Consumer Cryptocurrency Market Insights: Disruption, Consolidation, and Growth Opportunities

Original article: Peter Yuan Pan , Partner at 1kx

Compiled by: Yuliya, PANews

This research was originally presented by 1kx Network to its limited partners and provides insights into the important strategic value and development prospects of the consumer cryptocurrency market. The following is the latest market observations.

New platform evolution rules

In the history of technology development, whenever a new platform emerges, a new market leader is bound to emerge. Existing market leaders often lose their market position due to misjudgment of new opportunities, slow response or poor execution. The root cause of this phenomenon is that new technology paradigms require completely new thinking patterns and business strategies. This law has been fully verified in the gaming and video fields over the past decade.

Disruptive evolution of the mobile gaming market

In the 2000s, the traditional game market was dominated by hardcore games, and players generally pursued high-fidelity graphics and deep immersive experiences. At that time, mobile devices were completely at odds with the needs of the mainstream game market due to their small screens, limited performance, and lack of high-quality content. Traditional game players had little interest in mobile games, and mainstream game publishers therefore ignored this emerging market.

However, the potential of mobile gaming platforms is obvious. It finally realized the vision of allowing users to play online with players around the world anytime and anywhere, creating a new category of mobile free games. This not only created an unprecedented new player market, but also gave birth to a group of new game companies. These successful companies are completely based on game types that are very different from traditional games, and their target users do not even identify with the identity labels of traditional game players.

Despite the general industry belief at the time that "these are not real games and these are not real gamers," mobile gaming ultimately achieved the astonishing feat of revenue that is more than twice that of traditional gaming.

Market changes in the video sector

A similar disruptive development pattern has emerged in the online video sector. In an era when TV networks dominate global media consumption, the limitations of this traditional model have become increasingly apparent: high barriers to entry, expensive production costs, and limited distribution to local or regional markets. Even so, traditional entertainment industry executives still underestimated the potential of online video.

However, forward-looking market observers have recognized the revolutionary characteristics of online video platforms: decentralization, low barriers to entry, and natural globalization. These characteristics have brought disruptive changes to content creation and distribution.

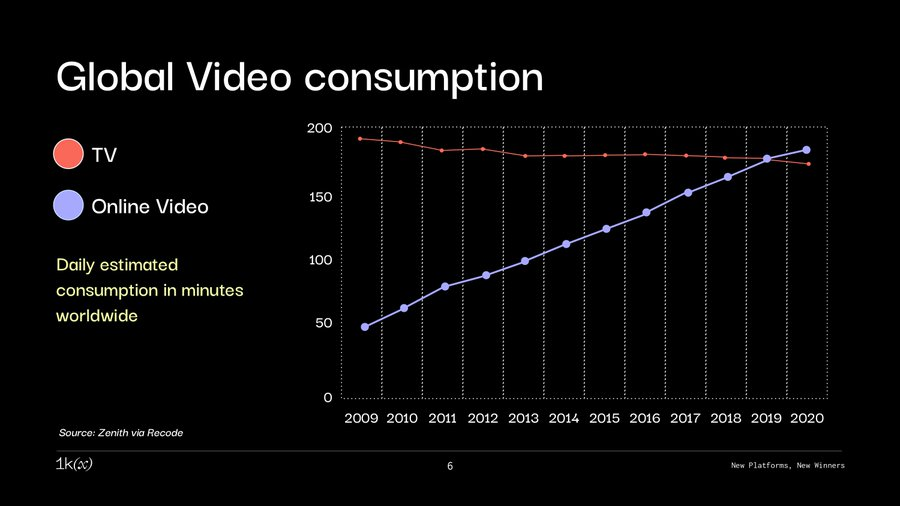

As a result of the market changes, the traditional entertainment industry has been restructured and new media companies have emerged. Similar to the mobile gaming sector, these emerging contents are fundamentally different from the content formats of traditional platforms. A new generation of entertainment stars and brands (such as Mr. Beast, Bella Poarch, etc.) has emerged rapidly, and innovative business models based on online video distribution channels (such as Shein) have emerged. Online video has eventually surpassed traditional TV and maintained a continuous growth trend.

