Memecoins Are Rising From the Dead After Hitting Historic Lows, Says CryptoQuant

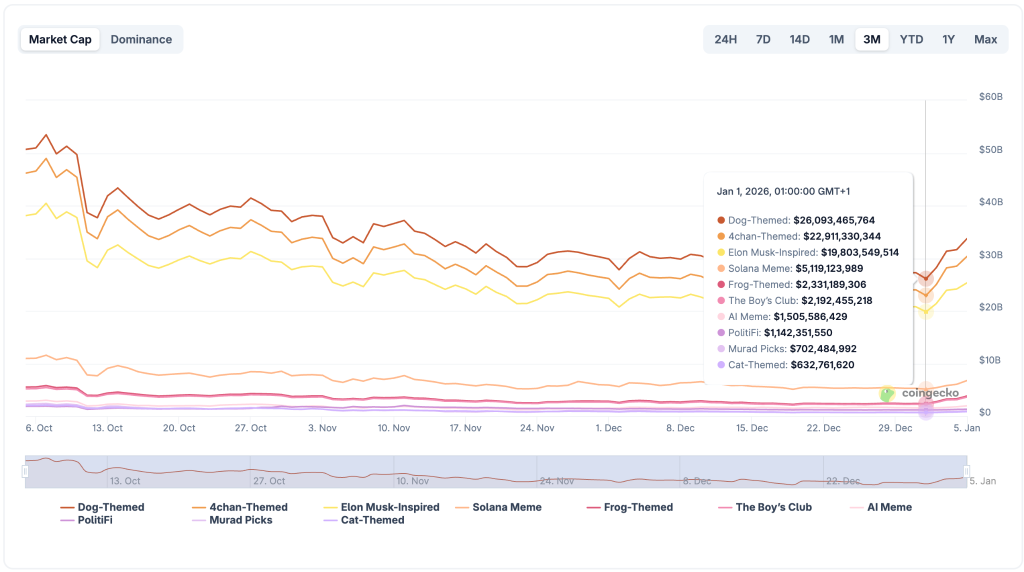

Memecoins have surged back to life following a historic collapse that pushed their market share to unprecedented lows in December 2025.

The sector has added over $8 billion in market capitalization since the start of 2026, with major tokens posting double-digit gains that caught traders off guard.

Source: CoinGecko

Source: CoinGecko

This sudden reversal comes after a year marked by declining interest and contracting valuations.

CryptoQuant data shows that memecoin dominance in the altcoin market hit a historic low in December 2025, dropping to 3.2% from 11% in November 2024.

The last time this metric reached such depths preceded a massive memecoin rally, suggesting the current rebound could mark the beginning of another speculative cycle.

Market Rebounds With Force After Holiday Slump

PEPE led the charge with a 65% gain year-to-date, climbing 34% in a single 24-hour period. BONK also surged 49% while FLOKI jumped 40%.

Trading volumes reached $9 billion as short liquidations amplified price movements.

The rally began immediately after the holiday period, when traders typically maintain cautious positions.

Lower volatility in Bitcoin created space for speculative assets to attract capital.

In fact, during the same period, Bitcoin has turned a new leaf, starting the year by breaking the $90K resistance and currently trading around $93,000.

Dogecoin broke through a multi-year downtrend with over 20% gain while Shiba Inu added 18.9% on the week.

On-chain data confirmed renewed accumulation in PUMP, BONK, and FLOKI as wallet interactions increased sharply.

Social sentiment shifted dramatically as PEPE added roughly $3 billion to its market capitalization in a single day.

The token’s trading volume exceeded the broader market average by more than three times, reflecting intense speculative interest.

Fear of missing out spread rapidly across crypto platforms as sidelined traders rushed to capture momentum.

Platform Dominance Shapes Sector Recovery

According to Messari’s report, Pump.fun continues to dominate Solana’s token ecosystem, accounting for 70-77% of new launches and up to 25% of daily network transactions.

Over 13 million tokens have been created through the platform since early 2024, representing more than one-third of all tokens on Solana.

The platform has generated over $866 million in lifetime revenue while directing nearly all daily fees toward buybacks that have removed approximately 8% of PUMP’s circulating supply.

Despite the emergence of competing launchpads, independent memecoins still control 86.2% of total market capitalization, according to CoinGecko’s State of Memecoins 2025 Report.

Launchpad-based tokens peaked at 20.5% market share in January 2025 before declining, suggesting grassroots launches retain stronger community support.

Dog-themed memecoins maintain dominance at 39.5% of the sector excluding Dogecoin, though frog and cat tokens like PEPE, POPCAT, and MEW have also captured attention.

Geographic interest remains concentrated in the United States, which accounted for 30% of memecoin-related page views in November 2025, up from 20% at the start of the year.

Seven of the top ten most interested countries are from emerging markets, collectively representing 38% of total interest, reflecting strong retail participation in regions with mobile-first access.

Analysts Eye Historical Patterns for Guidance

The current setup mirrors the conditions in late 2020 that preceded the 2021 memecoin explosion.

A quiet December marked by low volumes gave way to sharp January gains fueled by post-tax-loss harvesting and renewed speculative appetite.

That cycle eventually pushed the sector’s market cap from under $10 billion to more than $100 billion.

Some analysts project the sector could reach $69 billion in market capitalization during Q1 2026 if current momentum holds.

Sustained Bitcoin stability could provide the foundation for an extended rally as traders rotate capital into high-beta assets.

However, caution remains warranted. The move could prove to be a bull trap if trading volumes fade or macroeconomic pressures intensify.

Currently, key metrics to watch include open interest growth and shifts in capital toward higher-risk assets.

If retail participation strengthens, 2026 could play out similarly to 2021’s memecoin surge, though heightened volatility will likely persist regardless.

You May Also Like

nLIGHT to Announce Fourth Quarter and Full Year 2025 Financial Results on February 26th

When silver became a meme stock, retail investors ultimately caught the falling knife.