Meet Screx: The rebel platform making DeFi make sense again

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Screx is redefining DeFi with an AI-powered, all-in-one platform that unites swaps, staking, lending, and more, finally making decentralized finance simple and user-focused.

- Screx positions itself as the “rebel of DeFi,” tackling fragmentation by uniting swaps, staking, lending, farming, and cross-chain tools in one seamless hub.

- Powered by AI smart routing, Screx optimizes every transaction for speed and cost, making DeFi simpler and more efficient for everyday users.

- With rapid community growth and an active presale on Gems.vip, Screx is gaining strong traction as a user-first solution in the decentralized finance space.

DeFi is in shambles. With hundreds of blockchains that can’t talk to each other, thousands of protocols that do nothing but clash, and apps that make even experienced users feel lost, DeFi has, as GenZ would put it, “lost the plot”.

Every few weeks, a new DeFi project crops up on the block, claiming to be the new web3 messiah, but only ends up adding more layers of confusion, more middle men, and alienating the user even more.

Screx, however, is a different story. It’s not another DeFi platform. Labelling itself as the rebel of DeFi, Screx dares to go against the current. The team behind this new venture is bold enough to directly address everything that’s wrong with DeFi, and show how to fix it.

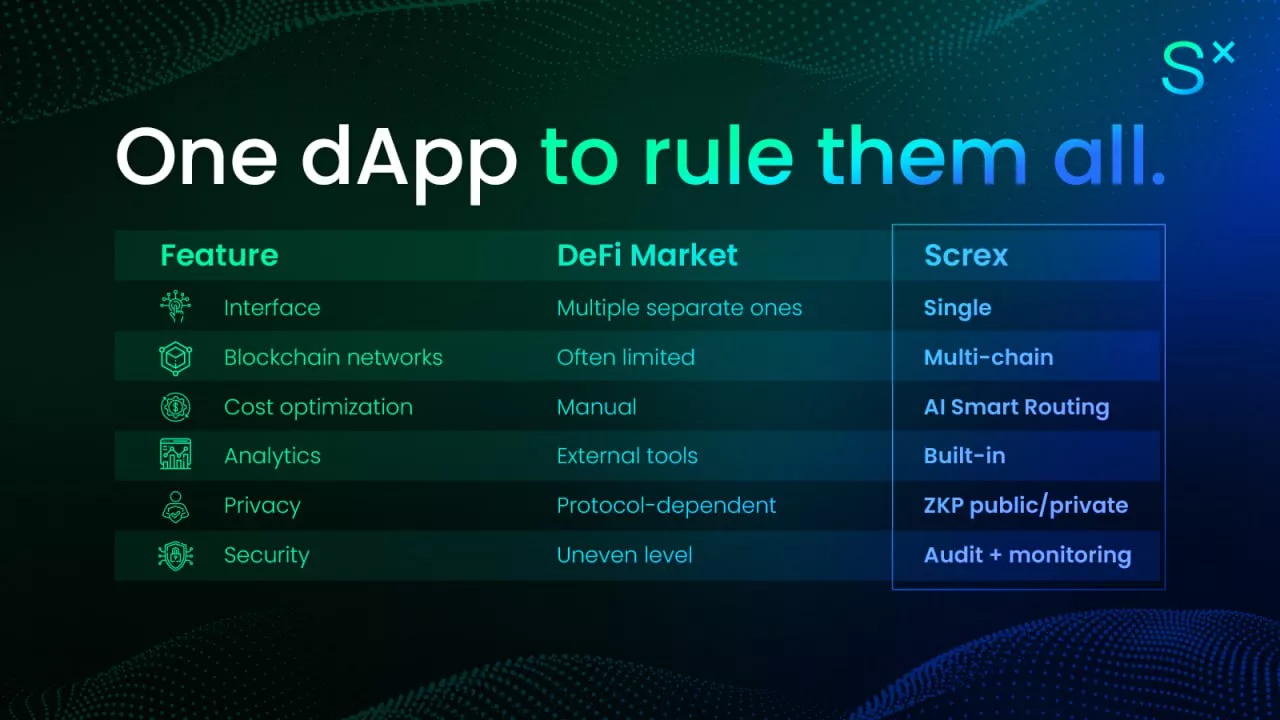

Screx is an all-in-one DeFi hub that connects swaps, staking, lending, farming, perpetuals, escrow, and cross-chain bridging within one intelligent environment. Powered by Smart Routing and AI, Screx acts as a command center for decentralized finance, designed to make DeFi finally usable and human-centered.

In short, Screx is focused on the user over all else. And that’s how you know that Screx is here to make a difference.

What’s broken and how Screx plans to fix it

It’s no secret that DeFi has a fragmentation problem. Because of the overwhelming number of platforms that operate in isolation, users now juggle dozens of apps, each with their own interface, risks, and wallets. DeFi, which was meant to make operations simple, transparent, efficient, and user-focused has de-evolved into a complicated mesh of unreadable tech.

Screx aims to correct this interoperability problem and restructure DeFi to hone in on what really matters: making the DeFi experience smoother and seamless for the user.

Tom Babiak, CEO of Screx, explains,“DeFi was supposed to give people freedom, but instead it created walls between them. With Screx, we’re building a path that finally connects it all.”

User focused DeFi: Built to simplify the complex

Screx does what every major DeFi project wishes it could: redefine the DeFi experience. By replacing the maze of disconnected services with a unified, seamless ecosystem, Screx makes the DeFi interaction something users look forward to instead of dread.

And for those wondering how Screx is achieving this seemingly impossible task: The answer is AI.

On Screx, smart routing systems select the most optimal network and execution path for each transaction. This novel approach reduces costs and maximizes speed without manual adjustments. In simple terms: AI finds the best path for every transaction. Ironically, using AI, Screx has made DeFi more human.

Everyone’s talking about Screx

With nearly 15k followers on X (Twitter), 55k members on its Telegram channel and over a thousand regular readers on its Medium blog, Screx has managed to capture community attention in a matter of months.

Its presence at TOKEN2049 Singapore, its $10,000 Giveaway, onboarding influencer Mando CT as brand ambassador and of course, maintaining an active and thriving social media presence gives investors the confidence they need to trust the project’s long-term vision and growth potential.

The Screx presale

The SCRX presale is live on Gems.vip/Screx, and it’s moving fast. With each round, token prices rise, which is a sign of growing confidence in both the project and its mission.

Investors can review full details in the Screx Blackpaper and explore the ecosystem through the official website and the Linktree.

Conclusion

Screx strives to remove the existing friction in DeFi by building a unified, intelligent, and interoperable environment where users can control every aspect of their digital assets in one place. Everything Screx builds and every solution the team behind Screx comes up with is aimed at creating a relaxed and effortless experience for the user. And so far, it’s doing an incredible job at it, or as GenZ would put it: Screx has passed the vibe check.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

You May Also Like

Three dormant wallets, suspected to belong to the same entity, purchased 5,970 ETH eight hours ago.

NVIDIA Stock Price Analysis as OpenAI Issues Concerns About its Chips