For several years now, Ethereum has maintained its position as the second-largest digital asset by market capitalization. However, its growth has slowed, and limited price movement has caused investors to explore new opportunities. During this period, the Nexchain AI token presale has emerged as one of the most promising alternatives this Q4.

With a series of completed stages and rising investor participation, the Nexchain AI token presale has become a focal point for those seeking more substantial returns. Thousands of investors are now turning toward Nexchain’s innovative AI-driven blockchain technology as a more adaptive and performance-oriented solution compared to Ethereum’s existing model.

Nexchain’s Layer-1 AI Blockchain Offers a Real Alternative to Ethereum

Nexchain AI is the first blockchain fully developed using artificial intelligence. Its hybrid Proof-of-Stake consensus integrates Directed Acyclic Graph (DAG) structures and AI-based optimizations. This architecture allows the network to execute transactions in parallel, unlike Ethereum, which still validates blocks sequentially.

Additionally, Nexchain AI implements sharding and machine learning-based fraud detection, enabling high throughput and enhanced security. The platform supports adaptive smart contracts, which automatically optimize performance and enforce compliance using real-time data. Its network also features post-quantum cryptography and anomaly detection tools, increasing its resilience to advanced cyber threats.

Advanced bridging protocols facilitate interoperability across blockchains. These allow secure asset transfers between networks while maintaining integrity through AI-based verification mechanisms. Nexchain’s cross-chain capabilities stand in contrast to Ethereum’s limited native interoperability features.

Nexchain AI Token Presale Reaches Stage 28 with Growing Investor Interest

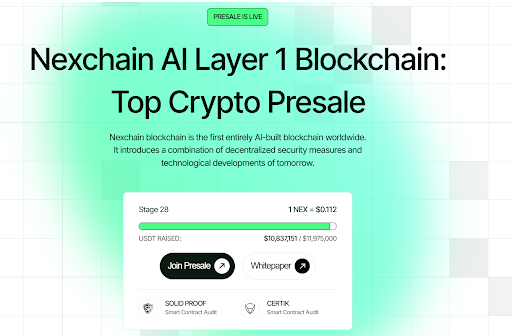

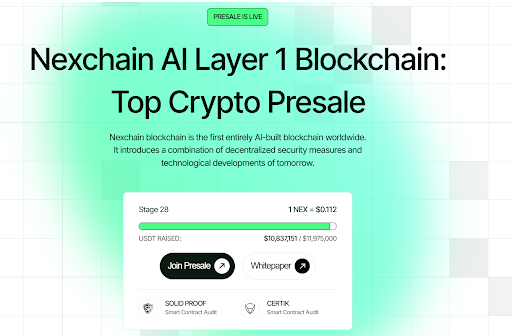

Nexchain’s ongoing token presale has seen exponential growth. Stage 25 sold out at $0.10 per NEX, raising $9.27 million. Stage 26 closed next at $0.104, adding another $10.125 million. With continued whale interest, Stage 27 followed swiftly, raising $11.025 million at $0.108 per NEX.

Now in Stage 28, each NEX token is priced at $0.112. As of press time, $10,837,151 has already been raised out of the $11,975,000 allocation. This leaves limited slots before the stage closes, validating ongoing accumulation from larger investors. The token presale continues to move at a steady pace due to Nexchain’s increasing relevance.

Source: Nexchain AI

CERTIK provides third-party security assurance for Nexchain, further strengthening investor confidence in the ongoing token presale. The project also features a structured tokenomics model, with a total supply of 2.15 billion NEX tokens and a balanced allocation between early investors, ecosystem rewards, and liquidity provisioning.

Testnet v2.0 Launch in November Brings AI Risk Detection and Bonus Rewards

Nexchain’s Testnet v2.0 will go live in November, featuring a redesigned interface and real-time AI Risk Score functionality. This system helps prevent scam transactions and MEV exploits by analyzing transaction data before confirmation.

The Testnet v2.0 phase will run from October 13 to November 28. Users participating with the promo code TESTNET2.0 will receive a 100% bonus. These features are designed to prepare the ecosystem for widespread adoption while adding value to the token presale.

Additionally, Nexchain’s long-standing $5M airdrop initiative continues, offering weekly rewards and grand prizes. Users who stay engaged are more likely to earn higher rewards at the end. This community-backed program complements the ongoing token presale by keeping participants involved in the ecosystem.

Conclusion

The Nexchain AI token presale presents a compelling alternative to Ethereum, particularly in the shifting market dynamics of Q4. Its AI-integrated blockchain design supports scalable, secure, and cross-chain applications with real-world utility. With Stage 28 nearing completion and continued involvement from whales, the momentum is clear.

Testnet v2.0’s November launch and the ongoing airdrop further enhance investor engagement. Backed by CERTIK’s security and a sustainable token model, Nexchain positions itself as a long-term contender in the blockchain space. The token presale continues, offering a rare opportunity for early participation in a platform built for the future.

More Details:

Website: https://nexchain.ai/

Telegram: t.me/nexchain_ai/3

X: https://x.com/nexchain_ai

Airdrop: https://nexchain.ai/airdrop

Read more: The Rise Of Nexchain AI’s Token Presale

Disclaimer

Please be advised that all information, including our ratings, advices and reviews, is for educational purposes only. Crypto investing carries high risks, and CryptoNinjas is not responsible for any losses incurred. Always do your own research and determine your risk tolerance level; it will help you make informed trading decisions.

The post Nexchain AI Token Presale Gains Momentum As Investors Seek Alternatives Beyond Ethereum appeared first on CryptoNinjas.