Celebrity coin issuance no longer works? Ronaldinho's coin issuance encounters a collapse of trust

Author: Frank, PANews

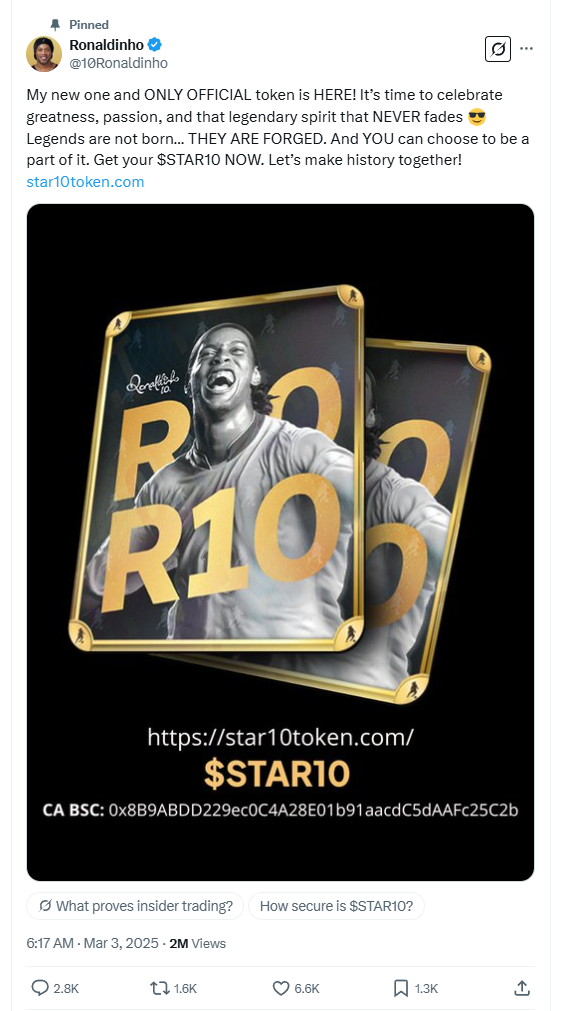

Since Trump, celebrity coin issuance seems to have become a new business practice. On March 2, the well-known retired football star Ronaldinho also announced the launch of his personal token $STAR10 on the BSC chain. In the sluggish market, although the circulating market value has reached a maximum of 32 million US dollars, it is still far from the expected rush to buy. On the contrary, many conspiracy theories about this token have been exposed on social media. A certain coin issuance team in Shenzhen has not locked up the fund pool, the coin minting authority has not been abandoned, and insiders have rushed ahead of schedule. Scandal news has followed one after another. Even CZ, the founder of Binance who forwarded the online information, was once besieged by users. Is the business practice of this celebrity coin issuance craze really a one-way harvesting password to get rich?

Football genius reduced to a tool for harvesting? Professional team manipulation is in doubt

Ronaldinho, once known as the most talented Brazilian football star in history, was generally called Ronaldinho by fans. He was loved by fans during his career and was once called the football wizard. However, he became famous at a young age, lacked self-discipline, and ruined his career after indulging in sensual pleasures. He then spent money lavishly, went bankrupt, and used his fame to make money. Like many talented athletes from poor backgrounds, Ronaldinho unfortunately chose such a script.

After trying various ways of making money by performing side jobs, the crypto industry’s ability to reap quick profits seemed to be a better option for him.

On February 22, Ronaldinho tweeted, "Cryptocurrency looks good here," and began to announce his token issuance plan. However, as the crypto market continued to be sluggish, the final token was not officially launched until ten days later.

During these ten days, the crypto market experienced a sharp decline, the previously popular Solana chain also showed signs of decline, and the BSC chain tried to become a new MEME hotspot with CZ's frequent interactions. From Ronaldinho's final choice, it can be seen that there may be a team behind him who is well versed in the laws of crypto market changes and is giving him advice.

