Trump wields the "tariff stick" to bloodbath the world, and the crypto market reappears "Black Monday"

Author: Nancy, PANews

As Trump wields the "tariff stick", the global capital market has fallen into a vortex of violent turbulence. The macroeconomic negatives are superimposed on the liquidity crisis, the positions of whales have been liquidated one after another, panic selling has occurred one after another, and the bulls have been hit hard and left the market... This storm caused by policies has once again put the crypto market in a severe test of survival.

Cryptocurrency market hit by tariff storm, whales liquidate positions and sell at a loss

"Black Monday" has struck the world again. Since Trump announced the massive increase in tariffs, the reaction of financial markets has continued to ferment, and risky assets have been sold off across the board, from traditional stock markets to crypto markets.

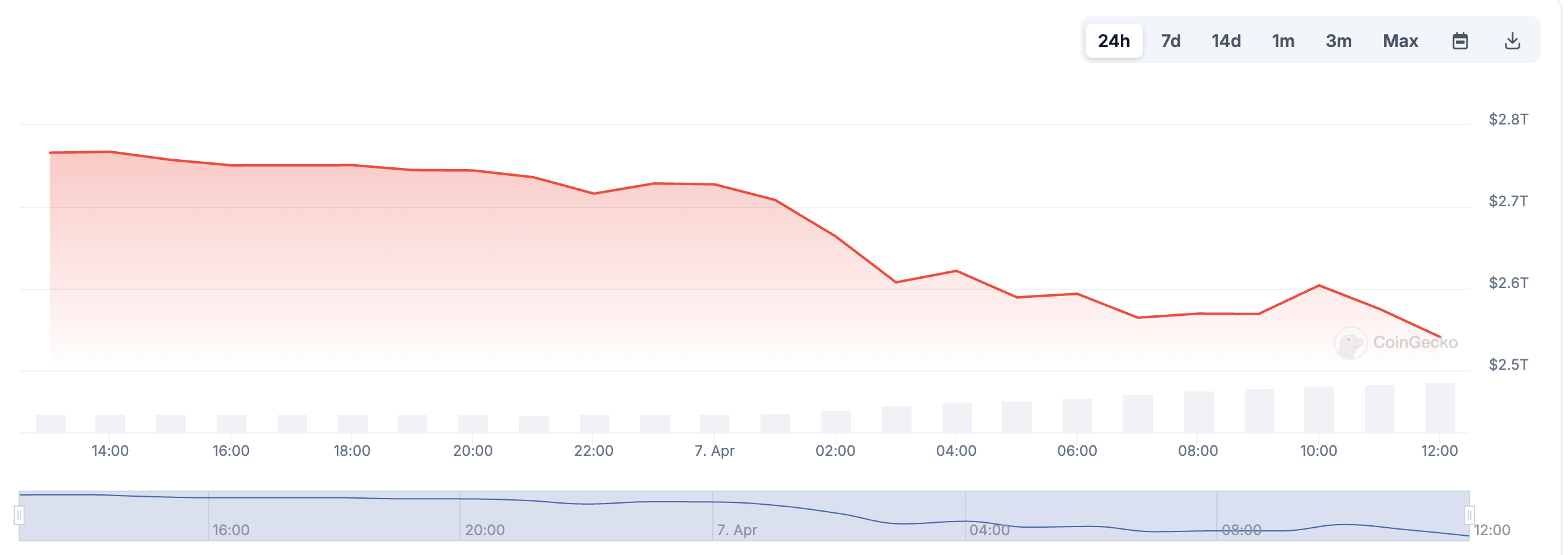

According to Coingecko data, the total market value of global cryptocurrencies fell by 9.7% in the past 24 hours, shrinking to $2.53 trillion. Among them, the price of BTC once fell below the 77,000 mark, and ETH fell below $1,600.

