EchoStar records $16.5B impairment charge as it moves to scale back 5G network plans

EchoStar Corp has taken a non-cash impairment charge of $16.5 billion as revealed in its third-quarter earnings. The satellite and telecommunication firm is moving to decommission parts of its 5G network infrastructure. Alongside the charge, EchoStar agreed to sell additional spectrum licenses to SpaceX for $2.6 billion.

Based on the earnings release by EchoStar, some of the 5G will no longer be usable after recent spectrum sales to AT&T and SpaceX. The satellite company revealed that a third-party valuation and management review company assessed and determined that the value of some of its spectrum assets was overvalued under the previous accounting baseline.

EchoStar sells additional spectrum to SpaceX for $2.6 billion

According to EchoStar’s Q3 financial release, the sale of additional licenses to SpaceX, valued at approximately $2.6 billion, included an unpaired AWS-3 license in addition to the license included in the September agreement, which was valued at $17 billion. The satellite and telecommunication firm acknowledged that it has now amended the September deal to include more licenses.

Echostar stock rallied to $73.03, representing a 1% growth after the announcement, before consolidating at $71.18, representing a 0.16% drop on the daily chart. So far, the stock has gained 212.12% year-to-date, with a year-to-date range of $ 14.90 to $85.37.

The firm has been restructuring its satellite business to narrow its scope in wireless networks. EchoStar noted that the latest non-cash impairment charge is pending regulatory approval.

The satellite and telecommunications firm entered the mobile network market in an effort to develop a nationwide 5G wireless network. Along the way, the firm has faced hurdles, especially pressure from the U.S. government and regulators over its spectrum usage.

EchoStar was accused of hoarding valuable frequencies rather than deploying them, which led to the sale of a portion of the licenses to AT&T in August for approximately $23 billion. The firm effectively lost a portion of its 5G build-out obligations.

EchoStar has confirmed that it will now rely on AT&T’s network infrastructure to deliver mobile services through its Boost Mobile brand rather than building an entire proprietary network.

The satellite and telecommunication provider has also confirmed that the impairment charge is tied directly to the assets that will no longer be used in the initially planned wireless 5G rollout.

Akhavan says the combination of spectrum licenses will enable direct-to-cell service

According to EchoStar’s financial release, the decrease in asset utility, prior sales of spectrum rights, and the reevaluation of network equipment led to a write-down of $16.6 billion.

The impairment charge is considered the largest ever across the telecom or satellite services industry. The firm added that specific infrastructure, either deployed or planned for deployment, will no longer be supported under the revised strategy.

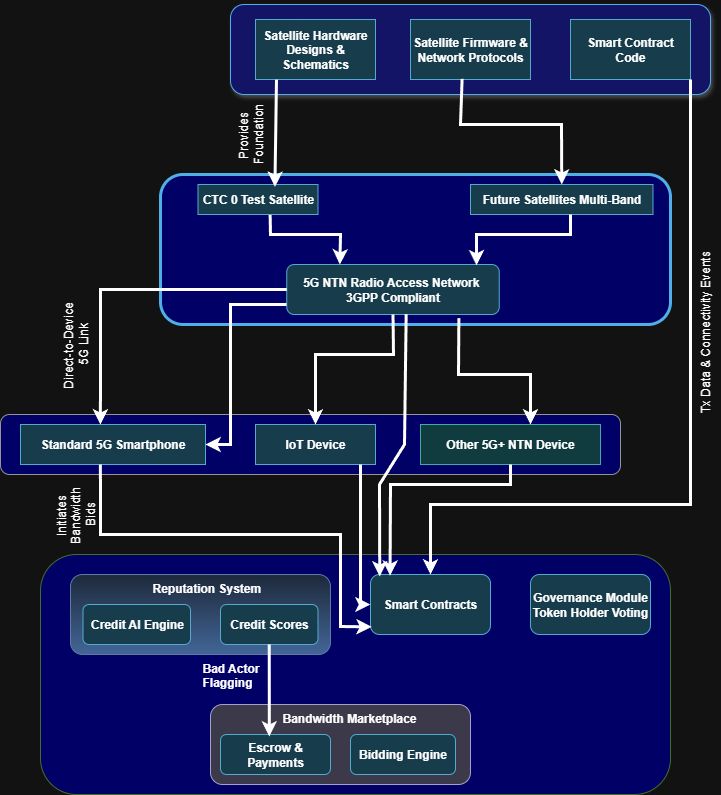

Hamid Akhavan, CEO of EchoStar Capital, noted that the combination of AWS-3 uplink, AWS-4, and H-block spectrum from EchoStar will facilitate the realization of powerful and economical direct-to-cell service. He believes that together with the rocket launch and satellite manufacturing capabilities, consumers and enterprises will benefit, including their Boost Mobile customers.

SpaceX’s acquisition of $2.6 billion worth of satellite spectrum licenses was intended to expand the telecommunication company’s prior spectrum monetization program and boost its Starlink network, which has been experiencing outages recently.

According to a cryptopolitan report, Starlink crashed after key internal software services failed to operate the core network recently. The carrier already promised to offer direct-to-cell satellite connectivity for areas with no signal at all. With the latest acquisition of the EchoStar licenses, the integration may be possible soon.

Want your project in front of crypto’s top minds? Feature it in our next industry report, where data meets impact.

You May Also Like

Kalshi debuts ecosystem hub with Solana and Base

Spacecoin Saving Lives with Decentralized Connectivity