On February 28, Twitter user @R10coin_ broke the news that a Shenzhen coin issuing team was behind Ronaldinho’s coin issuance, and the whistleblower claimed to be another professional token issuing company, and first negotiated a $6 million cooperation agreement with Ronaldinho to jointly issue tokens. Later, because another Shenzhen coin issuing team intercepted him with $10 million, he chose to expose the matter. He also posted some email information and Ronaldinho’s signed documents. The community generally believes that this is just a farce of black-eating-black, but everyone seems to have become accustomed to this kind of insider trading. Previously, President Milley’s coin issuance farce also exposed these coin issuance insider information to the public. As of March 4, the user’s Twitter account has been blocked.

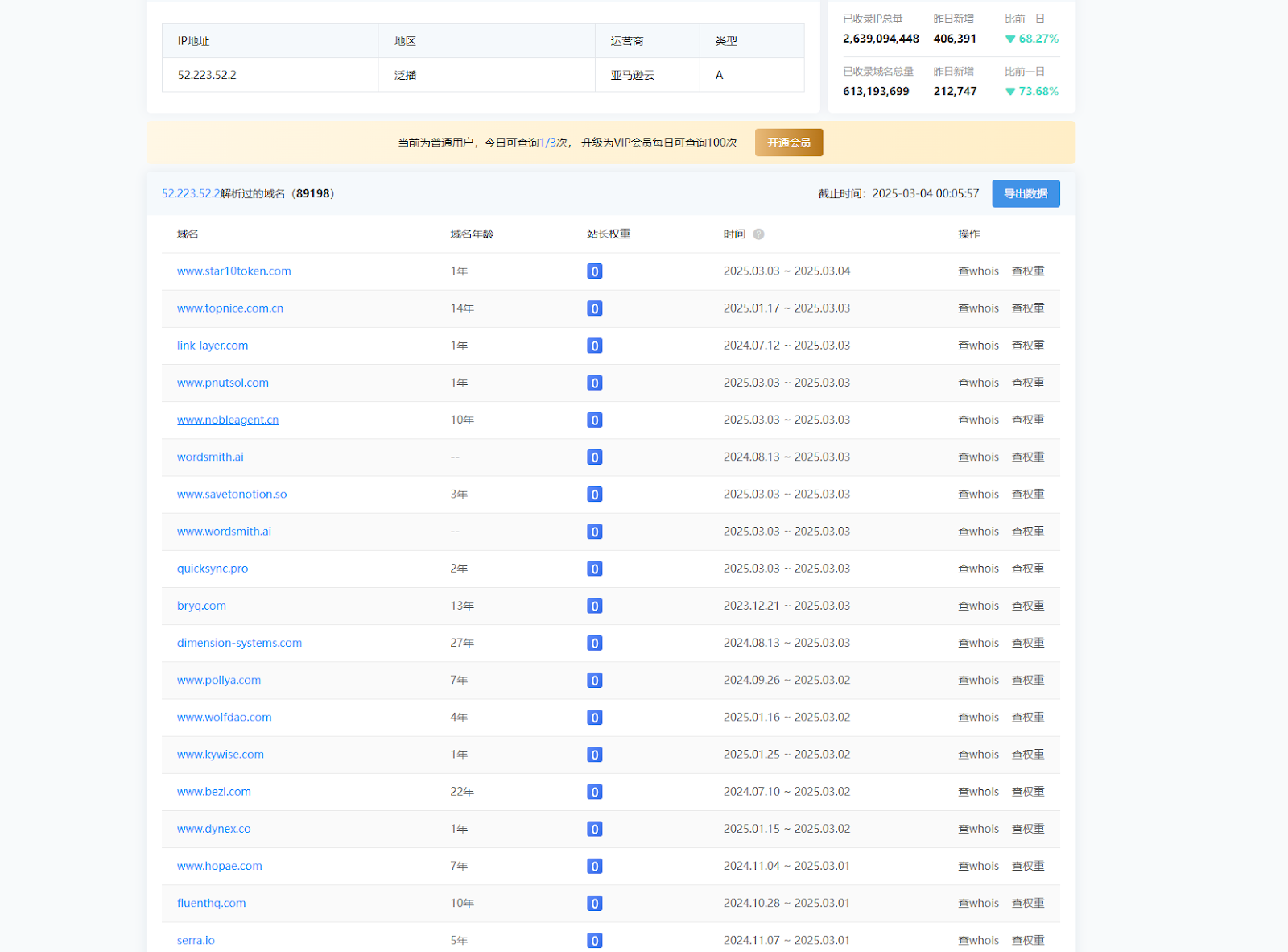

Since the user did not release more substantive insider information, the team behind Xiao Luo’s coin issuance is still unknown. According to PANews’ investigation, the official website domain name of $STAR10 token is hosted by the well-known domain name service provider GoDaddy, and there are two deployed IP addresses. After reverse query, these two IP addresses are from Amazon cloud servers. This IP has resolved more than 80,000 domain names, so it is impossible to prove that it is controlled by the same person.

However, it is interesting that the official website address of another well-known MEME coin PNUT appeared in the parsed list of the IP. PNUT is also one of the MEME coins that was launched on Binance last year. However, from the current chain of evidence, there is no direct evidence that there is a conspiracy group behind the issuance of $STAR10 tokens as mentioned on social media.

