Virtuals encountered "acclimatization" on the first day of Solana launch, with Agent graduation rate only 8.3% and data challenged by market fluctuations

Author: Nancy, PANews

In the early morning of today (February 12), Solana Degens sat in front of the computer for a long time, looking forward to the official launch of Virtuals Protocol on Solana. However, this largest AI Agent issuance platform on Base did not replicate the previous wealth effect. At a time when AI Agent was not popular, Virtuals Protocol's multi-chain expansion plan seemed to encounter the dilemma of "not adapting to the local environment", with not only a low graduation rate but also insufficient market participation.

The graduation rate on the first day of Solana launch was 8.3%, and market participation was sluggish

On January 25, Virtuals Protocol announced that it will expand to the Solana ecosystem and launch a number of new plans, including launching Meteora transactions on Solana, establishing a Strategic SOL Reserve (SSR), converting 1% of transaction fees into SOL for ecological incentives, and hosting a Virtuals AI hackathon in March this year with technical support from the Solana Foundation.

In order to help more smart agents in the Base ecosystem expand to Solana, Virtuals Protocol's co-founder Wee Kee proposed two solutions on January 26 to optimize liquidity and user experience, as the liquidity pool on Uniswap has been locked for ten years and cannot be migrated. On the one hand, the team is exploring ways to allow interested teams to use 50% of the cbbtc in their proxy wallets as a source of liquidity to create additional liquidity pools on the Solana chain. On the other hand, the team is also studying inter-chain abstract swap solutions, which will allow users to purchase proxies on Base with SOL, or purchase proxies on Solana with ETH.

Virtuals Protocol's Solana expansion plan has also sparked market speculation. In response, EtherMage, a core contributor to Virtuals Protocol, said that moving toward multi-chain is crucial for Virtuals Protocol to realize its vision. Solana is the first step. Virtuals Protocol will also expand to several other blockchains and has set up dedicated resources to work with blockchain leaders/foundations to ensure that projects established in the ecosystem receive financial support.

However, despite Virtuals Protocol taking the first step towards multi-chain expansion, market performance has not met expectations. In the early morning of February 12, Virtuals Protocol announced the official launch of Solana and released several details: the contract address of all Solana's prototype proxy tokens remains unchanged when they are converted to Sentient; once the proxy has accumulated a binding curve of 42,000 tokens VIRTUAL, the proxy will graduate and create a liquidity pool on Solana's liquidity platform Meteora (the same founding team as Jupiter); 1% of Sentient transaction taxes are allocated to Virtuals Protocol and manually distributed to proxy creators, proxy partners, and proxy sub-DAOs at a ratio of 30%-20%-50% until the automated allocation mechanism is launched.

