Pump.fun price charts a bearish wedge pattern as whales exit, will it crash?

Pump.fun has recently announced a fund designed to finance early-stage projects built openly on its platform. Despite the ecosystem-focused initiative, whale dumping, along with a bearish pattern developing on the daily chart, hints that the token may be looking at more downside in the upcoming sessions.

According to data from crypto.news, Pump.fun (PUMP) rose 12.5% to an intraday high of $0.0027 on Thursday, Jan. 22, before stabilizing at around $0.0026.

PUMP’s rally followed after the Pump.fun team unveiled Pump Fund, a new investment arm that will finance early-stage projects built openly on its platform. Under the program, 12 selected teams will each receive $250,000 in funding at a fixed $10 million valuation.

This initiative officially kicked off on Monday, Jan. 19, with a 30-day “Build in Public” hackathon designed to move the ecosystem beyond its reputation as a mere factory for viral memecoins.

Such ecosystem-oriented developments often stir renewed interest among developers and retail investors by providing actual utility and mentorship, and hence help support prices at least in the long run.

Pump.fun price at risk

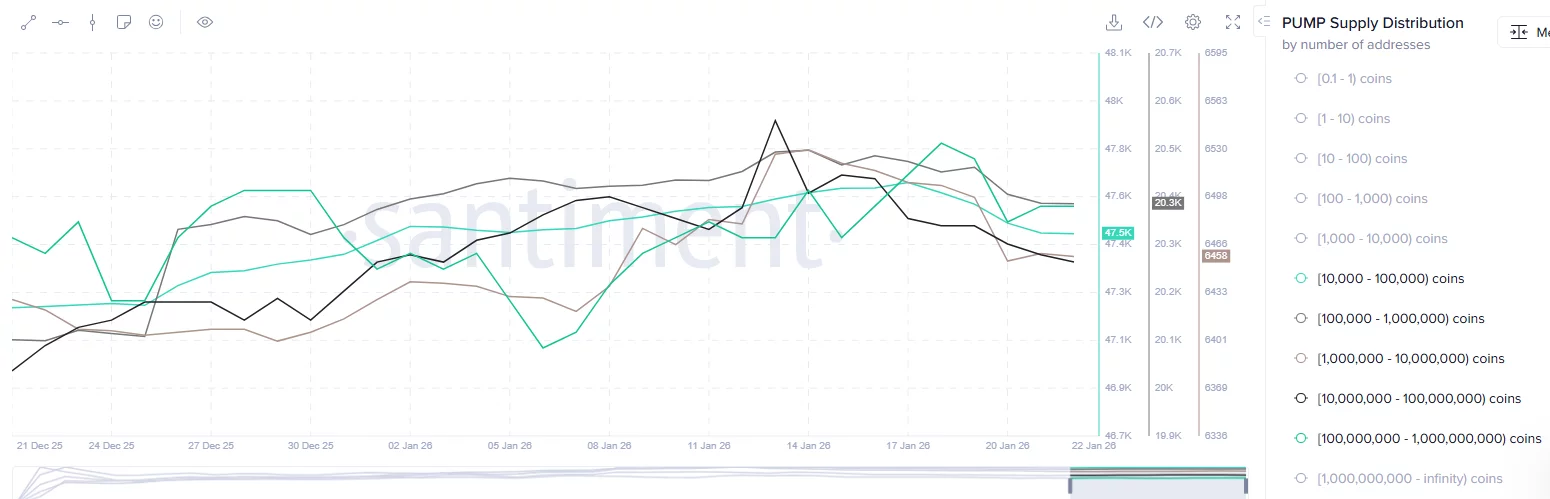

However, despite the positive news, recent whale activity suggests a different scenario could be at play. Data from Santiment indicates that the number of whales holding between 10,000 and 1 billion PUMP tokens has dropped this week.

Typically, when whales start to lose interest in a token, it often leads to a significant erosion of buying pressure, which leaves the price vulnerable to retail-driven volatility and downside momentum.

At the same time, PUMP price action is close to confirming a rising broadening wedge pattern that has been taking shape since late December last year.

Such a pattern is formed when an asset’s price makes higher highs and higher lows within two ascending diverging trendlines, signalling increasing volatility and a potential bearish reversal upon a breakdown below the lower support line.

Technical indicators such as the MACD and Chaikin Money Flow index showed signs that bears were starting to gain footing in the market. Notably, the MACD line was approaching a bearish crossover with the signal line, and the CMF is close to falling below the zero line, which indicates that capital is beginning to flow out of the asset.

Based on the bearish pattern and the technical signals, a sustained drop below the 50-day SMA support level at approximately $0.0024 could position the token for more decline.

A decisive break beneath this level could help bears target the Dec. 24 low of $0.0016, which stands approximately 38% lower than the current price.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

You May Also Like

China Blocks Nvidia’s RTX Pro 6000D as Local Chips Rise

Market Records Largest Long-Term Bitcoin Supply Release In History, Here’s What It Means For BTC