Florida Lawmaker Refiles Crypto Bill To Let State Invest In Bitcoin, ETFs, NFTs

Florida House Republican Webster Barnaby has refiled a crypto reserve bill after a previous effort failed, expanding it from allowing investments in Bitcoin alone to crypto ETFs, NFTs, and other blockchain-based assets.

The legislation, Florida House Bill 183, would allow up to 10% of certain public funds, including pension assets, to be allocated to digital assets. It also introduces new custody, documentation, and fiduciary standards for holding and lending these assets.

By expanding the scope to multiple cryptocurrencies and ETFs, the revision gives the state more investment flexibility while meeting regulatory and oversight requirements.

The bill would also allow Florida citizens to pay certain taxes and fees in digital assets if it is approved. These payments would then be converted into dollars and transferred to the state’s general fund.

The revised bill looks to take effect on July 1 next year. It also aims to authorize the State Board of Administration to invest pension and other funds into crypto.

Only Three State Crypto Bills Enacted Into Law

Barnaby’s bill is the latest in a series of crypto reserve bills that were introduced in state legislatures during the 2025 legislative season.

But many of the proposed bills were rejected. Only three of them, namely ones from Arizona, Texas, and New Hampshire, have been enacted into law.

Arizona’s HB 2749 only allows for the creation of a crypto reserve using unclaimed property, while the Texas Senate Bill 21 specifically establishes a Bitcoin-only reserve.

Meanwhile, New Hampshire’s HB 302 gives the treasurer the ability to invest up to 5% of public funds in digital assets. However, these assets must have a market cap of more than $500 billion to be included.

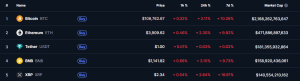

Top five cryptos by market cap (Source: CoinMarketCap)

Looking at the top five largest cryptos by market cap, Bitcoin is the only digital asset that meets HB 302’s capitalization requirement. Altcoin leader Ethereum (ETH) could also meet the requirement soon if there is a strong enough price increase, with its capitalization of over $471.98 billion, according to CoinMarketCap data.

Florida Seeks To Ease Regulation Around Stablecoin Issuers

In addition to the revised crypto reserve bill, Barnaby is also looking to ease the regulatory requirements for stablecoin issuers in Florida with the filing of HB 175.

That bill aims to clarify that recognized payment stablecoin issuers should not be required to obtain separate licenses or registrations. Under this bill, stablecoin issuers need to be fully collateralized with either US dollars or treasuries. These firms will have to conduct public audits of their reserves at least once a month as well.

Similar to HB 183, the Florida lawmaker wants the stablecoin bill to take effect on July 1 next year.

Stablecoin firms that want to issue their tokens in the US already have to follow the Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act. It was signed into law by US President Donald Trump on July 18, 2025, after passing both the Senate and the House with bipartisan support. This act is also the first US federal statute to regulate “payment stablecoins.”

One of the GENIUS Act’s main goals is to reduce regulatory ambiguity in the stablecoin market. Similar to HB 175, the act requires that payment stablecoins by fully backed by liquid assets. The composition of these backing reserves needs to be transparent as well.

Issuers also need to provide periodic disclosures, audit reports, and reserve composition so that users and regulators can monitor the assets’ backing.

The regulatory clarity has boosted the stablecoin market, which recently saw its capitalization soar to a new all-time high of $314 billion. Much of the growth was seen by Tether’s (USDT) and Circle’s USD Coin (USDC), which are currently the two biggest stablecoins in the market with respective capitalizations of $181.37 billion and $75.96 billion.

You May Also Like

New Zealand RBNZ Interest Rate Decision in line with expectations (2.25%)

Mississippi holds hearing on xAI data center amid environmental lawsuit threat