Best Crypto to Buy Now – XRP Price Prediction December

The close of November left the crypto market grappling with heavy uncertainty, and XRP was no exception. The month had been overshadowed by fear and volatility as shifting expectations around Federal Reserve policy put pressure on risk assets.

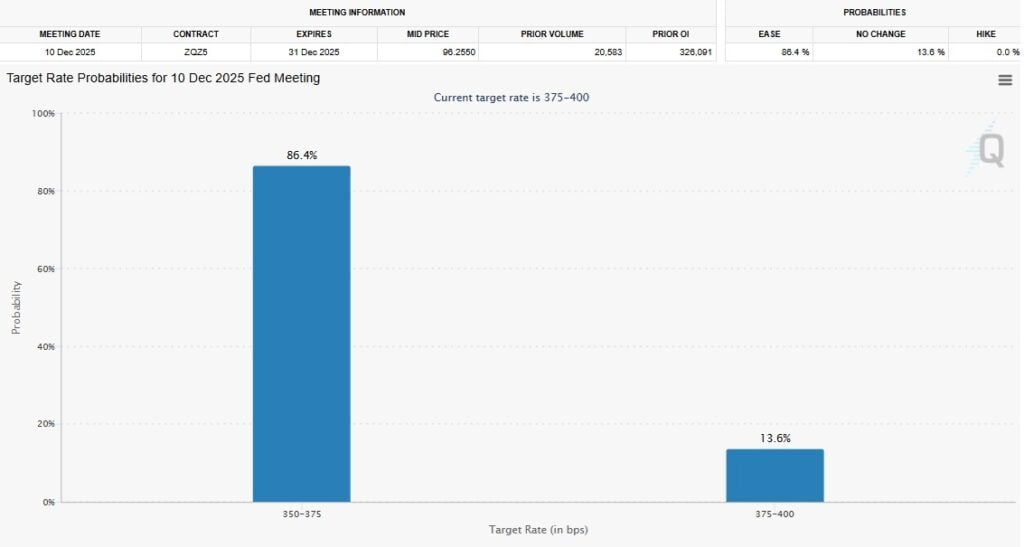

Expectations for a potential interest rate reduction plunged to the low 20–30% range earlier in the month before rebounding sharply to roughly 86%, creating whiplash across investor sentiment.

Source – CME FedWatch Tool

Additional anxiety came from major institutional players as concerns tied to JP Morgan’s actions and broader skepticism in the financial sector fed into the already fragile atmosphere.

The aftermath of what many perceived as a significant market manipulation event on October 10 extended deep into November, contributing to the market’s instability. Despite this, XRP demonstrated resilience.

While the asset retreated about 10% in total throughout the month and briefly dipped into the $1.80 range, it held its ground better than many expected given the turbulence that surrounded it.

Source – Austin Hilton YouTube Channel

QT Ends in December: What It Means for Crypto

As December approaches, expectations shift toward gradual recovery rather than an instantaneous turnaround. No meaningful change is anticipated simply because the calendar flips to December 1, but several concrete macroeconomic factors could slowly tilt the environment in favor of digital assets.

One of the most significant milestones is the official conclusion of quantitative tightening (QT) at the start of the month. Since 2022, QT has withdrawn liquidity from the financial system by reducing the reinvestment of proceeds from maturing Federal Reserve assets.

With QT ending, the Federal Reserve will instead begin reinjecting liquidity back into markets, supplying the broader economy with renewed cash flow. Increased liquidity historically benefits equities, bonds, and cryptocurrencies, as it eases pressure on financial institutions and improves market stability.

This shift is viewed as broadly bullish for the crypto market and for XRP, although its impact is likely to unfold gradually rather than in a single dramatic event, making the current $XRP price prediction an important consideration for investors seeking the best crypto to buy now.

Sentiment Reset Incoming? Fed Rate Cut Could End November’s Crypto Fear Cycle

Another major catalyst arrives on December 10, when the Federal Reserve is expected to implement an interest rate cut. Lower interest rates typically stimulate economic activity by reducing borrowing costs on homes, cars, and other consumer-driven sectors.

As individuals and institutions gain more financial breathing room, positive market sentiment tends to follow, creating a pathway for renewed participation in digital assets.

Historically, sentiment has shown strong correlation with price behavior; periods of extreme fear have dragged down Bitcoin, XRP, and the wider market, while periods of rising confidence have fueled price recovery.

November contained more than eighteen days of extreme fear, clearly visible in the sentiment–price correlation, but the shift toward improved macro conditions suggests that negative sentiment may begin fading as December progresses.

XRP Price Prediction

XRP is showing steady strength above the key support zone between $2.00 and $2.10, creating a healthy base for the next move. The current structure suggests a short-term pullback toward $2.12 or even a brief dip to around $2.04 before momentum shifts higher.

After this reset, price action is expected to target the next major resistance cluster between $2.40 and $2.50. A breakout toward that zone would confirm continuation and keep the bullish trend intact.

Failure there could trigger temporary weakness, but the broader outlook still favors upward expansion. Overall, $XRP’s path points toward a corrective dip followed by a push into the $2.40–$2.50 region as the next significant test.

Best Crypto to Buy Now: Presale Excitement Builds Ahead of Market Shift

With market sentiment expected to shift in December, investors are already moving into Bitcoin Hyper (HYPER), which has quickly become one of the year’s standout presales, securing nearly $29 million in on-chain funding and establishing itself as a leading Bitcoin Layer-2 project.

The team is building a high-speed SVM-powered blockchain that includes its own wallet, explorer, bridge, staking system, and a planned meme coin launchpad. Continuous development updates highlight strong progress.

Presale details remain flexible, but the whitepaper outlines a target window of Q4 2025 to Q1 2026, with the latter appearing more likely to match stronger market conditions. The project’s focus on real utility sets it apart from typical presales, emphasizing long-term ecosystem growth rather than short-term hype.

Recent milestones, such as updates to infrastructure and community-building efforts, reinforce confidence in the project’s vision. With builder engagement increasing and product development advancing, Bitcoin Hyper is shaping into a pre-sale with significant future potential.

Visit Bitcoin Hyper

This article has been provided by one of our commercial partners and does not reflect Cryptonomist’s opinion. Please be aware our commercial partners may use affiliate programs to generate revenues through the links on this article.

You May Also Like

Recovery extends to $88.20, momentum improves

Fed Decides On Interest Rates Today—Here’s What To Watch For

U.S. regulator declares do-over on prediction markets, throwing out Biden era 'frolic'

Copy linkX (Twitter)LinkedInFacebookEmail