A Panoramic Review of Crypto Venture Capital in 2024: Infrastructure Project Financing is Active, Fund Raising is Weak

Author: insights4.vc

Compiled by: Felix, PANews

Crypto markets experienced significant growth in 2024, driven by key milestones such as the launch of a spot Bitcoin ETF in January 2024 and the election of a pro-crypto U.S. President and Congress in November. The market capitalization of liquid cryptocurrencies surged by $1.6 trillion (up 88% year-over-year) to $3.4 trillion by the end of the year, with Bitcoin's market value increasing by nearly $1 trillion to nearly $2 trillion by the end of the year. Bitcoin's gains accounted for 62% of the total market gains, and the boom in memecoins and AI tokens also contributed to Bitcoin's gains, which dominated on-chain activity, especially Solana.

Despite the market recovery, the crypto venture capital landscape remains challenging. Major trends such as Bitcoin, memecoins, and AI agent tokens offer limited venture opportunities as they primarily leverage existing on-chain infrastructure. Once-hot sectors such as DeFi, gaming, the metaverse, and NFTs have failed to attract significant new attention or capital. In anticipation of regulatory changes from the new U.S. administration, currently largely mature infrastructure businesses face increasing competition from traditional financial services intermediaries.

Emerging trends such as stablecoins, tokenization, DeFi-TradFi integration, and the intersection of crypto and AI show promise but are still in their infancy. Meanwhile, macroeconomic pressures, including high interest rates, have discouraged high-risk allocations, disproportionately affecting the crypto venture capital industry. After the high-profile crypto market crash in 2022, comprehensive VC firms have mostly remained cautious and stayed away from the crypto market.

According to Galaxy Research, venture investors invested $3.5 billion in cryptocurrency and blockchain-focused startups in the fourth quarter of 2024, up 46% from the previous quarter. However, the number of deals fell 13% from the previous quarter to 416.

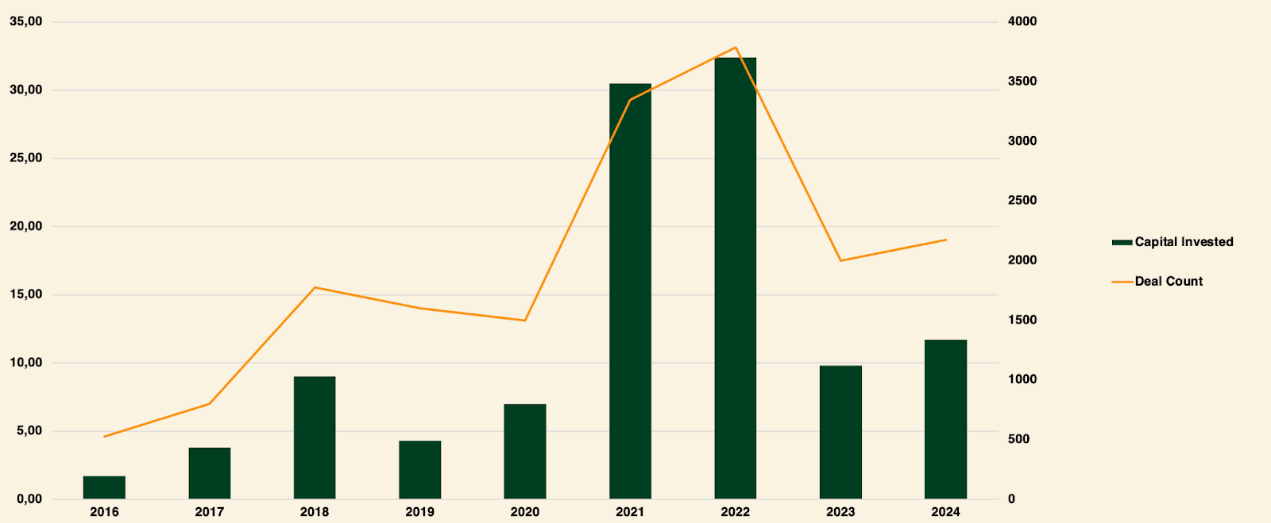

Crypto Venture Capital by Year (2016-2024)

Throughout 2024, venture capital investments in cryptocurrency and blockchain startups totaled $11.5 billion across 2,153 deals.

