Trading time: CZ brings BNB on-chain market heat, global central banks usher in "super week"

1. Market observation

Keywords: FOMC, ETH, BTC

Bitcoin ended last week with a positive line, and BTC has rebounded nearly 10 points from the low of $76,600. Markus Thielen, founder of 10x Research, said that it is difficult to judge whether Bitcoin will resume its upward trend in the short term, and it is recommended to close short positions at the current stage. He pointed out that Bitcoin may need to go through a consolidation period of up to 8 months. The market is currently in a wait-and-see attitude, and the ETF market lacks the motivation to "buy on dips". Most ETF fund inflows come from arbitrage-driven hedge funds, and the continued low funding rate also suppresses the willingness to further deploy capital.

Bitfinex analysts believe that the current adjustment is a normal "washout" behavior. Although multiple technical indicators have turned bearish, Bitcoin's four-year cycle is still an important factor affecting prices. Due to the high correlation between Bitcoin and traditional financial markets, its trend may need to find a bottom in sync with the stock market (especially the S&P 500 index). He pointed out that $72,000 to $73,000 constitutes a key support range, but Bitcoin's next move will be mainly dominated by macro factors such as global Treasury yields and stock market trends. Although the impact of the trade war has been digested by the market to a certain extent, continued economic pressure may further dampen market sentiment. It is worth noting that based on historical seasonal patterns, network economist Timothy Peterson predicts that Bitcoin is expected to hit a new high before June, with a median target price of $126,000.

Economist Peter Schiff warned that a 12% drop in the Nasdaq index could indicate a bigger drop for Bitcoin. He analyzed that if the Nasdaq enters a bear market and falls 40%, the price of Bitcoin could fall to $20,000. In contrast, gold has a negative correlation with the Nasdaq and has risen 13% since December 16, 2023.

In terms of market dynamics, the latest poll by Data For Progress shows that 51% of American voters oppose the government's inclusion of cryptocurrencies in its strategic reserves. At the same time, the number of bitcoins held by the hacker group Lazarus Group has reached 13,562, making North Korea the world's third largest bitcoin-holding state entity. On the other hand, Binance founder Zhao Changpeng spent BNB to buy TST and mubarak over the weekend, which may lead to a recovery in the BNB chain market. GMGN data shows that in the past 24 hours, 7 Meme coin projects have a market value of more than $1 million, among which mubarak has a market value of nearly $150 million.

From March 17 to 23, major central banks around the world will usher in a highly anticipated "super week", with a number of central banks including the Federal Reserve, the Bank of Japan, and the Bank of England holding monetary policy meetings. The market generally expects central banks to keep interest rates unchanged, but investors need to pay close attention to the central bank's judgment on the economic outlook. Especially against the backdrop of uncertainty in Trump's trade policy, the central bank's attitude may have an important impact on market sentiment.

2. Key data (as of 13:30 HKT on March 17)

-

Bitcoin: $83,149.42 (-11.15% year-to-date), daily spot volume $24.523 billion

-

Ethereum: $1,895.97 (-43.22% year-to-date), with a daily spot volume of $10.533 billion

-

Fear of corruption index: 32 (fear)

-

Average GAS: BTC 2 sat/vB, ETH 0.48 Gwei

-

Market share: BTC 60.77%, ETH 8.4%

-

Upbit 24-hour trading volume ranking: XRP, AUCTION, BTC, STMX, VANA

-

24-hour BTC long-short ratio: 0.998

-

Sector ups and downs: Crypto market sectors generally fell, CeFi sector rose 2.71%, RWA sector rose 0.72%

