Bitcoin Crashes To $93K As Retail Rotates Into Bitcoin Hyper

Takeaways:

- Bitcoin has dropped from about $125K to the low $90Ks, triggering heavy liquidations and extreme fear, yet longer term fundamentals remain intact.

- Bitcoin Hyper uses a Solana style execution layer and a canonical Bitcoin bridge to unlock fast, low fee $BTC payments and smart contracts.

- The $HYPER presale has raised more than $27.79M at $0.013285 per token, helped by whale entries and strong retail participation.

Bitcoin has just reminded everyone that it still runs on hard mode. After tagging an all-time high near $125K in October, the price has now flushed to roughly $93K, wiping out its 2025 gains and triggering more than half a billion dollars in liquidations across the market.

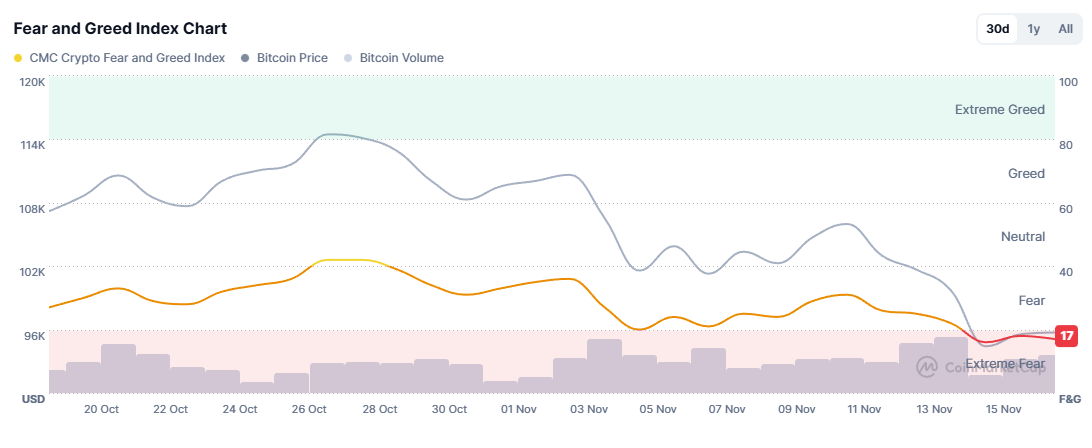

Data shows Bitcoin dropping more than 25 percent from the peak, with sentiment flipping to extreme fear and analysts split between calling this a healthy bull market pullback or the start of a new structural bear phase.

Source: CoinMarketCap

Source: CoinMarketCap

Macro conditions are not outright disastrous. Inflation is easing, the Federal Reserve has already moved into rate cut territory, and institutional participation via spot ETFs remains significant. Yet Bitcoin has slipped under $100K, market dominance is still high, and altcoins have taken the bigger beating.

For smaller traders, this environment cuts both ways. Portfolios are bruised, but the reset also opens up room for higher beta bets on the next narrative. In past cycles, infrastructure that extends Bitcoin’s utility has often outperformed once the dust settled.

Right now, one of the more visible names in that lane is Bitcoin Hyper ($HYPER), a Bitcoin Layer 2 that tries to turn $BTC from a slow store of value into something people can actually use at scale.

Timing explains a lot of the interest. While Bitcoin is back in the low $90Ks, the Bitcoin Hyper presale is approaching $28M raised, helped by repeated six figure buys from larger players and steady retail flow.

Bitcoin Hyper ($HYPER) – Turning $BTC Dip Into Scaling Play

The core idea behind Bitcoin Hyper ($HYPER) is simple. Bitcoin stays the settlement backbone while most activity moves to a separate Layer 2 chain that feels closer to Solana in speed and cost. Users bridge $BTC from the base chain to a canonical bridge, where a Solana Virtual Machine smart contract verifies Bitcoin block headers and proofs.

On that Layer 2, transactions can settle in under a second and the network can process tens of thousands of transactions per second.

That’s a major step up from Bitcoin’s three to seven transactions per second on the base layer, which has always limited it to slow, high value transfers rather than everyday payments or complex applications.

Bitcoin Hyper uses rollup style batching and zero knowledge proofs to periodically commit state back to Bitcoin, so users keep Bitcoin’s security model while escaping its throughput bottleneck.

That architecture opens several doors at once. $BTC can back DeFi lending markets that settle to Bitcoin. Meme coins and NFTs can live in an SVM environment that existing Solana developers already understand, while still anchoring value to $BTC.

Cross chain flows between Ethereum, Solana, and Bitcoin become more realistic when everything connects through the same Layer 2 execution fabric. In a market that just watched leverage get wiped out at $93K, many participants are looking past short-term price pain and toward the infrastructure that could matter in the next phase of the cycle.

A Bitcoin Layer 2 that promises faster payments, usable DeFi, and a bridge for Solana style dApps into the $BTC ecosystem lines up cleanly with that rotation. For anyone reallocating rather than rage quitting, Bitcoin Hyper is one of the more obvious names to at least watch.

➡️ Consider tracking Bitcoin Hyper as a $BTC scaling bet.

$HYPER Presale Nears $28M As Upside Math Attracts Dip Buyers

Presale metrics are often noisy but raising more than $27.8M while Bitcoin is in an aggressive drawdown is a real data point.

That places it among the largest crypto presales of 2025 and suggests a mix of whale tickets and a broad base of smaller holders. Some of those whale purchases include:

- $502K

- $379K

The staking design adds another layer of appeal. While exact rewards vary over time and stage, the current 41% mean early buyers can lock tokens and compound exposure while waiting for the token generation event and exchange listings.

Between the crash to $93K, extreme fear readings, and talk of a structural bear, the market is clearly nervous.

Yet a near $28M raise for a Bitcoin Layer 2 focused on speed and programmability shows that conviction has not disappeared. It has simply moved one step further out on the risk curve, looking for projects that might benefit if Bitcoin recovers and actually becomes more usable.

Visit the Bitcoin Hyper presale page for just such a project.

This publication is sponsored. Coindoo does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or any other materials on this page. Readers are encouraged to conduct their own research before engaging in any cryptocurrency-related actions. Coindoo will not be liable, directly or indirectly, for any damages or losses resulting from the use of or reliance on any content, goods, or services mentioned. Always do your own researchs.

The post Bitcoin Crashes To $93K As Retail Rotates Into Bitcoin Hyper appeared first on Coindoo.

You May Also Like

Trend Research has liquidated its ETH holdings and currently has only 0.165 coins remaining.

FCA, crackdown on crypto