According to PitchBook's 2025 Enterprise Technology Outlook, senior analyst Robert Le predicts that by 2025, annual investment in the crypto market will exceed $18 billion, with multiple quarters exceeding $5 billion. This is a significant increase compared to 2024, but still significantly lower than the levels in 2021 and 2022.

The increasing institutionalization of Bitcoin, the rise of stablecoins, and potential regulatory progress on DeFi-TradFi integration are all key areas of innovation going forward. These factors combined with emerging trends could foster a resurgence in venture capital activity.

Capital Investment and Bitcoin Price

Historically, there has been a strong correlation between the price of Bitcoin and the amount of capital invested in crypto startups. However, this correlation has weakened significantly since January 2023. Bitcoin has hit new all-time highs, while venture capital activity has struggled to keep up with Bitcoin.

Possible explanations:

- Weaker allocation interest: Institutional investors may be hesitant due to regulatory uncertainty and market volatility

- Market Narrative Shift: The current market narrative favors Bitcoin and may overshadow other crypto investment opportunities

- Venture Capital Outlook: The broader venture capital market is experiencing a downturn, impacting crypto investing.

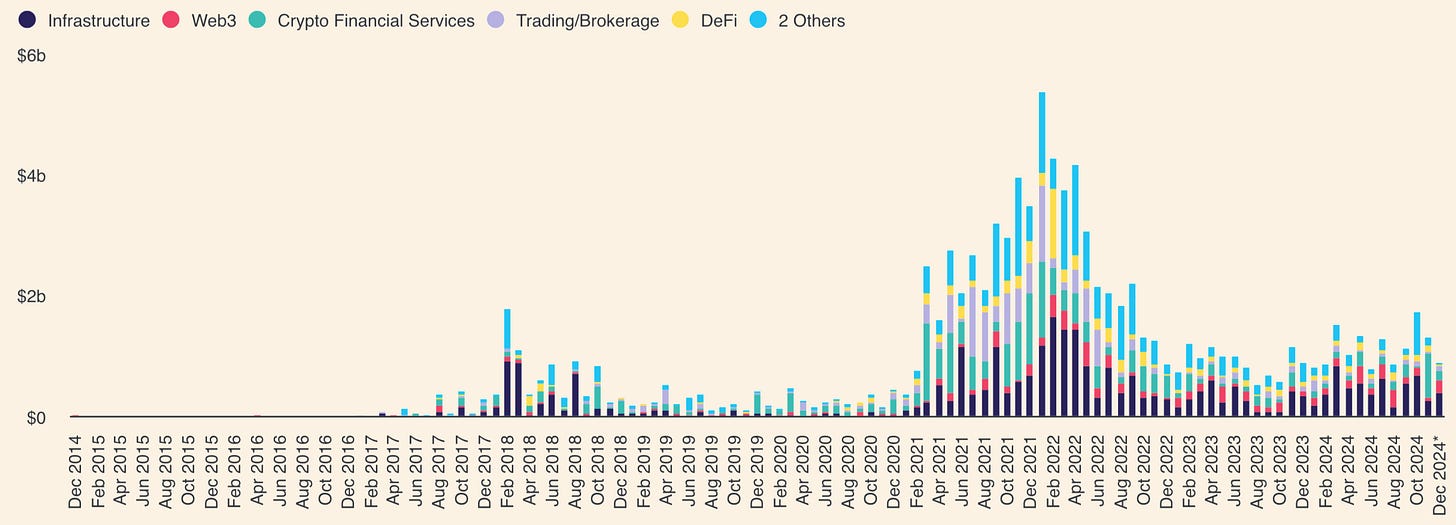

Infrastructure Track Dominates Crypto Venture Capital

Total financing amount of each track in 2024 (US dollars)

According to The Block, in 2024, infrastructure dominated crypto venture capital, attracting more than 610 deals and reaching $5.5 billion, a year-on-year increase of 57%. The investment focus is to expand the blockchain network through L2 solutions, increase speed, reduce costs and scalability. Modular technologies including data availability and shared sorters have received a lot of funding, while liquidity pledge protocols and developer tools remain key priorities.

