From the Libra scandal to Solana’s loss of money, can Jupiter’s multi-strategy layout restore market confidence?

Author: Nancy, PANews

At present, the Solana ecosystem is experiencing a "bleeding" crisis triggered by the Libra coin issuance scandal. The double blow of liquidity loss and market confidence has exacerbated the challenges within the ecosystem. As a star project in the Solana ecosystem, Jupiter once played a core role with its ultra-high liquidity share, but the involvement of the Libra scandal and the overall ecological crisis have plunged it into a quagmire. Despite this, Jupiter has recently been trying to send a signal to the outside world that it can break through the headwind through a number of strategies such as ecological expansion, token repurchase plans, and product iterations.

Trading engine slows down? Jupiter still has advantages in Solana ecosystem

Jupiter once drove the prosperity of the Solana ecosystem with its strong market appeal, but the Solana ecosystem confidence crisis has slowed down its trading engine and it is difficult to remain immune.

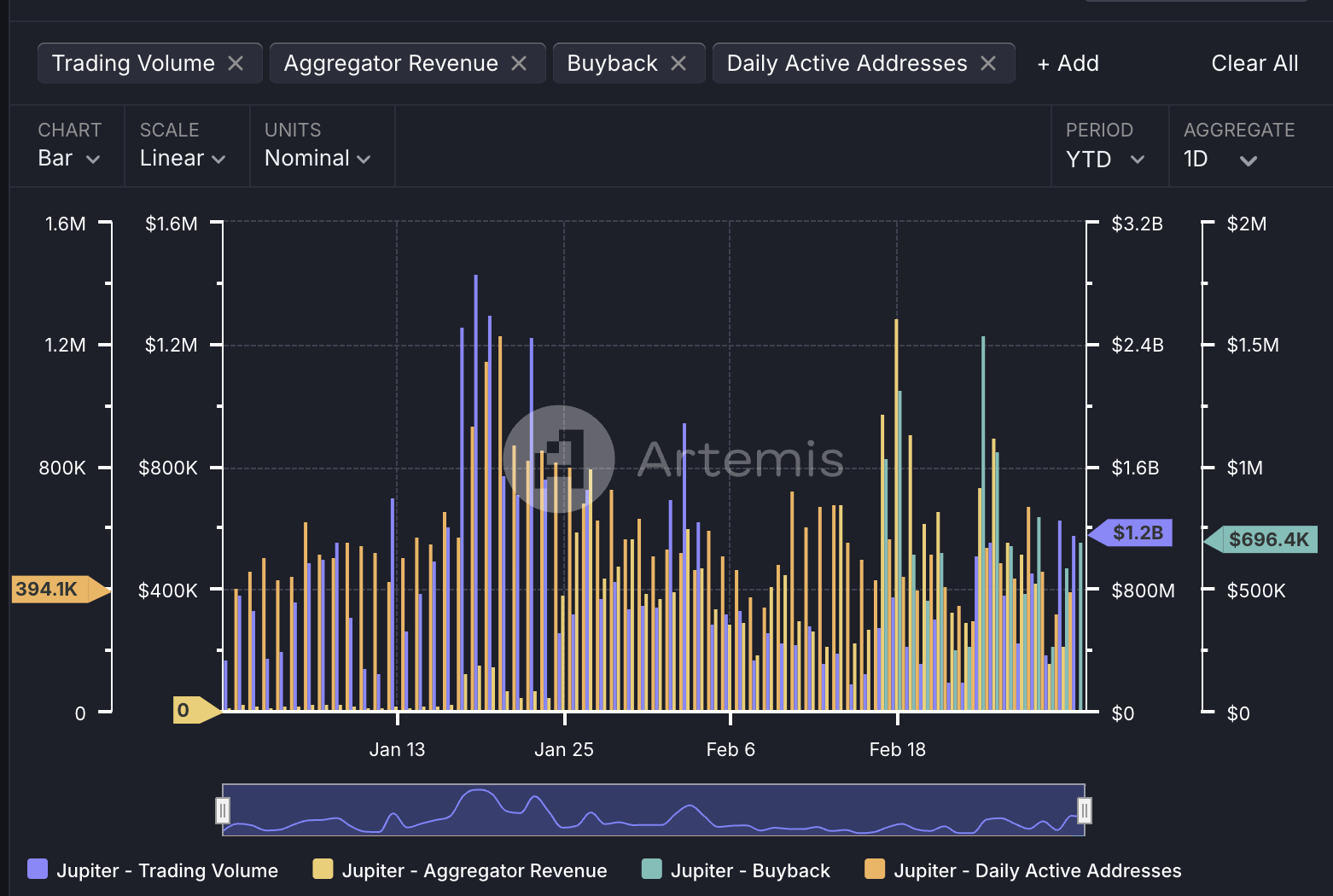

Artemis data shows that Jupiter's daily trading volume reached a historical peak of $2.9 billion in mid-January this year. However, trading activity has gradually declined since then. As of March 3, the daily trading volume fell back to $1.2 billion, a sharp drop of 58.6% from the peak.

The change in the number of daily active addresses also reveals the decline in community participation. On January 20 of this year, Jupiter's active addresses hit a new high of 1.2 million, highlighting its user participation boom at the time. However, as of