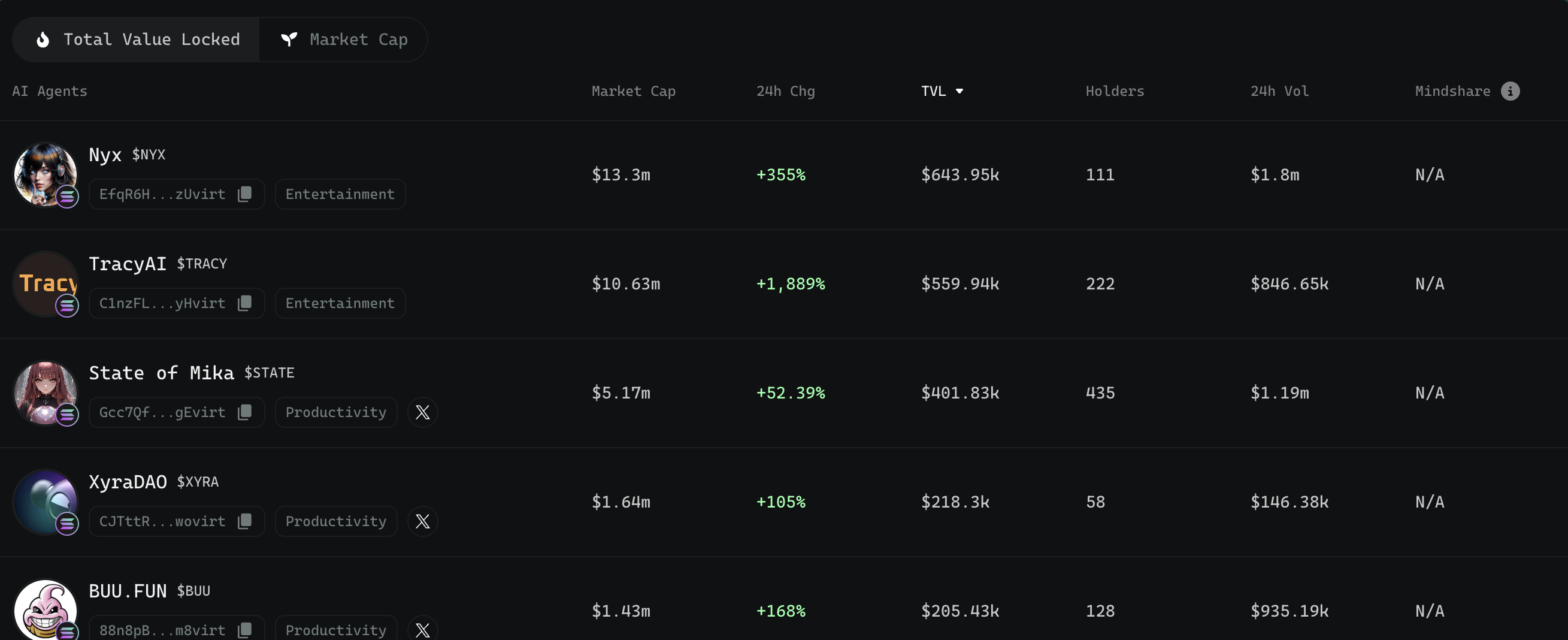

According to the official website, from early this morning till now, only 156 AI Agent tokens have been created on Solana's Virtuals Protocol, with a graduation rate of 8.3% (13). The market performance of graduated projects on Solana is also not satisfactory. There are only 5 projects with a market value of more than 1 million US dollars, of which Nyx, the agent project with the highest market value, has a market value of about 13 million US dollars. Not only that, overall, the price of most projects has shown a trend of opening high and closing low, and the prices of about half of the projects are close to zero. In particular, in terms of participation, except for the cucumber tester project whose price has been halved, which has more than 2,600 addresses, the number of addresses held by other projects is generally small, usually hundreds or even dozens of addresses. Judging from the data, the market response to Virtuals Protocol's entry into Solana is relatively cold.

In order to promote the growth of the Solana ecosystem and enhance the attractiveness of the network, EtherMage also recently disclosed that "we have received requests from many teams hoping to use the repurchase funds to simultaneously establish cross-chain TVL on Solana." To this end, Virtuals Protocol will adjust the repurchase and destruction plan of the Base proxy project, and plans to help proxy projects with more than US$10,000 TVL to execute the establishment of cross-chain TVL (about 100 projects).

Despite the challenges of cyclical fluctuations in business, the company still ranks first in market share

As the overall AI Agent track has experienced a deep correction in recent times, projects including Virtuals Protocol are facing market challenges brought about by cyclical fluctuations.