NFT and gaming startups raised $2.5 billion, up slightly from $2.2 billion in 2023. Despite steady funding, NFT market activity declined as memecoin gained traction. While deal activity has matured since its peak of 936 deals in 2022, NFTs and gaming remained a focus with over 610 deals. Enterprise blockchain funding fell sharply, down 69% year-over-year from $536 million to $164 million in 2023.

Web3 funding has shown some resilience, raising $3.3 billion in the last two years, close to the $3.4 billion raised in 2021-2022. Growth is driven by emerging trends such as SocialFi, Crypto AI, and DePIN. DePIN has become a fast-growing vertical, attracting more than 260 deals and nearly $1 billion in funding.

DeFi experienced a strong recovery in 2024, reaching more than 530 funding rounds compared to 287 funding rounds in 2023 (up 85% year-over-year). Bitcoin-based DeFi use cases, including stablecoins, lending protocols, and perpetual swaps, were a key driver of this growth.

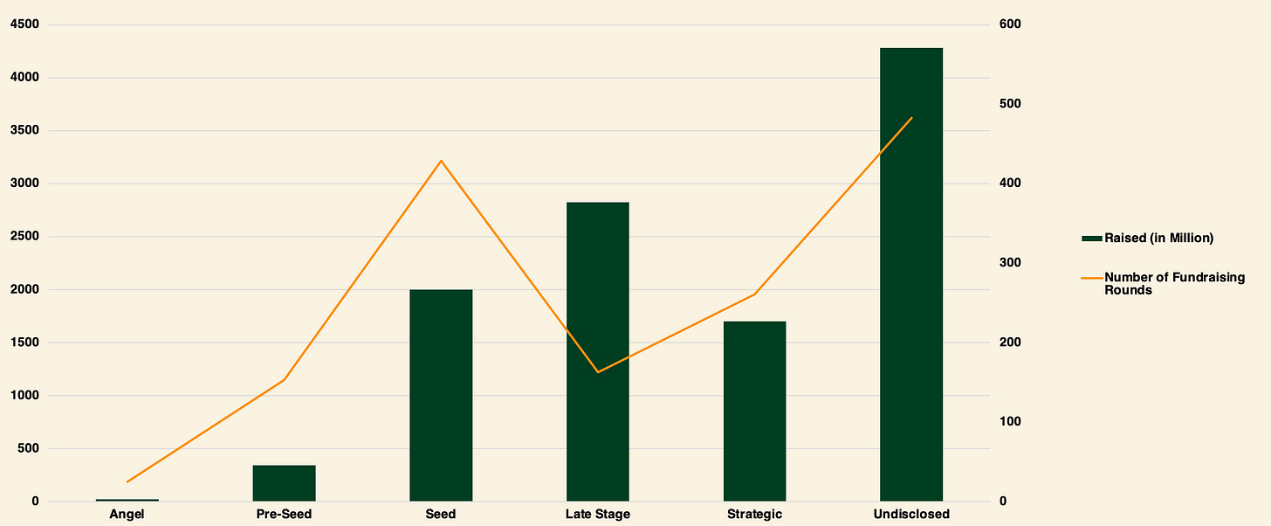

Crypto Venture Capital Investments by Type

The above chart shows that, excluding undisclosed rounds, the crypto industry is still highly concentrated in the early stages of financing. Early-stage deals attracted the majority of capital investment, accounting for 60%, while late-stage financing accounted for 40% of total capital, a significant increase from 15% in the third quarter.