March 3, this number has dropped sharply to 394,000, a drop of 67.2%. The sharp drop in active addresses not only points to a slowdown in trading activity, but also suggests that users' confidence in Jupiter and even the Solana ecosystem has been impacted. However, Solana's overall daily active addresses also fell by about 48.1% during the same period, which also shows that Jupiter's decline is synchronized with the overall ecological environment.

The weakening of trading activity directly affected Jupiter's revenue performance. Artemis data showed that its aggregator's daily revenue fell 83.3% from a peak of $1.3 million to only $216,000 as of March 3. This weakness in revenue also reflects Jupiter's vulnerability in the current market environment.

Despite the pressure on trading activity and revenue, Jupiter's weight in the Solana ecosystem still shows a certain resilience. Artemis data shows that Jupiter's daily trading volume accounts for 11.6% of Solana's total, a slight increase from the peak of 10.4% in January. However, Jupiter's daily active address share has dropped by 36.5% from the peak, accounting for 9.4% of Solana as of March 3.

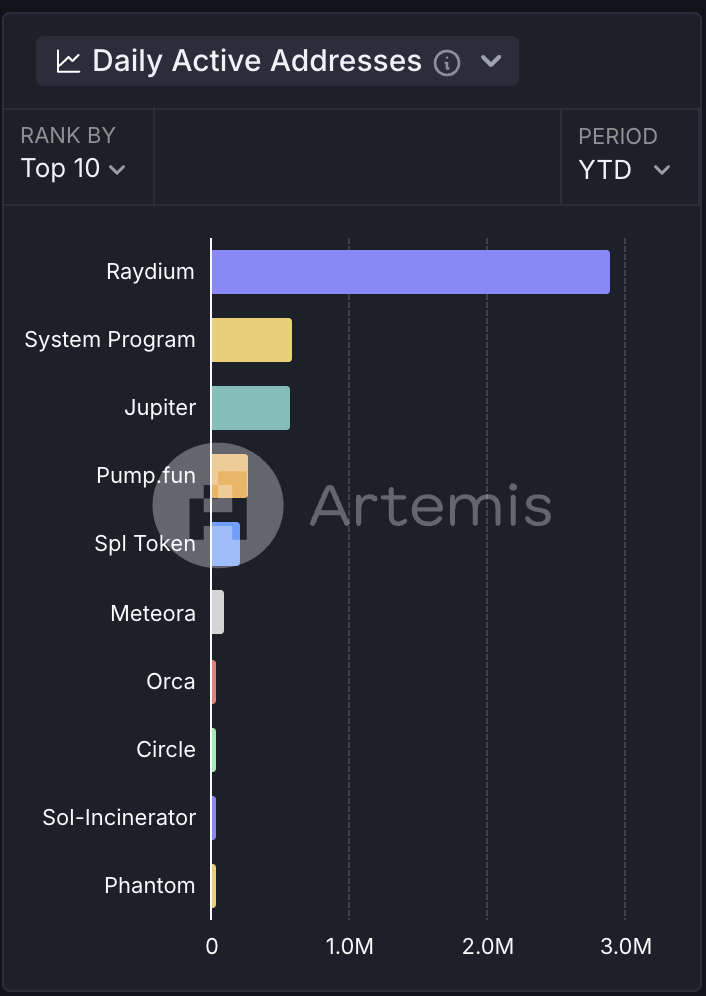

From the perspective of ecological ranking, according to Artemis data, since 2025, Jupiter has been ranked second in the Solana ecosystem with a daily transaction volume of US$260 million, second only to Raydium; the number of daily active addresses is 572,000, ranking third; and the gas fee consumption contributed US$45.7 million, ranking second. These data also show that Jupiter still maintains the role of Solana's core liquidity pillar, but its influence has been reduced.

