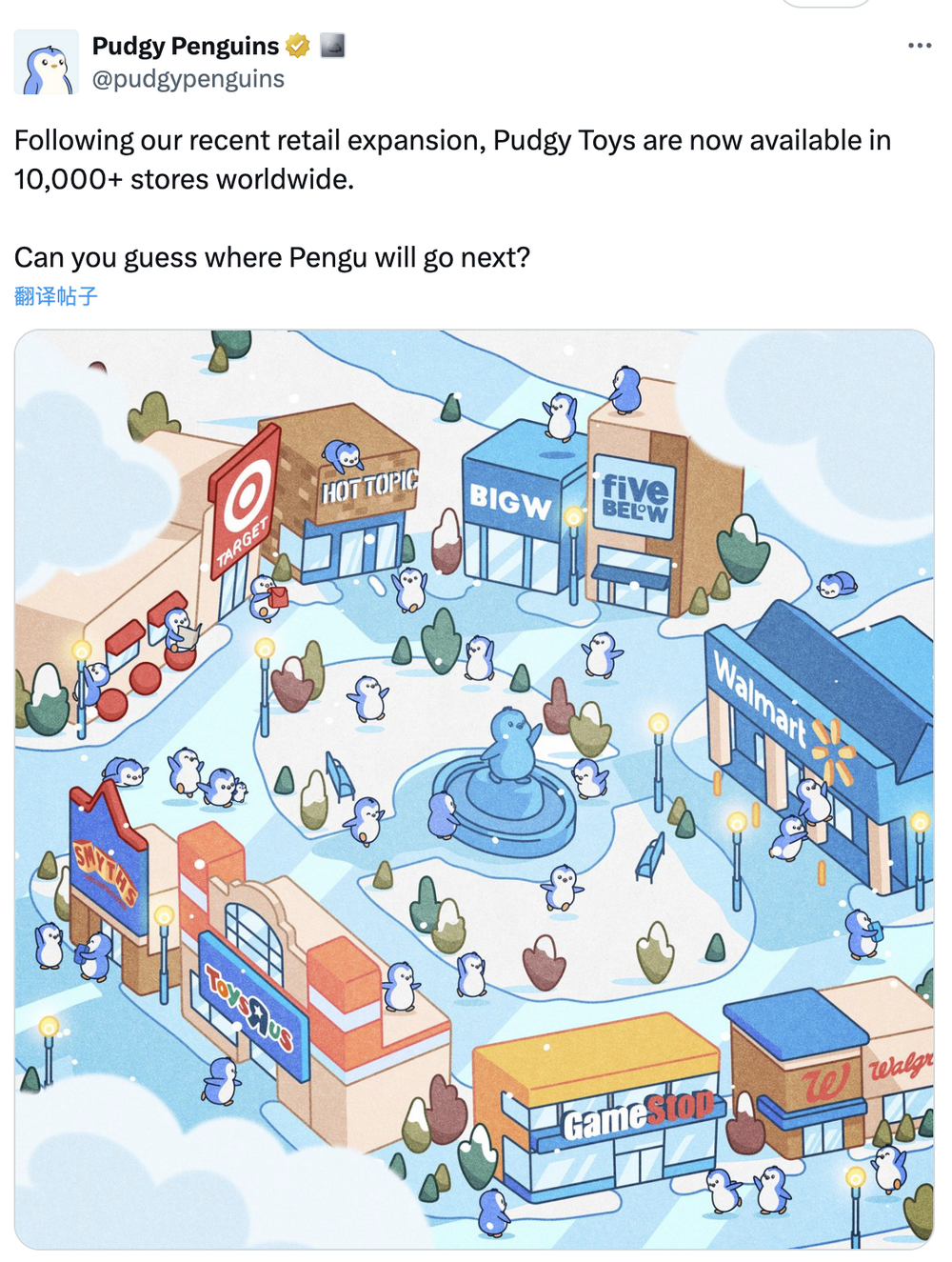

Of course, Pudgy Penguins's peripheral toys, Pudgy Toys, are also continuing to expand their influence in the consumer market. According to official data, Pudgy Toys has successfully landed in more than 10,000 stores around the world and sold more than 2 million toys last year. In addition, Pudgy Penguins also revealed that it has achieved more than 10 billion exposures on social platforms such as Instagram, TikTok, X, Telegram and Discord, and an average of more than 300 million people see and share Pudgy Penguin-related content every day. This high level of social media exposure will further promote its brand awareness and market demand.

From brand partnerships to community building, Pudgy Penguins continues to expand

Since the beginning of this year, Pudgy Penguins has continued to expand its influence around the world through multi-dimensional efforts in IP expansion, marketing and community building.

In terms of IP expansion, Pudgy Penguins continues to deepen its cooperation with global brands. For example, at the beginning of this year, Pudgy Penguins reached a cooperation with PEZ, one of the world's largest candy brands, and its image appeared in the PEZ product line together with well-known brands such as Pokémon and Disney; in February, Pudgy Penguins cooperated with Minini of LINE FRIENDS, one of the largest IPs in South Korea and Asia; in March, Pudgy Penguins launched a cooperation series with VANDYTHEPINK, one of the world's largest streetwear brands; this month, Pudgy Penguins teamed up with Lotte, a Korean retail and entertainment giant, to launch a limited edition Bellyland X Pudgy Penguins collectibles, and its derivative NFT series Lil Pudgy also revealed that it will launch its YouTube Show at the end of May. This series of cooperation has further enhanced the IP image of Pudgy Penguins and enhanced the brand's diversification and market awareness. IP expansion is also the strategic focus of Pudgy Penguins. Its CEO Luca Netz revealed a few months ago that the team currently has 65 people, of which 45 are focused on the IP field.

