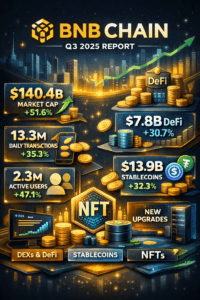

BNB Chain: Exponential Growth of Activity, Tokens, and DeFi in Messari Report

In the third quarter of 2025, BNB Chain demonstrated a strong acceleration in key metrics such as market capitalization, on-chain activity, and DeFi ecosystem growth, marking one of the most dynamic quarters of the year for Binance’s blockchain according to the State of BNB Chain Q3 2025 report by Messari.

Key Points of the BNB Chain Report

- BNB market capitalization +51.6% QoQ to $140.4 billion, ranking fifth among global cryptocurrencies.

- Average daily transactions +35.3% to 13.3M and active addresses +47.1% to 2.3M.

- DeFi TVL +30.7% QoQ to $7.8 billion.

- Average daily DEX volume +29.6% to $2.4 billion.

- Stablecoin market cap +32.3% to $13.9 billion.

- NFT trading +95% to $1.8M per day.

Market and Performance of BNB

In Q3 2025, the market capitalization of BNB rose by 51.6% compared to the previous quarter, reaching $140.4 billion. This growth positioned BNB in the fifth place among the most capitalized crypto assets, ahead of projects like Solana but behind Bitcoin, Ethereum, USDT, and XRP.

The average price of BNB increased by 53.5% on a quarterly basis, closing above $1,000 per token, a strong indicator of market confidence and bullish dynamics supported by increased on-chain adoption and network activity.

However, the total revenue from network fees has remained stable around $44 million, despite the expansion of activity. This is due to significant hard forks (Lorentz and Maxwell) that have reduced the average transaction cost, encouraging adoption but compressing monetization per transaction.

On-Chain Activity: Transactions and Users

The quarter saw a significant increase in activity:

- Average daily transactions: 13.3 million (+35.3% QoQ).

- Daily active addresses: 2.3 million (+47.1% QoQ).

The increase is driven by both DeFi applications and high-frequency trading, stablecoins, and NFTs. The combination of lower fees and improved network performance has created a favorable environment for adoption by new users and advanced traders.

DeFi: Sustained Growth and TVL

The Total Value Locked (TVL) in the DeFi sector has reached $7.8 billion, marking a +30.7% increase.

Leading Protocols

- PancakeSwap: $2.3 billion TVL (+35.4% QoQ).

- ListaDAO: $1.9 billion TVL.

- Venus Finance: $1.9 billion TVL.

- Aster: +2.600% QoQ after the Token Generation Event.

This growth not only reflects the demand for on‑chain financial services, but also the expansion of new segments such as liquid staking, lending, and tokenized asset markets. PancakeSwap, in particular, has expanded its offering by including tokenized real-world assets, increasing institutional involvement in the network.

Expanding Stablecoin Market

The market cap of stablecoins on BNB Chain has risen by 32.3% to $13.9 billion, with several emerging issuances alongside established assets

- USDT: approximately $8 billion (+27.1% QoQ).

- USD1 and USDC: steadily growing.

- USDe & USDF: massive expansion respectively over +1,000% and +464% QoQ, supported by integrations with Binance and cross‑chain services.

These data indicate a growing trust in stablecoins as a bridge for trading, payments, and DeFi, reinforcing BNB Chain’s position as a multi-asset hub.

NFT: Market Resurrection

In Q3 2025, NFT activity showed a significant recovery:

- Average daily volume: $1.8 million (+95% QoQ).

- Average daily sales: 6,026 (+109.8% QoQ).

The growth has been driven by platforms like Moongate, with real use of NFTs (events, ticketing), in addition to speculative projects related to event and gaming ecosystems.

Technical Infrastructure and Innovation

Reth Client

BNB Chain has released the alpha of the new Reth client, which offers:

- Synchronization up to 40% faster.

- Increased throughput and capacity for future upgrades.

MEV & Security

The adoption of the Builder API has reached 99.8% of blocks produced, with a 136.1% QoQ increase in MEV-related block production.

Additionally, the Good Will Alliance initiative has reduced sandwich attacks by over 95%, enhancing the trading experience for DeFi users.

Development Ecosystem and Partnerships

BNB Chain has expanded its development support with:

- MVB Season 10 and 11, accelerators focused on AI, DeFi, gaming, and infrastructure.

- Institutional partnerships like Franklin Templeton on the tokenization of regulated assets.

- xStocksFi for tokenized real-world assets and consolidation of partner wallets following the sunset of BNB Wallet.

A Quarter of Consolidation and Expansion

The State of BNB Chain Q3 2025 by Messari highlights a quarter of strong growth on multiple fronts. From market capitalization to on-chain metrics, from DeFi expansion to the recovery of NFTs, including infrastructural innovations and strategic partnerships, BNB Chain has solidified its position as one of the leading blockchain ecosystems in the global crypto landscape.

In an increasingly competitive market, these results indicate not only resilience but also the ability to innovate and attract users, developers, and capital in the most dynamic areas of digital finance.

You May Also Like

Strategy vergroot BTC voorraad: MSTR aandeel stijgt ondanks druk op Bitcoin koers

RBNZ guidance to support richer NZD – BNY