In addition, the official website shows that the total staked amount of JUP exceeds 580 million, accounting for more than 21.5% of the circulation, which also reflects the community's continued participation in JUP DAO governance, or providing a short-term selling pressure buffer for the token.

From trust crisis to long-termism, Jupiter's multi-line layout restores confidence

The Libra scandal was the trigger for Jupiter to fall into the quagmire. In the LIbra insider trading scandal in February this year, Libra created a liquidity pool on Meteora, and Jupiter was accused of colluding with Meteora due to Meow's dual identity (Meteora co-founder). Although Meteora co-founder Ben resigned afterwards, and Jupiter responded that it did not participate in the issuance of Libra in any form, saying that no team members were found to have rushed to buy shares, it did not save Jupiter from the reputation crisis, and its token JUP also fell for a time.

"We talk about crypto being the future, but in reality, there is often a lack of commitment to long-termism and accountability for results. One thing is certain: we believe in what we are doing, we believe in being responsible for long-term results, and we believe that the crypto industry will truly change the world in the future, no matter how volatile the short-term situation is," Meow said in a recent post.

Faced with the slowdown of the Solana ecosystem and the Libra turmoil, Jupiter has responded with a variety of strategies. In recent times, it has announced a multi-pronged layout including acquisition expansion, token economic adjustment and transparent governance, in an effort to regain market trust.

In terms of ecological expansion, Jupiter has made a number of recruitments and acquisitions in the past year, including the acquisition of majority stakes in Sonarwatch and Moonshot in recent months, and is currently conducting two unannounced acquisitions to enhance the team and the capabilities of the three pillar platforms Jup.ag, Jupiverse and Jupnet. The acquisition funds will be paid by the treasury.

