Trading time: $75,000 is the recent key support level for BTC, and Ethereum may repeat its 2019 trend

1. Market observation

Keywords: SOL, ETH, BTC

Market volatility has become the norm. Bitcoin fell below $80,000 again this morning. Crypto analyst Eugene said that the overall trend is still biased downward. Although there is a possibility that BTC has bottomed out at 76k or a double bottom in the 74-76k range, this probability is decreasing over time. He expects BTC to drop to the 66k psychological mark set by Michael Saylor, and pointed out that the upward trend or range of BTC has been broken in all time frames, and 75k is currently the last key support level. For SOL, Eugene believes that $80 is a good buying price, but if it falls below this level, the next support level will fall directly to $25.

Meanwhile, Ethereum is showing even weaker performance, with the relative strength index (RSI) on the ETH/BTC two-week chart falling to a record low of 23.32. While an RSI below 30 is usually seen as an oversold signal, the current continued decline indicates an acceleration of the downward trend, which analyst Alessandro Ottaviani described as a "flying knife" market, suggesting that buyers are having difficulty timing their entry. If ETH/BTC fails to rebound from the 0.022 level, ETH/BTC may continue to fall to the 0.020-0.016 BTC range, a further drop of about 30% from the current price. Currently, Ethereum faces strong challenges from competitors such as Solana, and VanEck data shows that Solana's decentralized exchange trading volume has surpassed Ethereum. Cryptocurrency analyst Benjamin Cowen believes that Ethereum will have to go through a "painful period" before rebounding, and its current trend is repeating the pattern of the 2019 market cycle, and it needs to wait for monetary policy changes to bottom out.

2. Key data (as of 13:00 HKT on March 14)

-

Bitcoin: $81,912.51 (-12.43% year-to-date), daily spot trading volume $31.072 billion

-

Ethereum: $1,890.33 (-43.28% year-to-date), with a daily spot volume of $19.235 billion

-

Fear of corruption index: 27 (fear)

-

Average GAS: BTC 2 sat/vB, ETH 0.43 Gwei

-

Market share: BTC 60.72%, ETH 8.25%

-

Upbit 24-hour trading volume ranking: XRP, BTC, TRUMP

-

24-hour BTC long-short ratio: 0.992

-

Sector gains and losses: SocialFi sector rose 2.49%, RWA sector fell 2.22%

-

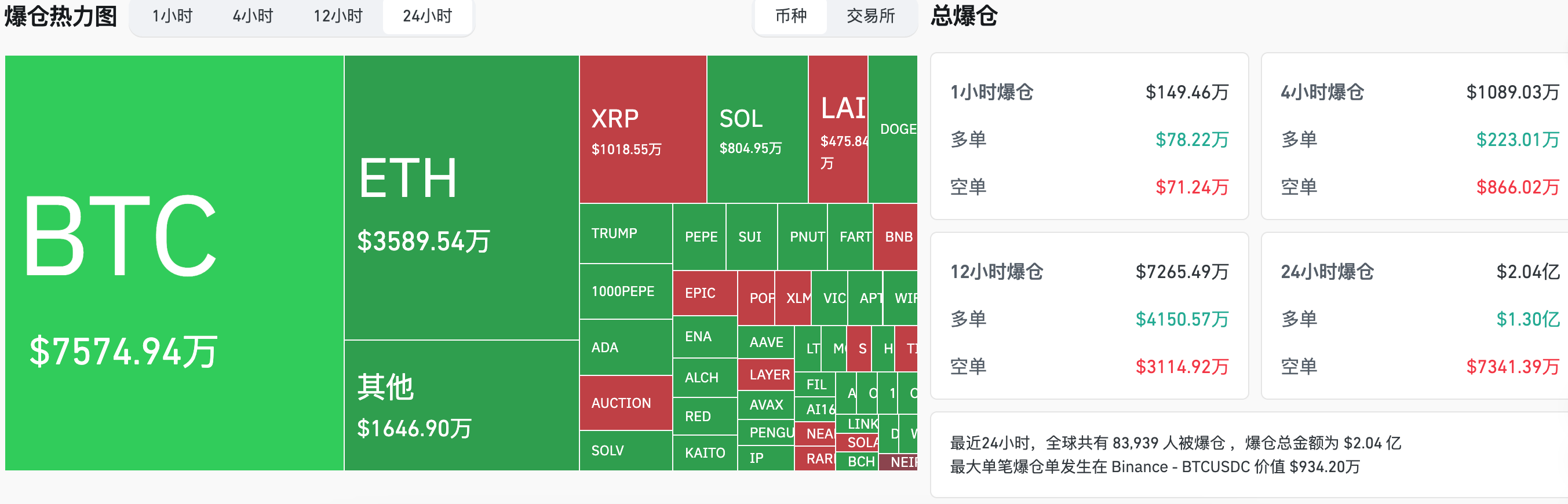

24-hour liquidation data: A total of 83,939 people were liquidated worldwide, with a total liquidation amount of US$204 million, including BTC liquidation of US$75.7494 million and ETH liquidation of US$35.8954 million

3. ETF flows (as of March 13 EST)

-

Bitcoin ETF: -$143 million

-

Ethereum ETF: -$73.63 million

4. Important Dates (Hong Kong Time)

US President Trump met with US technology leaders, including the CEOs of HP, Intel, IBM, and Qualcomm. (March 11, 2:00)

US President Trump signed an executive order. US February unadjusted CPI annual rate (March 12, 20:30)

-

Actual: 2.8 / Previous: 3% / Expected: 2.9%

U.S. February seasonally adjusted CPI monthly rate (March 12, 20:30)

-

Actual: 0.2% / Previous: 0.50% / Expected: 0.30%

Number of initial jobless claims in the United States for the week ending March 8 (10,000 people) (March 13, 20:30)

-

Actual: 22 / Previous: 22.1 / Expected: 22.2

5. Hot News

Lit Protocol announces LITKEY token economics: 4.8% for ecological airdrops

US court approves 3AC to expand $1.53 billion claim against FTX

U.S. Treasury meets with crypto custodians to discuss Bitcoin reserve management options

The US government wallet address transferred thousands of dollars of AVAX tokens 9 hours ago

World Liberty Finance increased its holdings of SEI tokens by $100,000 4 hours ago

Coinbase adds DOGINME (doginme) to its asset roadmap

US Democratic lawmakers pressure Treasury to halt Trump's Bitcoin reserve plan

U.S. stocks closed: Nasdaq fell nearly 2%, Apple fell more than 3%

BNY Mellon is expanding its services for stablecoin issuer Circle, people familiar with the matter said.

The annual rate of PPI in the United States in February was 3.2%, and the monthly rate was 0%

Robinhood to List PENGU, POPCAT and PNUT

Solv Raises $10 Million for Bitcoin Reserve Issuance to Drive Institutional BTC Finance Adoption

CBOE Submits 19b-4 Application to SEC for Franklin XRP ETF

Deribit: About $3.27 billion in crypto options will expire this Friday, and BTC's biggest pain point is $86,000

Six of Trump's 22 cabinet members hold Bitcoin or related investment products

You May Also Like

Best Crypto to Buy as Saylor & Crypto Execs Meet in US Treasury Council

BlackRock boosts AI and US equity exposure in $185 billion models