Cardano (ADA) Plunges by 8% Daily but This Important Indicator Flashes the Buy Signal

The start of December brought another substantial correction, affecting most leading cryptocurrencies.

Cardano’s ADA was among the worst-hit, with its price slipping by 8% over the past 24 hours. However, one crucial metric suggests a rebound could be on the way.

Are the Bulls Coming Back?

The past several months have been quite painful for Cardano’s investors, as the asset’s valuation currently trades below $0.40, representing a 60% decline from the local peak in mid-September. The market capitalization slipped under $15 billion, making it harder for ADA to return to crypto’s top 10 club.

-

- ADA Price, Source: CoinGecko

Despite the bearish conditions, some analysts believe there is light at the end of the tunnel. X user Ali Martinez observed ADA’s recent price performance and claimed that the TD Sequential has flashed a buy signal.

Marcus Cornivus also chipped in, outlining the $0.38-$0.40 range as the “biggest demand zone.” The analyst thinks that if this floor holds, “the chart becomes a launchpad and the next wave opens fast.” He argued that the mid-range at $0.55-$0.60 is the first wall, and if momentum wakes up, there might be a breakout toward $0.82-$0.85.

A few days ago, X user Smith said he remains unfazed by ADA’s dump and used the opportunity to increase his exposure to the token. The analyst believes the coin has 10x potential, envisioning an explosion above $3.

Observing Other Metrics

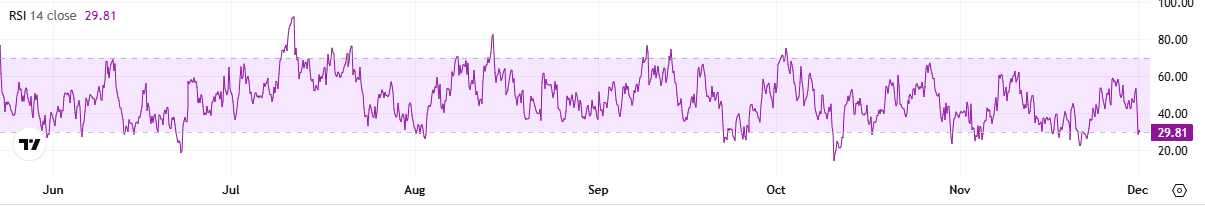

ADA’s Relative Strength Index (RSI) supports the thesis of a short-term recovery. The technical analysis tool ranges from 0 to 100 and measures the speed and magnitude of recent price changes to help traders identify a possible pivot point. It currently stands below 30, meaning oversold territory and a potential buying opportunity. On the other hand, anything above 70 is interpreted as a bearish zone.

-

ADA RSI, Source: CryptoWaves

ADA RSI, Source: CryptoWaves

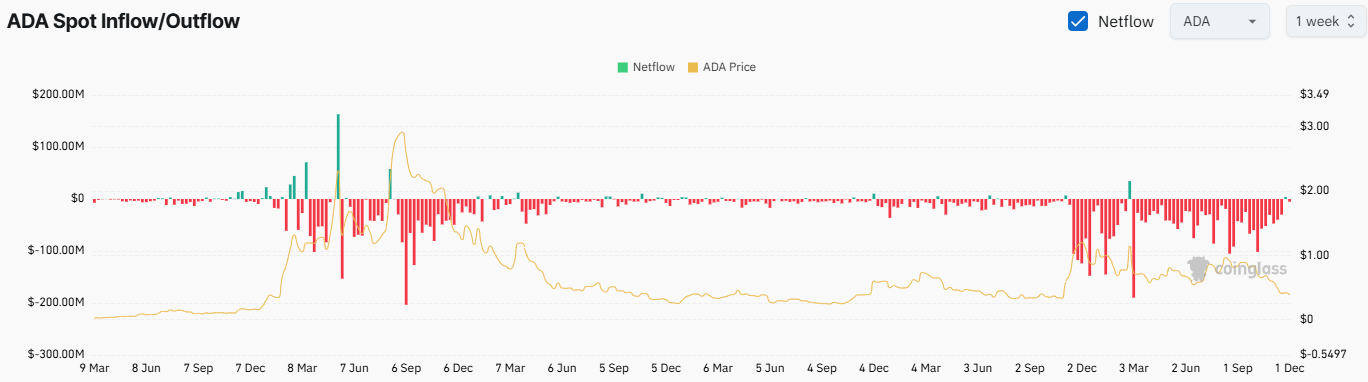

The asset’s exchange netflow over the past several months is also a sign of hope for the bulls. According to CoinGlass’s data, outflows have significantly surpassed inflows within that period, suggesting that investors have been shifting from centralized platforms to self-custody methods. This, in turn, reduces the immediate selling pressure.

-

ADA Exchange Netflow, Source: CoinGlass

ADA Exchange Netflow, Source: CoinGlass

The post Cardano (ADA) Plunges by 8% Daily but This Important Indicator Flashes the Buy Signal appeared first on CryptoPotato.

You May Also Like

Recovery extends to $88.20, momentum improves

Fed Decides On Interest Rates Today—Here’s What To Watch For

U.S. regulator declares do-over on prediction markets, throwing out Biden era 'frolic'

Copy linkX (Twitter)LinkedInFacebookEmail