Blockchain: The next generation consumer platform

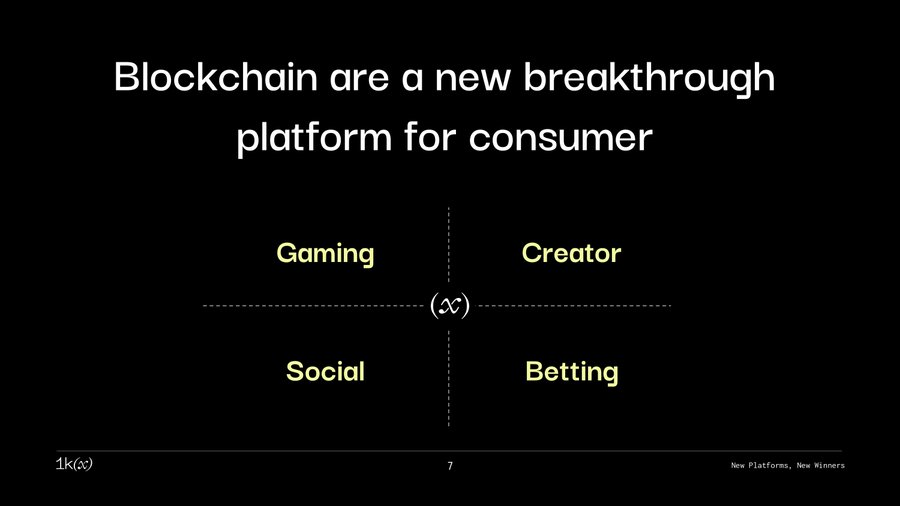

Blockchain technology is creating a new platform paradigm for consumers. This technology enables developers to build an application ecosystem with digital property rights and programmable incentive mechanisms from scratch in a decentralized, global environment.

Market analysis shows that this will bring revolutionary innovations to games, social media, creator economy and other fields, and give rise to a completely new market form. Similar to the development trajectory of mobile games and online videos, this market change will be achieved through content forms that are completely different from traditional platforms, and will create new user groups and market space.

Advantages of vertical integration

Market leaders in the consumer cryptocurrency space will have unprecedented growth potential, thanks to their unique advantage of vertical integration in a decentralized environment. In traditional markets, the most successful companies are often those that can achieve vertical integration . Take Amazon as an example. Although it started as an e-commerce platform, its cloud service division AWS now contributes 70-80% of the group's operating profit (only 15-17% of total revenue).

Companies in the traditional consumer sector generally pursue vertical integration, but are often constrained by technology costs. The open source nature of the Web3 ecosystem enables market leaders to achieve vertical integration naturally as their business grows, more effectively control each link in the value chain, obtain economies of scale, and achieve flexible commercial realization. This enables leading companies in the consumer cryptocurrency sector to achieve faster growth and larger business scale than their Web2 competitors.

Market practice verification

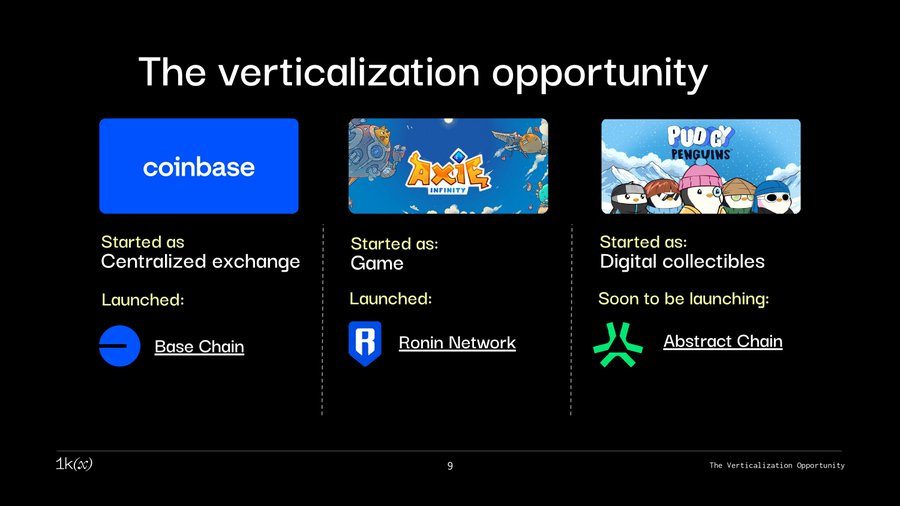

This vertical integration strategy has been proven in many cases:

- Coinbase started with centralized exchange business and then launched the Base chain network

- Axie Infinity develops Ronin Network based on its large user base

- Pudgy Penguins uses existing distribution channels to build Abstract Chain

- LINE and Kakao launch Kaia Chain with user advantages

Consumer-grade encryption technology is considered to be the final form of the development of consumer Internet. With the continuous advancement of blockchain and encryption technology, its application potential in the consumer field is becoming more and more significant, which may reshape the way consumers interact with the Internet and become an important driving force for the future digital economy.

You May Also Like

Best Crypto to Buy as Saylor & Crypto Execs Meet in US Treasury Council

BlackRock boosts AI and US equity exposure in $185 billion models