RIVER Climbs 156% to ATH as Justin Sun Invests $8M Amid Market Warnings

RIVER posted a 156% gain over seven days. The token climbed from $17.52 to an intraday high of $54.12, surpassing its previous recorded all-time high of $53.10, after TRON founder Justin Sun announced an $8 million strategic investment. The rally pushed the token’s market capitalization above $1 billion.

RIVER/USDT Perpetual Contract (1H) | Source: TradingView

The token’s 24-hour trading volume reached $38.4 million, down 46% from the previous day, according to CoinGecko data. RIVER now ranks 96th among all cryptocurrencies. Only 19.6 million tokens are currently available for trading out of 100 million total supply.

River announced on Jan. 21 that the investment will support integration of its satUSD stablecoin, a dollar-pegged digital currency, into the TRON ecosystem, according to the project’s statement. Users can exchange existing stablecoins like USDT for satUSD at equal value. TRON’s official Chinese account confirmed the deal.

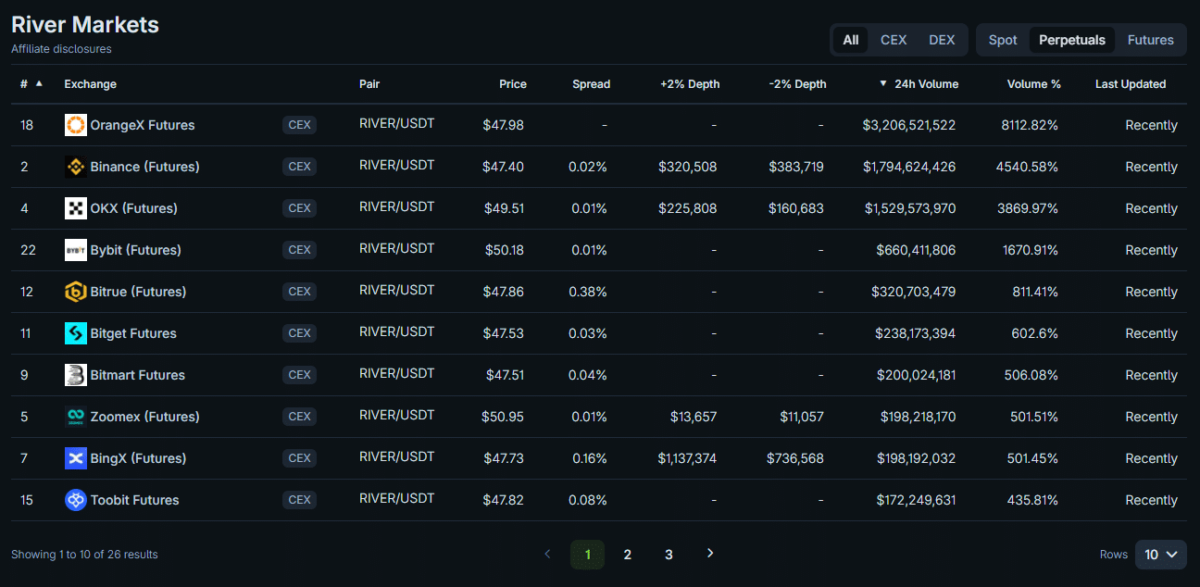

Derivatives Data Shows Heavy Short Positioning

Traders betting against RIVER faced steep costs to maintain their positions across major exchanges. Bybit and Gate showed funding rates of -16%, while Binance recorded -9.8% and OKX showed -12%, according to Coinglass data. These rates are among the most extreme in the market.

RIVER Perpetuals Markets Across Exchanges | Source: CoinGecko

Coinglass noted that trading in derivatives contracts exceeded actual token purchases by more than 80 times. The data provider characterized the price movement as driven by borrowed money rather than genuine buying interest, adding that such conditions can lead to sudden price reversals.

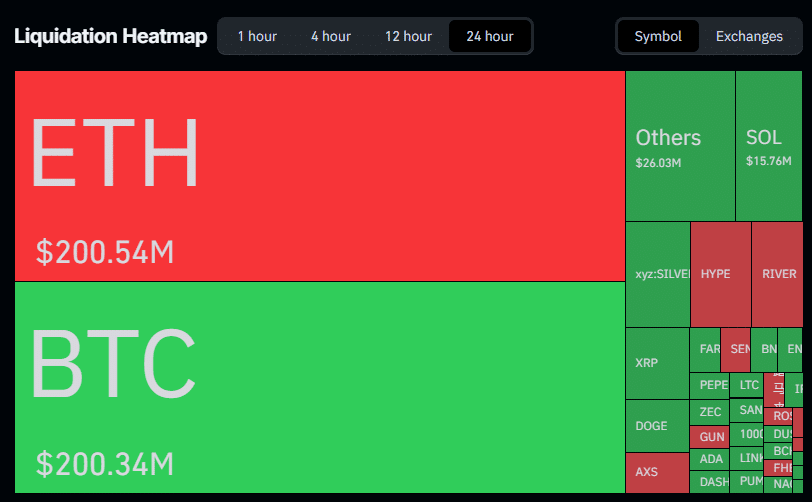

Liquidation Heatmap (24H) | Source: Coinglass

Ethereum ETH $2 955 24h volatility: 1.6% Market cap: $357.01 B Vol. 24h: $28.13 B and Bitcoin BTC $89 634 24h volatility: 1.8% Market cap: $1.79 T Vol. 24h: $46.82 B led 24-hour liquidations at $200.54 million and $200.34 million respectively, with leveraged positions forcibly closed when traders could not cover their margin requirements. RIVER appeared among the actively liquidated tokens during this period.

Wide Price Spreads Across Exchanges

RIVER traded at different prices across exchanges. Kraken listed RIVER at $54.37 while Toobit showed $52.88, a gap of nearly 3% between venues.

RIVER Spot Markets Across Exchanges | Source: CoinGecko

Buy and sell orders remained thin across most venues. Bitget, the largest market by volume at $10.5 million, showed limited pending orders near the current price. Large trades could significantly move the price under these conditions.

The broader cryptocurrency market declined 1.82% during the same period, with total market capitalization at $3.08 trillion. The Fear & Greed Index registered 24, indicating extreme fear among investors. Bitcoin dominance stood at 57.5% with BTC trading near $88,500.

nextThe post RIVER Climbs 156% to ATH as Justin Sun Invests $8M Amid Market Warnings appeared first on Coinspeaker.

You May Also Like

Franklin Templeton CEO Dismisses 50bps Rate Cut Ahead FOMC

FullProgramlarIndir.app | Download Free Full Programs (2026)