Hidden secrets in the contract: backdoor permissions trigger a crisis of trust

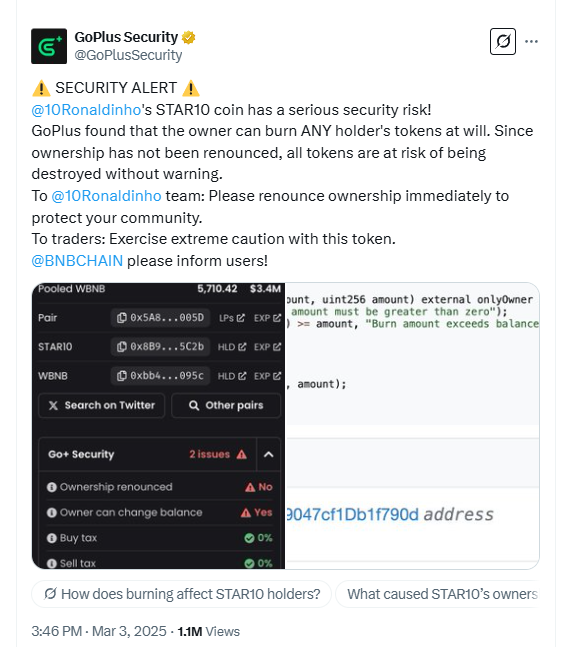

However, during the token issuance process, people still seem to feel the insincerity of the $STAR10 token issuance. According to GoPlus Security monitoring, the contract owner of the $STAR10 token still retains the right to destroy the token, and the fund pool lock-up period is only one month.

This reserved backdoor operation made many users think that the project was preparing for harvesting. Therefore, it triggered a collective condemnation on social media. CZ, the founder of Binance, first retweeted Ronaldinho’s coin launch without paying attention to this loophole, and said that this move was not an endorsement, but just a thank you for choosing to launch on BNB Chain, but then suffered a collective condemnation from users.

However, perhaps due to pressure from the community, Ronaldinho's team later stated on Twitter that it had given up the right to mint coins and extended the lock-up period by 255 years to 2281 years.

However, this kind of remedy after the loss does not seem to have received more recognition from the community. As of March 4, the number of addresses holding coins on the token chain was approximately 9,500, far from TRUMP's 640,000 and also less than LIBRA's 27,000 addresses.

Insider trading made a huge profit of 282 times. Was it another case of internal players making advance arrangements?

