Whale Wallet Deposits Additional USDC to Expand LIT Holdings, Price Rally Ahead?

- A whale wallet has deposited USDC worth $2 million into Lighter, possibly to purchase more LIT.

- This comes after $4.03 million worth of USDC were transferred into Lighter.

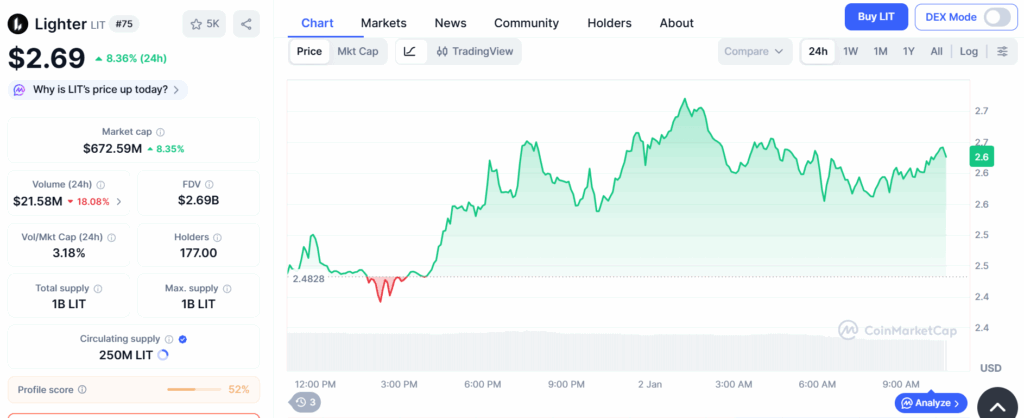

- LIT is trading at $2.69, up by 8.36% over the past 24 hours.

A whale wallet just deposited additional USDC into Lighter. The objective is reportedly to expand its holdings of LIT ahead of its anticipated bull run. However, projections show possible corrections for the next 3 months. The wallet now holds more than 2 million Lighter tokens.

USDC Into Lighter for LIT

A whale wallet recently executed two transactions wherein they transferred USDC to Lighter to expand LIT holdings. Total holdings stand at 2.45 million for the collective value of approximately $6.03 million. The individual price comes to around $2.46 in 2 days.

The first transaction saw the whale wallet transfer USDC worth $4.03 million into Lighter. Almost $3.8 million was spent to accumulate 1.63 million LIT at an average price of $2.33. It was speculated that the whale wallet would buy more Lighter tokens. The wallet has deposited additional USDC worth around $2 million, and it could soon purchase LIT at the applicable price.

LIT Current Price

LIT is currently exchanging hands at $2.69, up by 8.36% over the past 24 hours. The token has also surged slightly by 0.66% in the last 7 days. Its 24-hour trading volume has dipped by 18.08% to around $21.58 million.

Source: CoinMarketCap

Source: CoinMarketCap

Notably, its ATH and ATL came on the same date, that is on December 30, 2025. The token peaked at $4.04 and went as low as $2.30 before ending the year. It is now down by 33.59% from ATH and up by 16.77% from ATL. The average LIT price for the whale wallet seems to be well above the ATL at the moment.

LIT Price Projection

LIT price projection for the next 3 months estimates a correction between 22.07% and 20.55%. The monthly decline could take the value to around $2.05, followed by a further decline to $2.09 by March-April 2026.

Overall sentiments are bullish – likely to be evaluated in detail as the token spends more time in the market. It has seen 2 green days in the last 3 days despite the FGI of 20 points. The long-term projection draws the trajectory for a growth of 115.74% by the end of December 2026. Surge may commence from September 2026 with an aim to surpass $2.80.

Highlighted Crypto News Today:

Jupiter Launches Mobile V3 With Native Pro Trading Tools

You May Also Like

The Channel Factories We’ve Been Waiting For

Gold Hits $3,700 as Sprott’s Wong Says Dollar’s Store-of-Value Crown May Slip