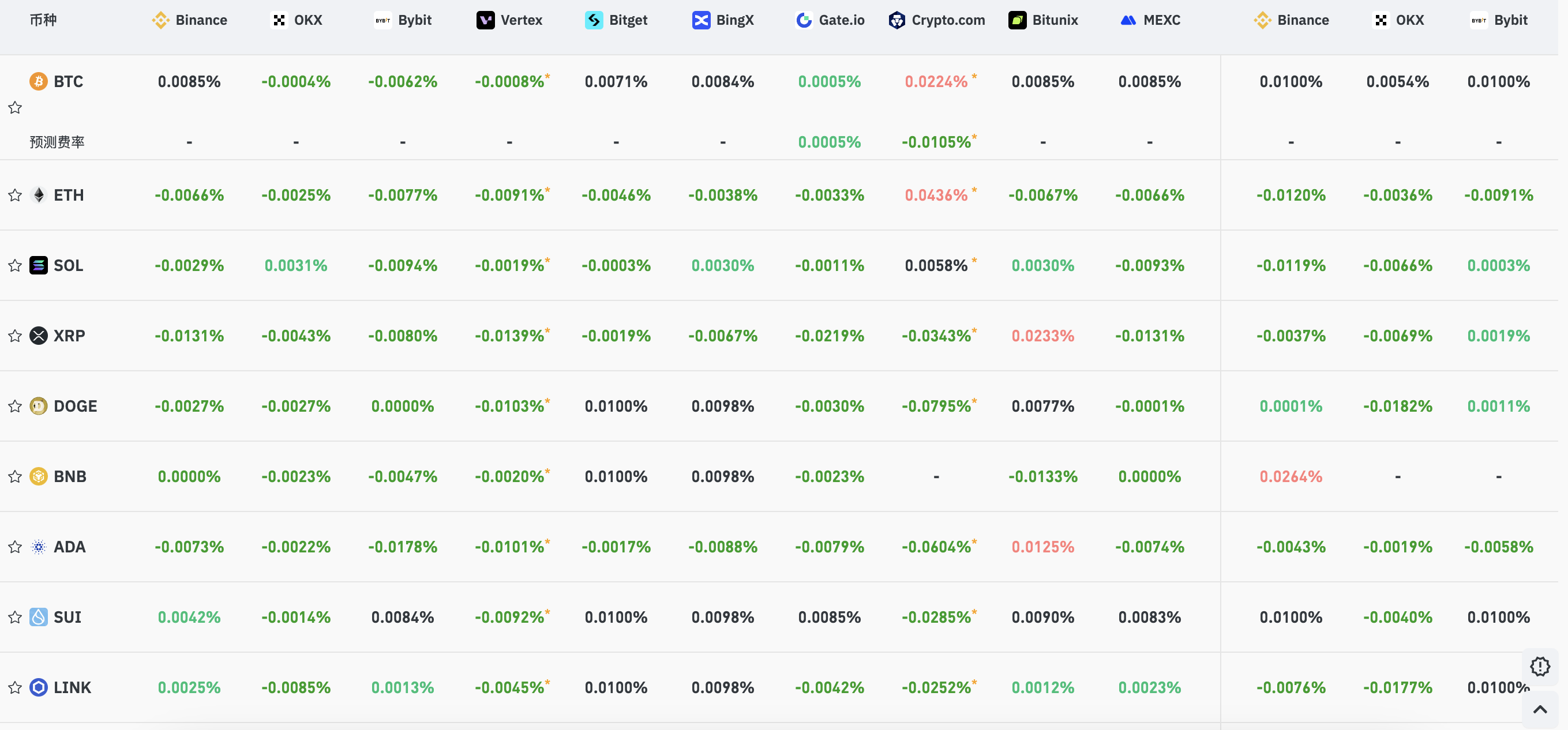

The bulls suffered a heavy blow under the violent market fluctuations. According to Coinglass data, the total liquidation of the entire network was about 986 million US dollars in the past 24 hours, of which 850 million long orders were liquidated and 136 million short orders were liquidated. Among them, the liquidation amount of BTC reached 328 million US dollars and ETH was about 293 million US dollars. Judging from the funding rates of mainstream CEX and DEX, the current rates are generally lower than 0.005%, indicating that market participants generally tend to be bearish and bearish sentiment is dominant.

The risk of on-chain liquidation is also significantly increasing. For example, according to Onchain Lens, a whale is facing liquidation. It provided 292.77 WBTC (about 23.05 million US dollars) and 964.39 COMP (about 38,000 US dollars) to borrow USDT and DAI, and the liquidation price was 76,284 US dollars. According to PeckShield monitoring, a giant whale was liquidated after WETH fell below 1,700 US dollars because it mortgaged 9,370 WETH to borrow 12.8 million US dollars of USDT. The liquidator seized a total of 4,480 WETH, about 7.26 million US dollars.