-

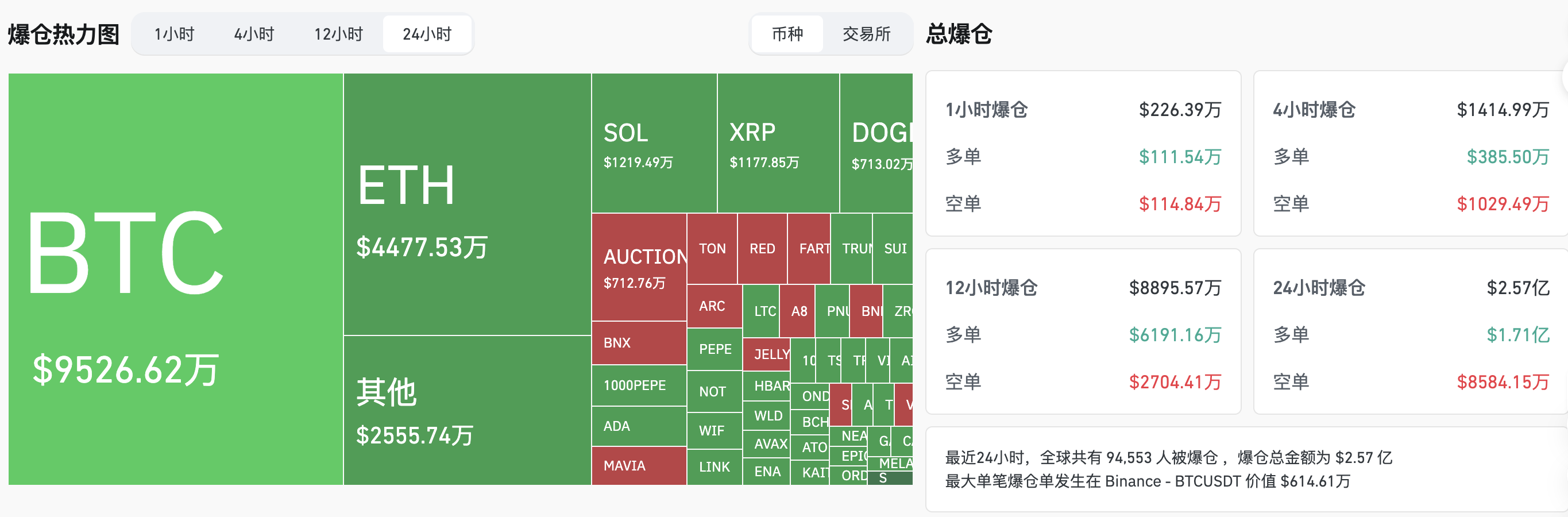

24-hour liquidation data: A total of 94,553 people were liquidated worldwide, with a total liquidation amount of US$257 million, including BTC liquidation of US$95.26 million and ETH liquidation of US$44.77 million.

3. ETF flows (as of March 14 EST)

-

Bitcoin ETF: -$68.41 million

-

Ethereum ETF: -$35.3 million

4. Important Dates (Hong Kong Time)

Nvidia holds its GTC conference until March 21. (March 17)

U.S. February retail sales monthly rate (March 17, 20:30)

-

Actual: Not announced / Previous value: -0.90% / Expected: 0.6%

Japan's central bank target interest rate as of March 19. (March 19)

Nvidia CEO Jen-Hsun Huang delivered a keynote speech. (March 19, 01:00)

U.S. EIA crude oil inventory for the week ending March 14 (10,000 barrels) (March 19, 22:30)

-

Actual: Not announced / Previous: 144.8 / Expected: Not announced

The Federal Reserve FOMC announced its interest rate decision and a summary of economic expectations. (March 20, 02:00)

US Federal Reserve interest rate decision (upper limit) until March 19 (March 20, 02:00)

-

Actual: Not announced / Previous: 4.50% / Expected: 4.5%

Federal Reserve Chairman Powell held a monetary policy press conference. (March 20, 02:30)

UK central bank interest rate decision until March 20 (March 20, 20:00)

-

Actual: Not announced / Previous: 4.50% / Expected: 4.5%

Number of initial jobless claims in the United States as of the week ending March 15 (10,000 people) (March 20, 20:30)

-

Actual: Not announced / Previous: 22 / Expected: 22.5

5. Hot News

This week's preview | The US SEC cryptocurrency working group held its first roundtable meeting; CME plans to launch SOL futures

Macro Outlook of the Week: Trump’s “bitter tactics” force the Fed to cut interest rates, and the super central bank is coming this week

Data: MRS, FTN, QAI and other tokens will usher in large-scale unlocking, among which MRS unlocking value is about 97.4 million US dollars

Jinshi: It is rumored in the cryptocurrency circle that Trump may use the sovereign fund to buy Bitcoin

US Treasury Secretary: No guarantee that the US will not fall into recession

Analyst: The bull market may return in June, and the median target price of Bitcoin is expected to reach $126,000

Lazarus Group now owns approximately 13,562 BTC, pushing North Korea’s Bitcoin holdings above those of El Salvador and Bhutan

Analyst: BTC's four-year halving cycle is still an important factor affecting price trends, and the current key support range is $72,000-73,000

CZ suspected response to the purchase of TST and mubarak: do some testing on the weekend

Uber’s early investor: BTC will not be replaced as a value transfer protocol, but the market is monopolized by some giants

The address that may belong to the founder of DFG has hoarded $18.68 million in UNI and MKR

Pakistan Creates Cryptocurrency Committee to Regulate Blockchain and Digital Assets

Trump family crypto project WLFI bought $2 million of AVAX and MNT respectively 2 hours ago

In the past 7 days, NFT transaction volume decreased by 7.84% month-on-month to US$109.2 million, and the number of buyers and sellers increased by more than 400%.

Cumulative net inflows into U.S. spot Bitcoin ETFs have fallen to their lowest level since January 2

Telegram founder Pavel Durov allowed to leave France for Dubai, TON rises 20%

Sonic Labs and AC: Plan to launch an exchange this year to compete with Binance and Coinbase

Binance Alpha Launches Mubarak

Analyst: The key to Bitcoin avoiding further decline is that the closing price this week cannot fall below $81,000

10x Research: Bitcoin is "very likely" to consolidate for another 8 months

Base ecosystem game project Henlo Kart has a contract loophole, and HENLO tokens fell 96.5%

David Sacks, the “Crypto Czar”, sold more than $200 million in digital assets through individuals and companies before taking office

You May Also Like

Best Crypto to Buy as Saylor & Crypto Execs Meet in US Treasury Council

BlackRock boosts AI and US equity exposure in $185 billion models