Google’s Willow Processor Maps Molecules 13,000x Faster Than Supercomputers

- Google’s quantum experiment achieved the first verifiable quantum advantage using the Willow quantum processor.

- The experiment maps the structure of a molecule 13,000 times faster than classical supercomputers.

- Future quantum computers could compromise cryptographic algorithms securing cryptocurrencies like Bitcoin and Ethereum.

- Experts are calling for accelerated development and adoption of quantum-resistant encryption standards.

- Regulatory and industry efforts are underway to address the potential risks posed by powerful quantum systems.

Researchers at Google have announced a significant milestone in quantum computing: they have successfully mapped out a molecule 13,000 times faster than the most advanced classical supercomputers, claiming the achievement as the first verifiable quantum advantage. This breakthrough was accomplished using Google’s Willow Quantum processor combined with innovative techniques known as “quantum echoes,” which utilize targeted waves to precisely image objects in detail.

The experiment focused on a single qubit, the fundamental unit of quantum information, applying a specific signal to induce a reaction. By reversing the process and measuring the returning “echo,” the scientists could efficiently capture detailed information about the molecule’s structure. Google confirms that this process is verifiable and reproducible on other quantum systems with similar specifications, marking a critical step toward practical quantum applications.

This groundbreaking development has important implications beyond scientific curiosity. A sufficiently powerful quantum computer could effectively break the cryptographic algorithms currently safeguarding digital assets. Encryption methods such as elliptic curve digital signatures, which underpin Bitcoin and many other cryptocurrencies, could become obsolete as early as 2030, according to experts.

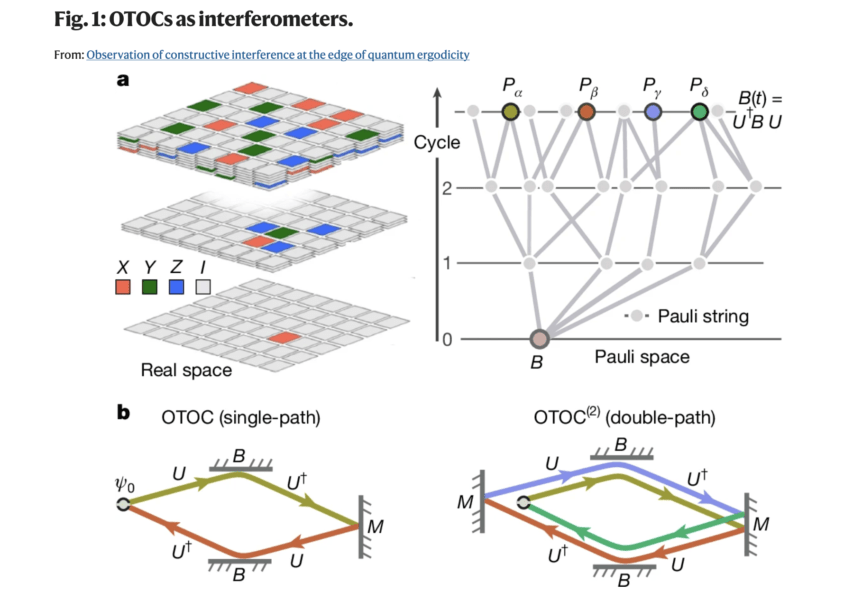

An illustration demonstrating how quantum interference strengthens echoes for detailed information mapping. Source: Nature

An illustration demonstrating how quantum interference strengthens echoes for detailed information mapping. Source: Nature

While current quantum computers lack the power to crack modern encryption—thanks to large key sizes ranging from 2,048 to 4,096 bits—advances in hardware could change this paradigm. Experts like David Carvalho, chief scientist at the Naoris cybersecurity protocol, warn that the threat to Bitcoin and other decentralized protocols is imminent if the community does not act proactively. The industry is now racing to adopt post-quantum cryptography standards before powerful quantum systems become a reality.

Despite ongoing efforts, some remain skeptical about how soon quantum computers will reach the ability to threaten crypto security. Pseudonymous tech analyst Mental Outlaw explains that current quantum systems are only capable of breaking very small keys, far from the size needed for secure encryption today.

Nevertheless, regulators and industry leaders are pushing for measures to mitigate future risks. The U.S. Securities and Exchange Commission (SEC) has received proposals outlining a roadmap for quantum-safe encryption standards by 2035. The crypto sector recognizes that addressing quantum threats now could safeguard digital assets and foster continued innovation in blockchain, DeFi, NFT platforms, and beyond.

This article was originally published as Google’s Willow Processor Maps Molecules 13,000x Faster Than Supercomputers on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

SEC Approves Generic ETF Standards for Digital Assets Market

Will SEC Approve T. Rowe’s XRP-Inclusive Crypto ETF?