PEPENODE Soars Toward $2M in Viral Presale as Analysts Call It the Best Meme Coin to Buy Now

Crypto mining in 2025 isn’t exactly beginner-friendly. Setting up a home operation can cost anywhere from $2,600 to nearly $24,000 just for equipment and infrastructure. Then come the monthly bills, from electricity to cooling and maintenance, adding even more expenses on top.

Throw in technical issues – such as heat management, noise, equipment failure, and fire risk – and it’s clear why most people skip mining altogether. Your hardware can also become obsolete within months as newer rigs hit the market, forcing constant reinvestment.

That’s where PEPENODE (PEPENODE) comes into play. This Ethereum-based project has raised nearly $2 million in its presale by flipping the mining model entirely: no hardware, no electricity costs, no technical setup. You buy virtual mining nodes as part of a browser-based game, upgrade them according to your own strategy, and earn rewards immediately.

Analysts are calling PEPENODE one of the best meme coins to buy right now. And with a 70% token burn on every upgrade and staking APYs above 650%, there’s every chance they might be onto something.

Mine-to-Earn Meets Aggressive Deflation With PEPENODE

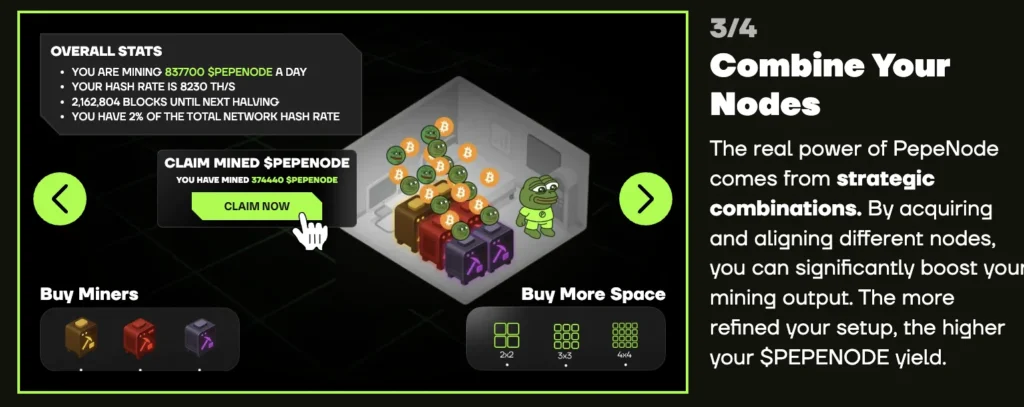

PEPENODE’s Mine-to-Earn system is built into a new browser-based strategy game. You purchase virtual mining rigs with PEPENODE tokens, upgrade them over time, and earn crypto rewards. No hassle and no large upfront costs.

Think of it like managing a virtual data center. Better equipment increases mining power, leading to larger payouts in PEPENODE tokens and other meme coins like PEPE and FARTCOIN. Top performers also unlock leaderboard bonuses and exclusive airdrops.

And every time you spend PEPENODE tokens to upgrade your rigs or expand facilities, 70% of those tokens get burned – permanently removed from circulation. Most meme coins inflate supply through staking rewards, but PEPENODE does the opposite. The more people engage, the fewer tokens exist.

Combine that system with tokens locked in staking, and you’ve got dual pressure squeezing the supply from both sides. With a capped supply, scarcity is built into the economics from day one.

Presale Hype Builds as PEPENODE Races Toward $2 Million Milestone

PEPENODE’s presale is going viral on Crypto Twitter. The project has raised close to $2 million since launching in August, with analysts expecting it to raise millions more before wrapping up.

Unlike most presale projects, you don’t need to wait for the exchange listing. Instead, you can buy and stake right away for an APY of 653%. Thanks to this setup, over 1.2 billion PEPENODE tokens have already been staked.

The presale is structured in tiers with dynamic pricing. Early buyers were able to get in at $0.001, but as demand increased, so did the price – now at $0.0011227. You can purchase using crypto or a bank card through PEPENODE’s official website.

Top analyst KIFS Crypto recently called PEPENODE one of the best meme coins to buy right now, citing its deflationary burns and Mine-to-Earn system. He also predicted it could “change meme coins forever” if the burns generate enough scarcity to trigger a price pump.

Is PEPENODE the Best Meme Coin to Buy Right Now?

PEPENODE’s tokenomics are clear and straightforward. With a capped supply just north of 210 billion, there’s no risk of inflation, as is the case with Dogecoin. Also, the development team has set aside portions of PEPENODE for infrastructure, node rewards, listings, and protocol development.

Security is also important. PEPENODE has completed a smart contract audit by Coinsult, which enhances transparency and increases the token’s credibility. The audit also verified that PEPENODE’s team can’t mint any tokens beyond the existing supply.

Looking ahead, PEPENODE’s roadmap is aggressive: post-TGE, the Mine-to-Earn game will go live. Future roadmap phases bring CEX listings, leaderboards, expanded node types, and partnerships with other meme coin projects.

All in all, as PEPENODE is still in its presale stage for now, now is the ideal time for early investors to maximize their advantage. With almost $2 million raised and momentum building, there’s a strong possibility this could be the best meme coin to buy in late 2025.

Visit PEPENODE Presale

You May Also Like

Crucial Fed Rate Cut: October Probability Surges to 94%

USD/INR edges lower as Indian Rupee gains on improving equity inflows