Dow Jones drops 300 points on CPI data, NVIDIA stock lifts Nasdaq on China news

Major U.S. stock indices were mixed despite Trump’s latest tariff push, but traders continue to focus on China.

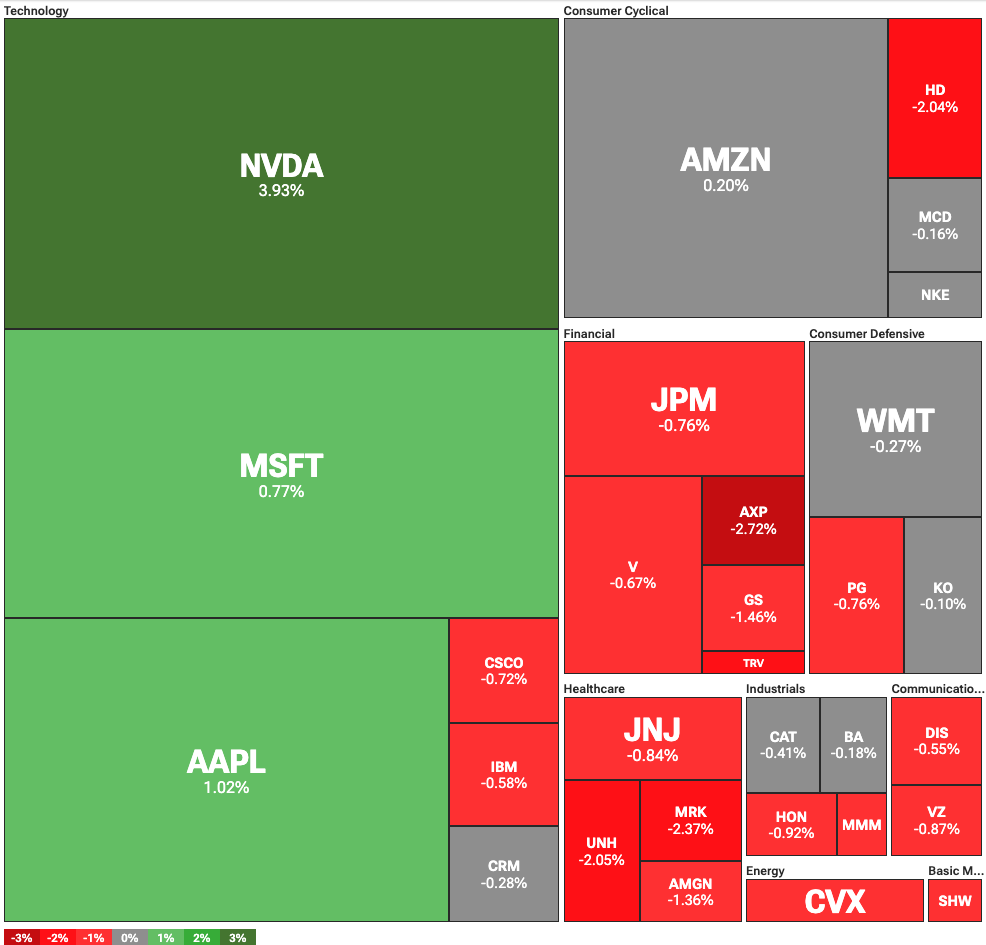

Stocks were mixed as trade news coincided with a rise in a key inflation metric. On Tuesday, July 15, the Dow Jones fell 320 points, or 0.72%, while the S&P 500 declined 0.13%. At the same time, the tech-heavy NASDAQ Composite rose 100 points, or 0.53%, as Nvidia’s strong performance boosted tech stocks.

Traders focused on the latest escalation of U.S. tariffs, while the June consumer inflation report showed the first signs of tariff-driven inflation. The Consumer Price Index rose rose 2.7% on an annual basis and 0.3% month over month. Both figures reflected accelerated inflation, likely driven by U.S. tariffs on major trading partners.

Still, the latest round of tariff increases did not trigger the same negative market reactions seen in April. One reason may be skepticism that Trump will follow through with his punitive measures. However, a significant factor in this market reaction may be related to China.

China absent from Trump’s tariff threats, Nvidia surges

China is the U.S.’s largest trading partner, a key supplier of inputs to high-value U.S. industries, and a major market for their products. This is especially true for the U.S. tech sector, particularly Nvidia.

Positive trade developments boosted Nvidia, with its stock rising 4% and once again approaching record levels. The price increase came after the chipmaker announced it would be free to sell its H20 GPUs to China. These advanced AI chips were previously subject to a U.S. ban that had cost the company billions.

If the U.S. de-escalates its trade war with China, markets may be able to shrug off the effects of tariffs on smaller trading partners. Still, the impact on inflation and growth could remain significant.

You May Also Like

SHIB Price Prediction: Mixed Signals Point to $0.0000085 Target by February End

SUI Price Prediction: Oversold Conditions Target $1.50-$1.85 Recovery by March 2026