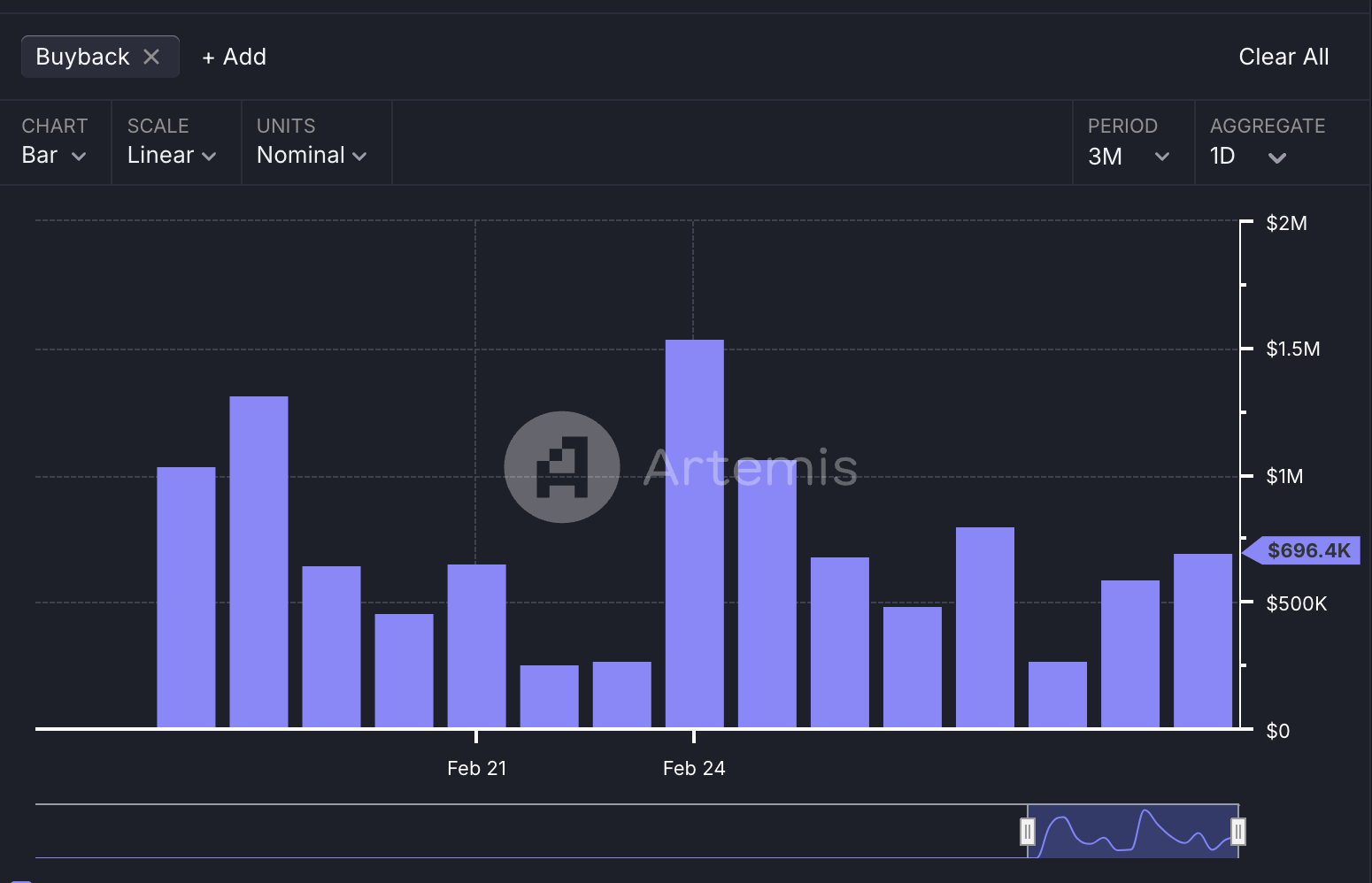

In terms of token value empowerment, Jupiter recently announced that an independent third party will conduct a comprehensive audit of the founders, Jupiter Treasury, Meteora Treasury and JUP tokens; at the same time, Jupiter established the Litterbox Trust, which is managed by an independent third party and has begun operations. In the next two years, it will receive 50% of the protocol's income for strategic accumulation of JUP, aiming to enhance the long-term stability of tokens. Officials said that this move does not involve short-term gains, but is a layout for the long-term development of the ecosystem and community. Artemis data shows that as of March 3, Jupiter has repurchased $10.8 million worth of JUP since February 17.

Moreover, Meow recently proposed the "2030 Proposal", planning to use its 280 million personal JUP tokens for team incentives and receive 500 million JUP as compensation in 2030. The proposal still needs to be decided by the community vote. Jupiter also recently announced the launch of the "GOAT Framework", which aims to make JUP the best token in the crypto industry and establish its position as a long-term token through four core dimensions: governance (including 30% supply destruction, "Jupuary" activities and working group budget adjustments and other key decisions), organicity (emphasizing the rejection of backroom deals, KOL promotion or market manipulation), consistency (cooperation with holders, community and team interests) and transparency (three token audits, multi-signature wallet disclosure and large-amount flow records).

In addition, Jupiter has also recently announced its 2030 team strategy, which will focus on decentralized liquidity platforms, global community expansion and Jupnet ecology in the next five years. It also plans to allocate 280 million JUP to new team members in the next three years (the startup team currently holds 1.4 billion JUP), but the source of funds requires community decision-making. There are two main options: one is to use strategic reserve funding, which will be unlocked from July 2025 without community voting; the other is to pay from Meow's personal holdings, which will be recovered from the strategic reserve in 2030, and apply for an additional 220 million JUP as an incentive (DAO adjustable).

In terms of product iteration, Jupiter merged with ApePro and changed its name to Jup Trenches, which can provide functions including dual account types, private key export, real-time data, etc. Jupiter Mobile launched last year will also undergo major updates.

In general, although the slowdown of the trading engine has put Jupiter under pressure in the short term, its position as the core pillar of the Solana ecosystem has not been lost. Whether it can stop the bleeding of the ecosystem or even achieve positive growth in the future by relying on the diversified strategic layout and the recovery of Solana still needs time to verify.

You May Also Like

Best Crypto to Buy as Saylor & Crypto Execs Meet in US Treasury Council

BlackRock boosts AI and US equity exposure in $185 billion models