According to on-chain analyst Ember, as the market fell, a whale address's loan position totaling 67,500 ETH (about $105 million) was completely liquidated when ETH fell to around $1,650. The whale address added 2,160 ETH as collateral at 1 a.m. (April 7) to lower the liquidation line, but was eventually liquidated at around 6 a.m. to repay its $74.4 million DAI loan. At the same time, a whale who used leverage to invest in AAVE also faces liquidation risks. If the price of AAVE drops another $7 (to $123), its 102,000 AAVE positions (worth $13.08 million) will be liquidated. From the purchase to the end of last year, the whale's floating profit was as high as $21.33 million, but now it has a floating loss of $3.58 million and has never sold. Another whale holding 57,000 ETH currently has a liquidation price of $1,564, and was almost liquidated at the same price as the 67,500 ETH position. Because it actively reduced its position a few days ago, it was barely hedging. Currently, its positions are still on the edge of the liquidation line, and it is expected that it will need to continue to reduce positions to reduce risks.

As the market panic rapidly heats up, many whales choose to cut losses. For example, Lookonchain monitors that a whale address panic-sold 14,014 ETH (about 22.14 million US dollars) in the past 3 hours; well-known trader Eugene posted that his BTC position (which had been reduced) that he built on Friday last week has been automatically liquidated due to the drop below the stop loss price; before today's market crash, a whale address deposited the remaining 778.5 BTC (about 64.33 million US dollars) into Binance to cut losses, and the loss of this position was 2.53 million US dollars. A whale unpledged 202,604 SOL and deposited it into Binance 2 hours ago, worth 24.3 million US dollars. The whale withdrew 201,755 SOL (worth 25 million US dollars) from Binance at a price of 124 US dollars on March 13, and currently has a loss of about 678,000 US dollars. OnchainLens monitored that a whale/institution deposited 1,000 BTC (worth $77.58 million) into Binance and 354.34 BTC (worth $27.49 million) into a new wallet address, facing a loss of $9.04 million.

Bear market signals have emerged? Investors may face a severe game cycle

As the Trump administration's promotion of the "reciprocal tariff" policy has caused severe turmoil in the global market, investor confidence has suffered a heavy blow. According to the latest Forbes survey, Wall Street elites' support for Trump's economic policies has dropped significantly, and market buying has almost disappeared. Although the financial circle's distrust of the current policy is spreading rapidly, Trump still insists that "sometimes the market must 'take medicine'" and firmly believes that the tariff policy will bring "very good things" to the United States in the long run.

Arthur Hayes, co-founder of BitMEX, pointed out that most of Trump's supporters do not hold a large amount of financial assets, which makes him more confident in implementing a tough tariff policy. Hayes reminded investors that if they want to predict when the Fed will restart easing, they should pay attention to the bond market volatility indicator MOVE index. When MOVE rises, traders who buy U.S. bonds or corporate bonds with financing will face higher margin requirements and be forced to close their positions. Once MOVE breaks through 140, the Fed may intervene in the market.

Goldman Sachs has also adjusted its expectations for Fed rate cuts, saying that if a U.S. recession hits, the risk of further Fed easing is higher. The bank expects the Fed to begin a series of rate cuts in June, earlier than the previous forecast of July, as part of a precautionary easing cycle. If the economy does fall into a recession, the Fed will adopt a more aggressive policy response, cutting interest rates by about 200 basis points next year. Given the increased probability of a recession, the agency's current weighted forecast shows a total rate cut of 130 basis points in 2025, up from 105 basis points previously.

As the "reciprocal tariffs" will officially take effect on April 9, global market volatility may be further exacerbated, and investors will face an increasingly severe game cycle.