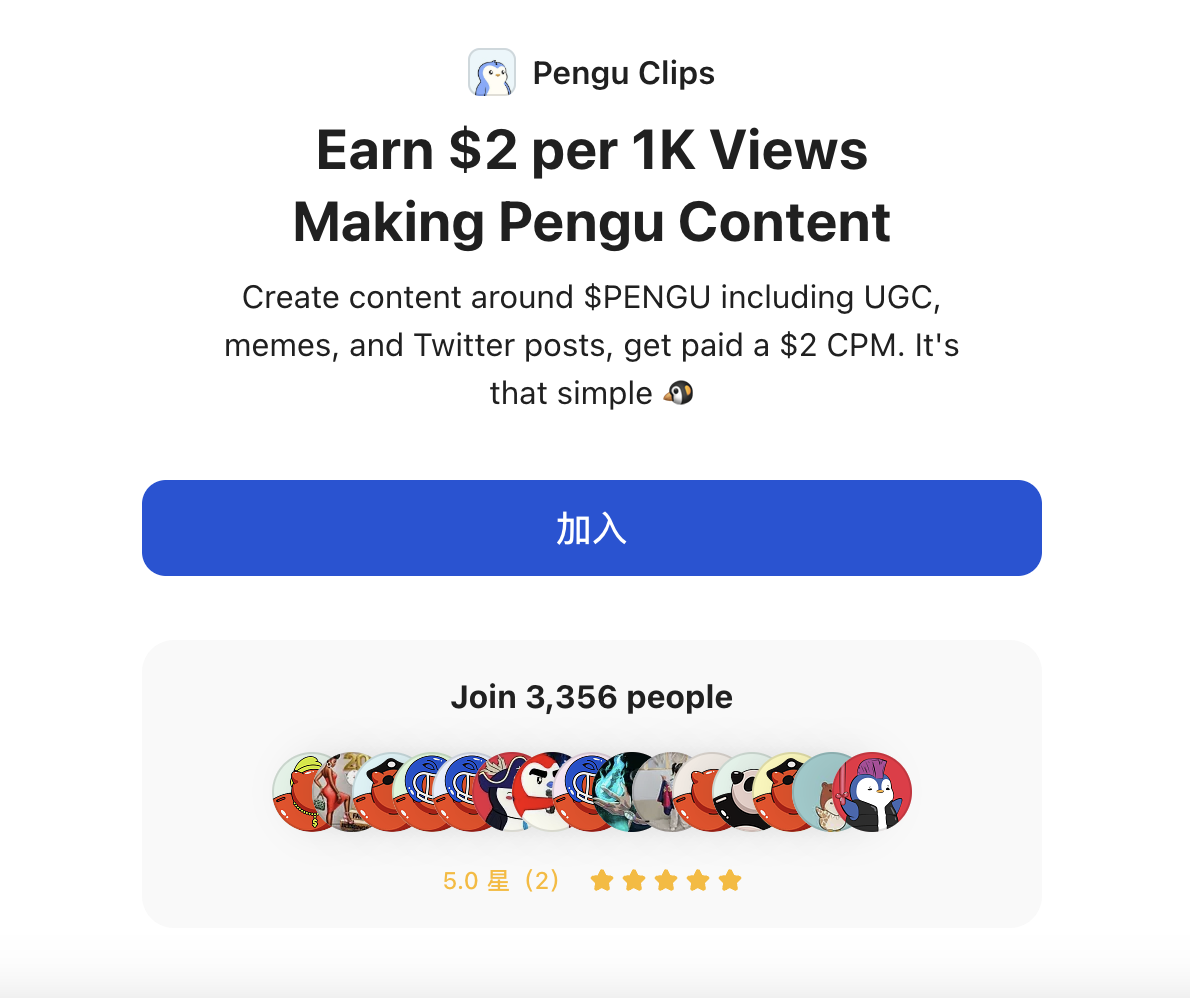

Pudgy Penguins' community incentive program on Whop

In terms of brand communication, Pudgy Penguins has taken a series of innovative measures to enhance the participation and vitality of its community. For example, in March this year, Pudgy Penguins launched Pengu Emojis, which received over 100,000 downloads in just two weeks. Recently, Pudgy Penguins also launched a community incentive program on Whop to encourage users to create content on social media around $PENGU to earn rewards, with each post receiving a maximum reward of $250. In order to further motivate active communicators in the community, Pudgy Penguins' community leader Berko recently stated that it plans to launch Pengu Bull SBT in the next few weeks to further enhance the sense of belonging and incentive mechanism of community members. This strategy not only effectively stimulated community enthusiasm, but also further amplified the brand's social communication effect.

In addition, Pudgy Penguins also benefited from the catalysis of ETF-related expectations. In March this year, Canary Capital submitted the S-1 application document for PENGU ETF to the US SEC. Although the ETF has not yet been officially approved, this move has increased the market popularity and brand exposure of Pudgy Penguins. It is worth noting that the Pudgy Penguins team also revealed that as an informal "government consultant", they maintain direct communication with policymakers 2 to 3 times a month.

You May Also Like

Best Crypto to Buy as Saylor & Crypto Execs Meet in US Treasury Council

BlackRock boosts AI and US equity exposure in $185 billion models