Aave joins the dividend army: over 100 million cash reserves start repurchase, or there will be favorable DeFi policies

Author: Nancy, PANews

After DeFi protocols such as Sky, Uniswap, Ether.Fi, Synthetix and Ethena adopted or proposed token repurchase strategies, decentralized lending leader Aave is about to join the DeFi dividend army.

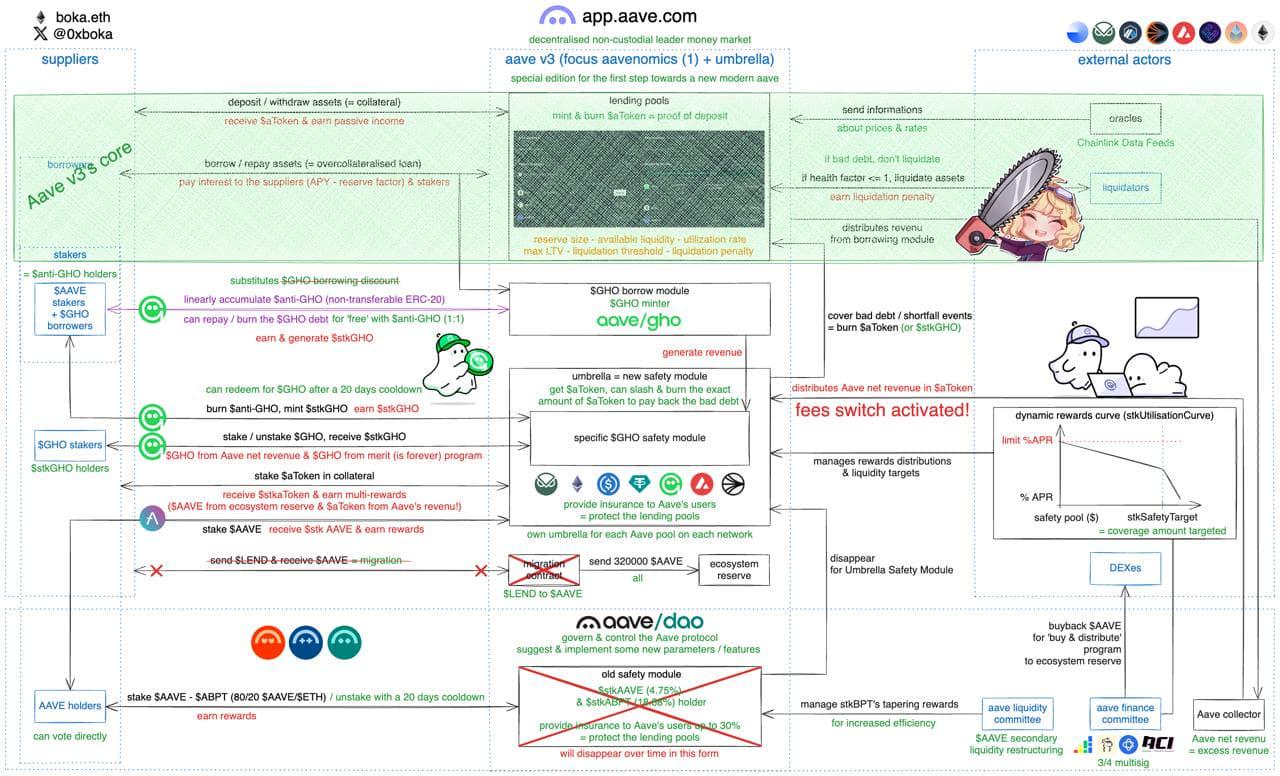

On March 4, the Aave community proposed a new heavyweight proposal to update its token economic model, including launching AAVE buybacks, redistributing excess protocol revenue, terminating LEND token migration, and upgrading secondary liquidity management. Boosted by this, Coingecko data shows that AAVE has risen by 21.3% in the past 24 hours.

Aave plans to start a dividend model, and the proposal is still in the stage of soliciting opinions

In the battle for DeFi liquidity, Aave has firmly established itself as the leader in the DeFi lending field with its abundant cash flow and innovative capabilities.

Aave's new Aavenomics proposal also revealed that Aave's market share and revenue have been rising over the past two years, including the supply of GHO stablecoins exceeding $200 million and Aave DAO's cash reserves reaching $115 million. This growth is due to Aave's near-monopoly revenue dominance in the lending protocol field, as well as its continued investment in innovation, such as the recent upgrade to Aave 3.3 and the upcoming Umbrella self-protection system. More importantly, Aave expects its revenue in 2025 to grow significantly (possibly more than $10 million per year) due to SVR (volatility protection mechanism), which can provide financial support for the implementation of Aavenomics.