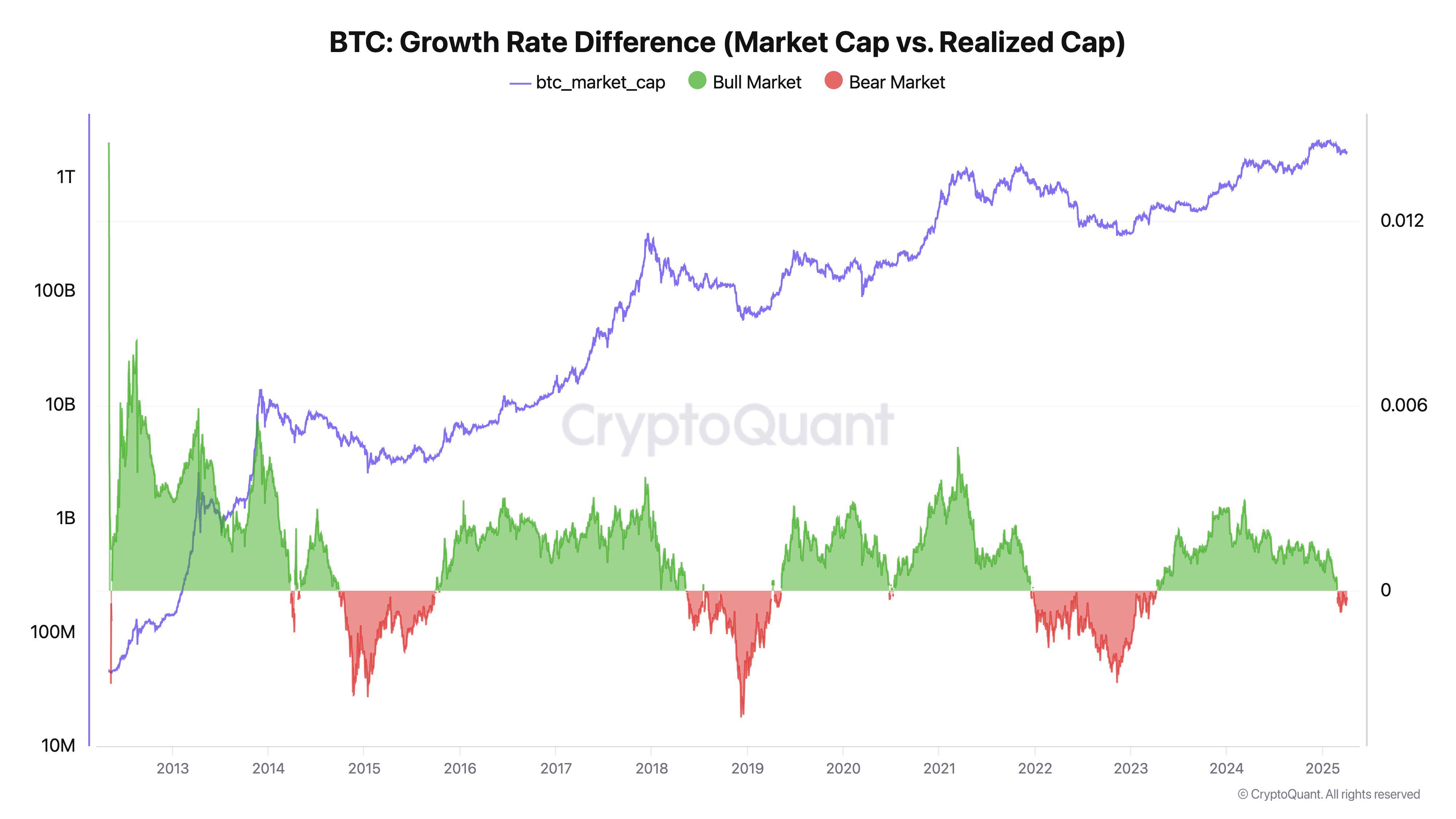

"The Bitcoin bull market cycle has ended, and the realized cap in the on-chain data shows that the market is currently showing typical bear market signals: although funds continue to flow into the market, prices have not risen accordingly. He further explained that when small amounts of funds can push prices up, it indicates a bull market; and when large amounts of funds cannot push up prices, it means a bear market is coming." CryptoQuant CEO Ki Young Ju bluntly stated that although selling pressure may ease at any time, based on historical experience, a real market reversal usually takes at least six months, and the possibility of a rebound in the short term is low.

Andrew Kang, partner at Mechanism Capital, also supports the bear market argument. He admitted that he had not paid close attention to cryptocurrencies in the past few months, but the possibility of ETH returning to $1,000-1,500 this year seems very high. When the speculative wave is obviously over, it is ridiculous for an asset with negative growth/profit to have a market value of $215 billion.

Eugene wrote that this decline is not only a turbulence in the crypto market, but also an unprecedented turbulence in the entire stock market. He vaguely feels that as long as he handles it properly, he may be able to create wealth that can change his destiny after this storm passes. But now, survival is the key.

You May Also Like

Best Crypto to Buy as Saylor & Crypto Execs Meet in US Treasury Council

BlackRock boosts AI and US equity exposure in $185 billion models