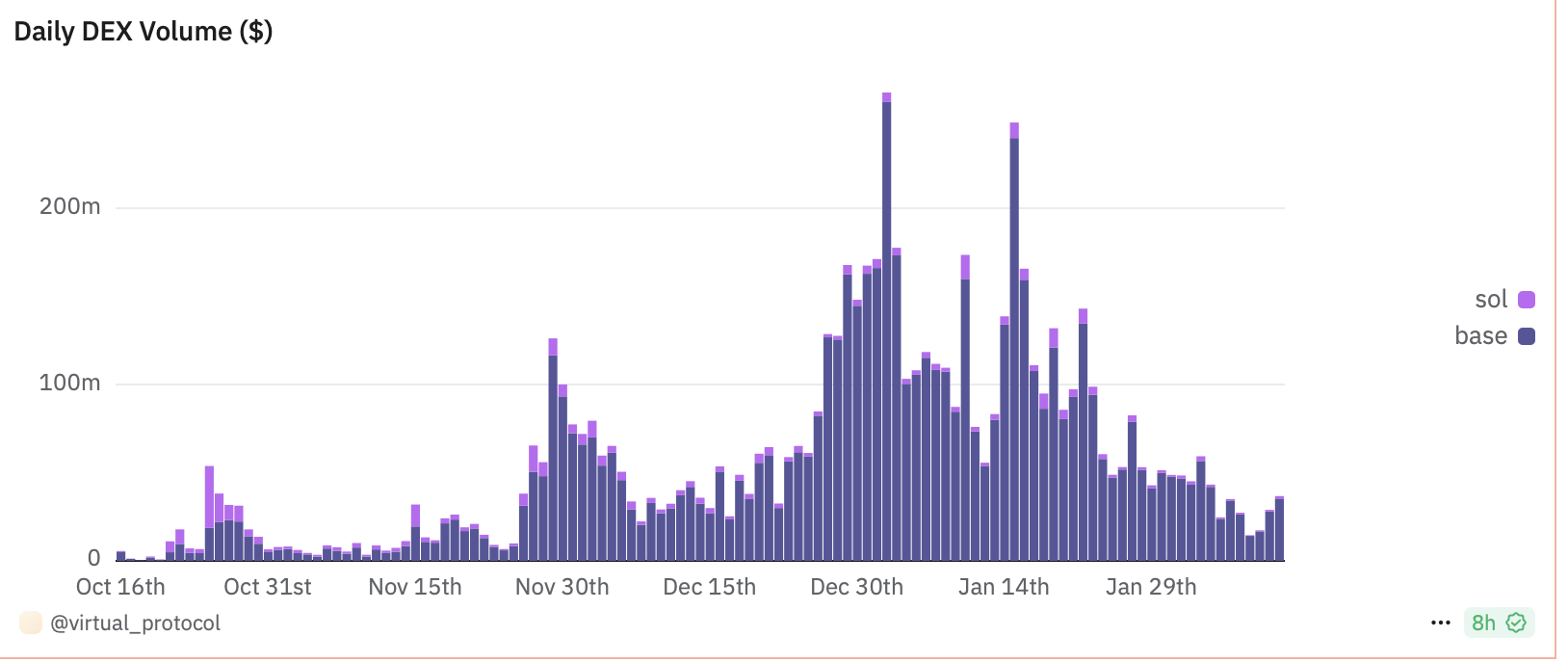

Dune data shows that as of February 12, Virtuals Protocol has successfully launched more than 17,000 Agents, with a DEX trading volume of nearly US$6.74 billion and cumulative revenue of more than US$37.766 million (Base network only).