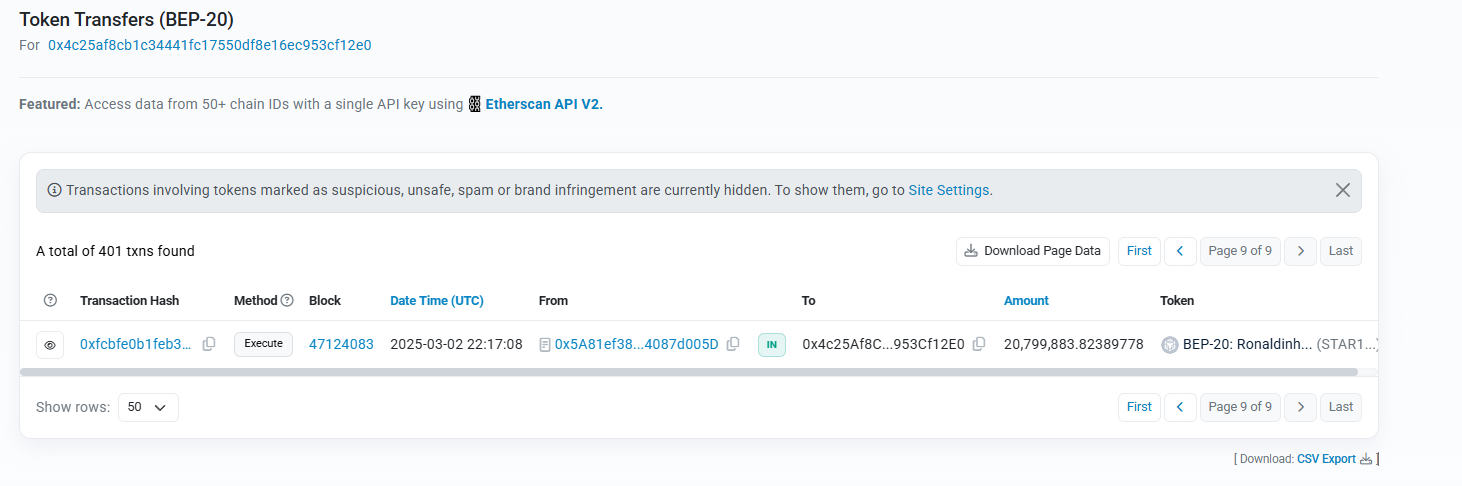

In addition, insider trading is also one of the tricks that celebrities often reveal when issuing coins. Similar signs also appeared in the issuance of $STAR10. According to Onchain Lens, an insider purchased 20 million $STAR10 tokens with 49 BNB (worth $29,000) before the token was issued. As of March 4, the address had sold $350,000 worth of tokens and still held more than $2.6 million worth of tokens that had not been sold.

According to PANews calculations, the average cost of this user was about $0.0014, and the highest point increased by about 282 times. The maximum holding value could reach $8.26 million, almost a quarter of the circulating market value. What is even more suspicious is that Ronaldinho’s Twitter coin issuance time is UTC time, March 2 at 22:17, and the purchase time of this address is 22:17:08. This time is even earlier than Ronaldinho’s release time. I wonder how the player at this address chose to invest $29,000 in a gamble without confirming the source of the token? PANews found through penetration that the initial funds of this address came from Binance hot wallet.

In general, Ronaldinho's coin issuance seems to be another failure. Similarly, NBA legend Scott Pippen launched his own token in August last year, but his token $BALL has a market value of only $4.5 million, with about 1,400 holders, a 24-hour trading volume of $2,300, and a total of 5 transactions, which can be described as a mess.

The recent LIBRA and MELANIA scams were also exposed as the work of conspiracy groups. People seem to have gotten used to this kind of harvesting routine and no longer blindly pay for it. As of March 4, the market value of $STAR10 was only $11.5 million, down 66% from its high point.

From an investment perspective, celebrity tokens have been almost wiped out so far, and for those celebrities who tried to quickly cash out through cryptocurrency issuance, this model of harvesting all the fish in the pond seems to be unsustainable.

You May Also Like

Best Crypto to Buy as Saylor & Crypto Execs Meet in US Treasury Council

BlackRock boosts AI and US equity exposure in $185 billion models