NFTs are booming—just without the crowd

NFTs, or non-fungible tokens, notched another strong week with a 20.67% rise in sales to $122.6 million, even as buyer and seller participation collapsed by over 80%.

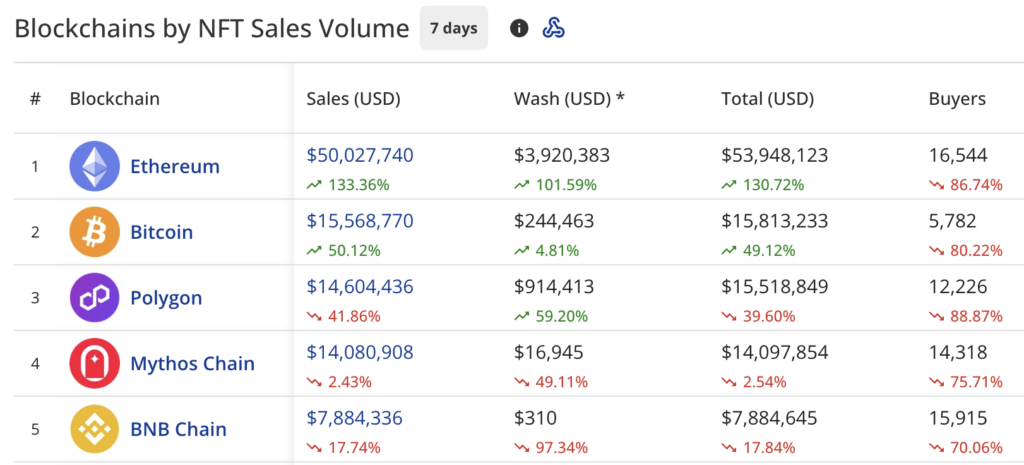

Ethereum reclaimed the top blockchain spot with $50 million in sales, while Bitcoin jumped from sixth to second place amid broader crypto market highs: BTC hit a new all-time high of $117,000 and ETH surged 17% in the last seven days.

Despite the shrinking user base, top collections like f(x) wstETH and Pudgy Penguins saw explosive gains, driven by institutional activity and high-value trades, including multiple six-figure Autoglyph sales. The market’s paradox: soaring valuations, fewer hands.

Ethereum NFTs reclaim dominance

According to data from CryptoSlam, market participation has contracted substantially with NFT buyers plummeting by 89.08% to 88,157, and NFT sellers falling by 82.62% to 56,817.

NFT transactions have remained relatively stable, increasing by 1.63% to 1,357,999.

Ethereum has reclaimed its dominant position with $50 million in sales — a 133.36% spike from the previous week. Ethereum’s wash trading has doubled, rising 101.59% to $3.9 million.

Bitcoin is now in second place with $15.5 million, a 50.12% increase. This represents a significant improvement from its previous sixth-place position.

Polygon (POL) has fallen to third place, with $14.6 million, a decline of 41.86%. The blockchain’s wash trading has increased by 59.20% to $914,413.

Mythos Chain holds the fourth position with $14 million, down 2.43%. BNB Chain (BNB) ranks fifth with $7.8 million, representing a 17.74% decline. Immutable (IMX) has dropped dramatically to sixth place, with $6.3 million, a 28.74% decline.

The buyer count has declined across all blockchains, with Ethereum leading the drop at 86.74%, followed by Polygon at 88.87% and Bitcoin at 80.22%.

f(x) wstETH position has taken the top spot in collection rankings with $15.8 million in sales, with a 2,056.28% surge. This collection is dominated by institutional activity with only 26 buyers and 1 seller.

The Courtyard on Polygon has fallen to second place with $12.3 million, a decline of 35.06%. The collection has seen substantial decreases in buyers (32.75%) and sellers (14.59%).

DMarket holds third place with $8.9 million, a 3% decrease. Bitcoin’s BRC-20 NFTs have climbed to fourth with $4.3 million, representing a 74.64% increase.

Pudgy Penguins has entered the top five with $3.2 million, surging 130.49%. The collection has doubled its transactions (100%), seen growth in buyers (146.43%), and sellers (107.89%).

Guild of Guardians Heroes, which dominated previous weeks, has disappeared from the top collections entirely.

Notable high-value sales from this week include:

- Autoglyphs #195 sold for 95 ETH ($283,623)

- Otherdeed Expanded #7 sold for 100 WETH ($278,128)

- Autoglyphs #194 sold for 215,000 USDC ($215,000)

- Autoglyphs #139 sold for 75 WETH ($189,994)

- BOOGLE sold for 1,150.02 SOL ($174,304)

You May Also Like

Recovery extends to $88.20, momentum improves

Fed Decides On Interest Rates Today—Here’s What To Watch For

U.S. regulator declares do-over on prediction markets, throwing out Biden era 'frolic'

Copy linkX (Twitter)LinkedInFacebookEmail