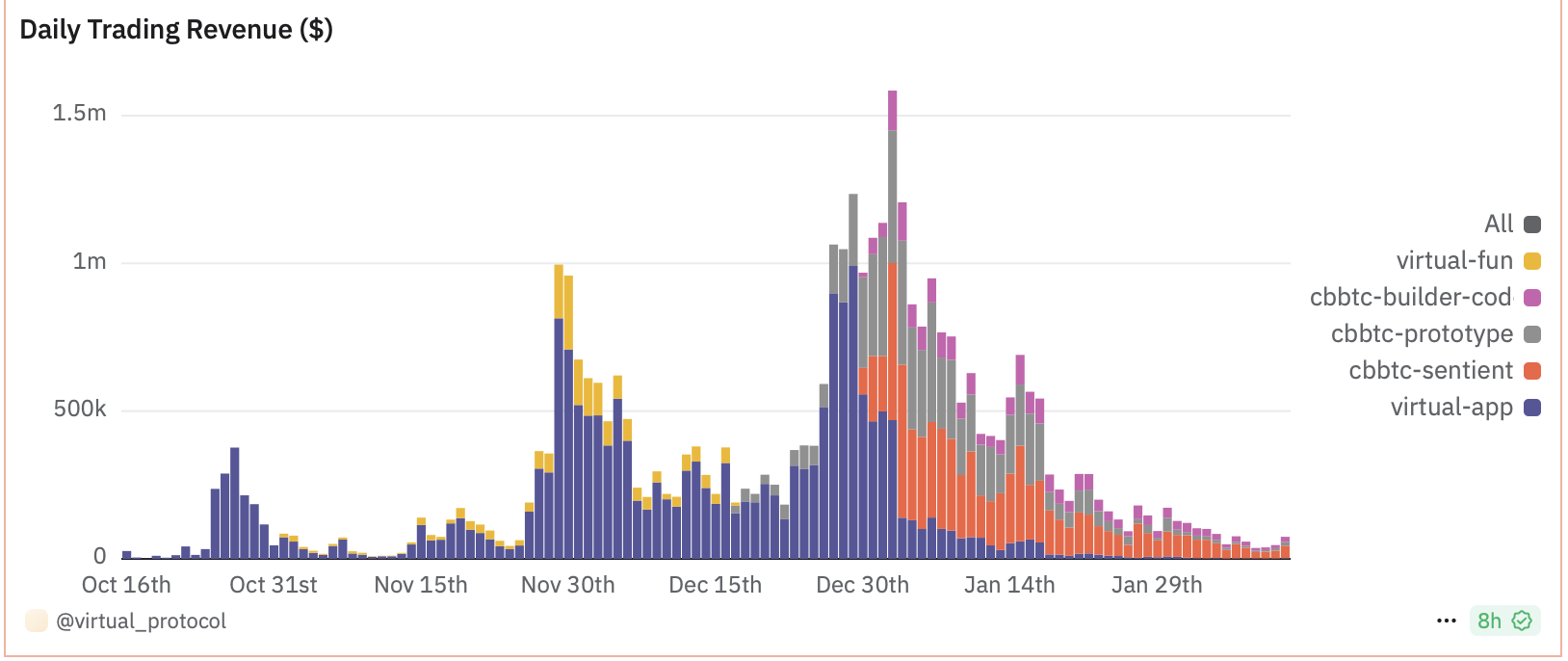

However, many data of Virtuals Protocol show a trend of slowing growth or even a significant decline. Dune data shows that in terms of the number of AI Agent creations, the average daily number of creations has dropped significantly since late January, and in most cases it is only in the double digits, far lower than the peak of more than 1,300 at the end of November last year. At the same time, revenue during this period has also declined significantly, with daily revenue mostly only hundreds of thousands or even tens of thousands of dollars, while it once exceeded $1.58 million at the beginning of this year. AI Agent's trading volume on DEX has also experienced a sharp decline, from the highest daily trading volume of hundreds of millions of dollars at the beginning of the year to the current level of tens of millions of dollars.

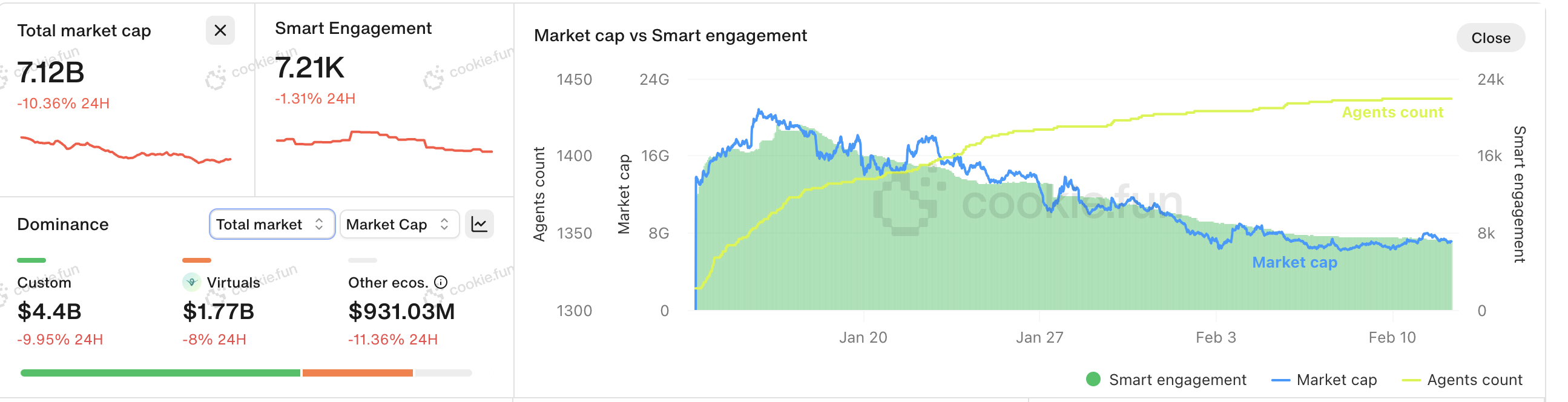

Similarly, the price of Virtuals Protocol token VIRTUAL has also seen a significant pullback. According to Coingecko data, the price of VIRTUAL has fallen by 46.3% in the past month. This downward trend in data is closely related to the overall cold reception of the AI Agent track. According to data from Cookie.fun, the overall market value of the AI agent market has shrunk by nearly 65.3% from its peak in the past month.

Despite this, Virtuals Protocol still occupies a leading position in the AI agent market. According to Cookie.fun data, the ecological market value of Virtuals Protocol has reached 1.77 billion US dollars, ranking first in the market and occupying 24.8% of the overall market share. However, due to the short time of Virtuals Protocol's launch on Solana, the AI Agent market on Solana is still dominated by ai16z, with a market share of nearly 19.2%.

From this point of view, faced with the sharp decline in the popularity of the AI Agent market, Virtuals Protocol still faces considerable challenges in regaining its growth momentum through a multi-chain expansion strategy.

You May Also Like

Best Crypto to Buy as Saylor & Crypto Execs Meet in US Treasury Council

BlackRock boosts AI and US equity exposure in $185 billion models