As investors pay more and more attention to the value capture ability of DeFi protocols, many DeFi projects have begun to turn to dividend or repurchase models to enhance the value return of tokens. Aave's repurchase proposal has demonstrated multiple advantages, including strong cash reserve support, diversified income structure, high-quality asset rewards, and efficient governance and execution efficiency.

The proposal proposes the following key measures:

Token Buyback and Distribution: Aave plans to launch a "Buy and Distribute" program, using excess protocol revenue to buy back AAVE tokens in the secondary market or through market maker partners and distribute them to the ecosystem reserve. The initial plan is to implement it at a scale of $1 million per week for 6 months, that is, $24 million for buybacks, and then adjust it according to the overall budget of the protocol. This mechanism is designed to reduce the circulating supply, increase the value of tokens, and provide a sustainable source for the DAO's AAVE budget.

· Umbrella and AFC Establishment: The proposal points out that Umbrella is a protection mechanism and growth tool for Aave users, and proposes to redistribute part of the excess income of Aave DAO to Umbrella aToken stakers. To implement this plan, the proposal proposes to form the Aave Financial Committee (AFC), composed of Chaos Labs, TokenLogic, Llamarisk and ACI, and set a 3/4 signature threshold. AFC will be responsible for managing collector contract assets, defining Umbrella liquidity targets, and executing budget allocations through TokenLogic's monthly financial management AIP.

· Protocol Revenue Redistribution: The proposal proposes to create an ERC20 token to Anti-GHO to enhance the rewards for Aave ecosystem stakers, which is generated by AAVE and StkBPT stakers. The initial generation of Anti-GHO is set at 50% of GHO revenue, of which 80% is distributed to StkAAVE holders and 20% is distributed to StkBPT holders. At the current GHO lending rate and supply, Aave distributes $12 million in protocol revenue to GHO stakers each year.

End of LEND Migration: After nearly five years of running the LEND to AAVE migration contract, Aave will close this channel and reclaim the remaining 320,000 AAVE (about $65 million) and inject it into the ecosystem reserve to provide more funds for growth and security.

· Secondary Liquidity Management Optimization: Aave DAO currently allocates approximately $27 million per year from the ecosystem reserve (based on current AAVE valuation) for secondary liquidity incentives. The proposal suggests a hybrid model that combines StkBPT staking with direct management by the Aave Liquidity Committee (ALC) to achieve greater liquidity at a lower cost.

However, the proposal is still in the stage of soliciting opinions. If consensus is reached, the proposal will be upgraded to the Snapshot stage. If passed, Aave will authorize the establishment of AFC and gradually implement it through AIP.

DeFi may welcome favorable policies, the White House supports the withdrawal of the "DeFi broker rule"

With the release of the Aave proposal, the DeFi industry may usher in a window of respite and growth due to favorable policies.

According to the Executive Policy Statement issued by the White House Office of Management and Budget (OMB), the U.S. government supports SJ Res. 3, a bill initiated by Senator Ted Cruz and others to veto the U.S. Internal Revenue Service (IRS) rules on “total proceeds reporting by brokers selling digital assets.”

It is understood that the rule was originally proposed by the Biden administration in late 2024, expanding the definition of brokers to cover DeFi protocol-related software and requiring some DeFi users to report total crypto trading revenue and taxpayer information. The White House believes that this regulation improperly increases the compliance burden of US DeFi companies, hinders innovation, and raises privacy issues. The statement made it clear that if SJ Res. 3 is submitted to the president, senior White House advisers will recommend that the president sign the bill into law to repeal relevant IRS regulations.

In this regard, U.S. Senator Lummis commented, "The IRS's regulations on DeFi fundamentally misunderstand how decentralized technology works. I have witnessed how regulatory clarity - not over-regulation - promotes innovation. These tough federal regulations may push American crypto entrepreneurs overseas, at a time when we should be nurturing this industry domestically. It is an honor to work with Senator Ted Cruz to revoke this attack on the crypto community."

The White House's support signal may mean a major shift in the direction of crypto policy. For the DeFi industry, if the rules are abolished, DeFi projects including Aave will be exempted from cumbersome reporting obligations and reduce operational compliance costs, retaining decentralized features, and may bring back funds and talents, further stimulating the wave of DeFi innovation in the United States.

As the DeFi industry may usher in a more relaxed development environment, Aave's innovation in token economics can not only strengthen its competitive advantage in the liquidity battle, but also accelerate DeFi's transformation to a sustainable value capture model. Real income is not only a financial indicator, but also the cornerstone of building a sustainable ecosystem.

You May Also Like

Cashing In On University Patents Means Giving Up On Our Innovation Future

Trump foe devises plan to starve him of what he 'craves' most