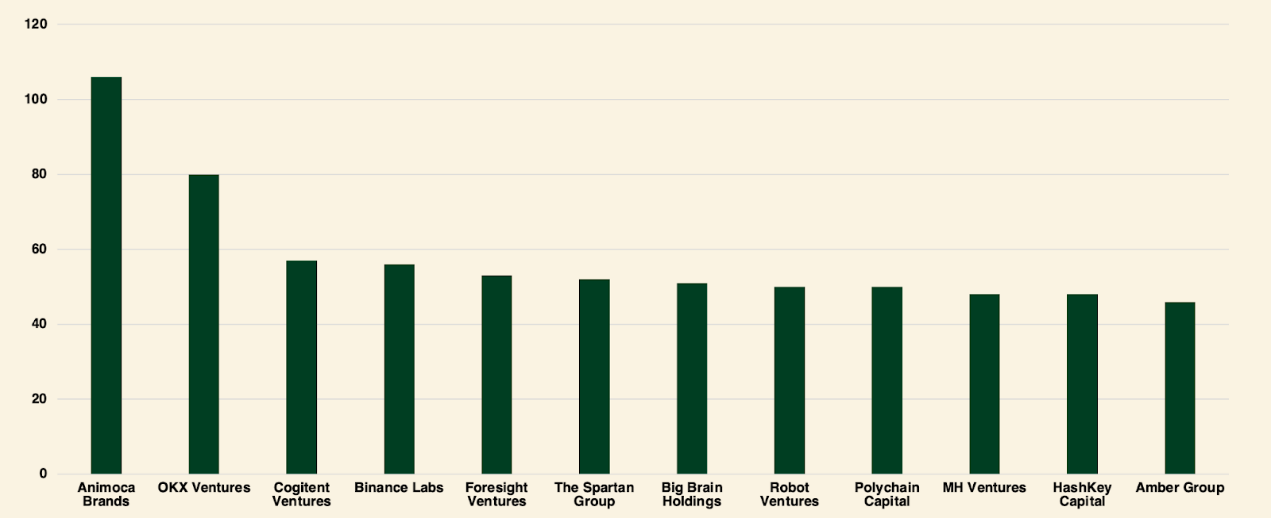

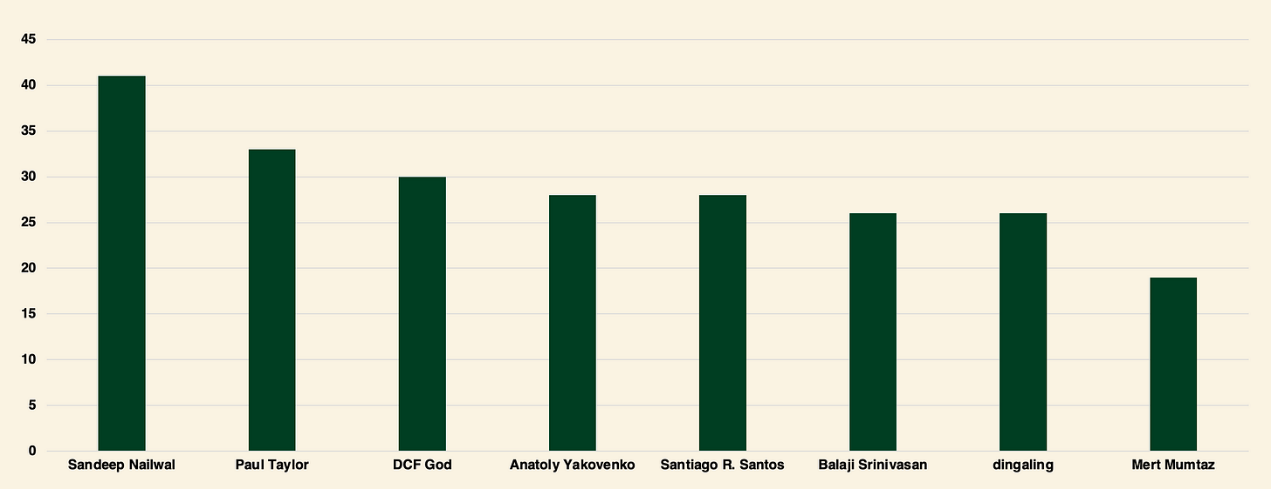

Most active investors

In 2024, Animoca Brands led venture capital activity with over 100 investments; followed by OKX Ventures with over 80 investments; Cogigent Ventures, Binance Labs, and Foresight Ventures completed approximately 60 investments each; while The Spartan Group, Big Brain Holdings, and Robot Ventures completed over 50 investments; major players such as Polychain Capital and Amber Group maintained over 40 investment activities.

Venture Capital Funds

Among angel investors, the most active is Sandeep Nailwal (founder of Polygon), who has participated in more than 40 investments; followed by Paul Taylor and DCF God, who have participated in more than 30 investments each; Anatoly Yakovenko (founder of Solana); Santiago R. Santos and Balaji Srinivasan are also important participants, having completed more than 25 investments; Mert Mumtaz lags slightly behind, but is still very active.

Angel Investors

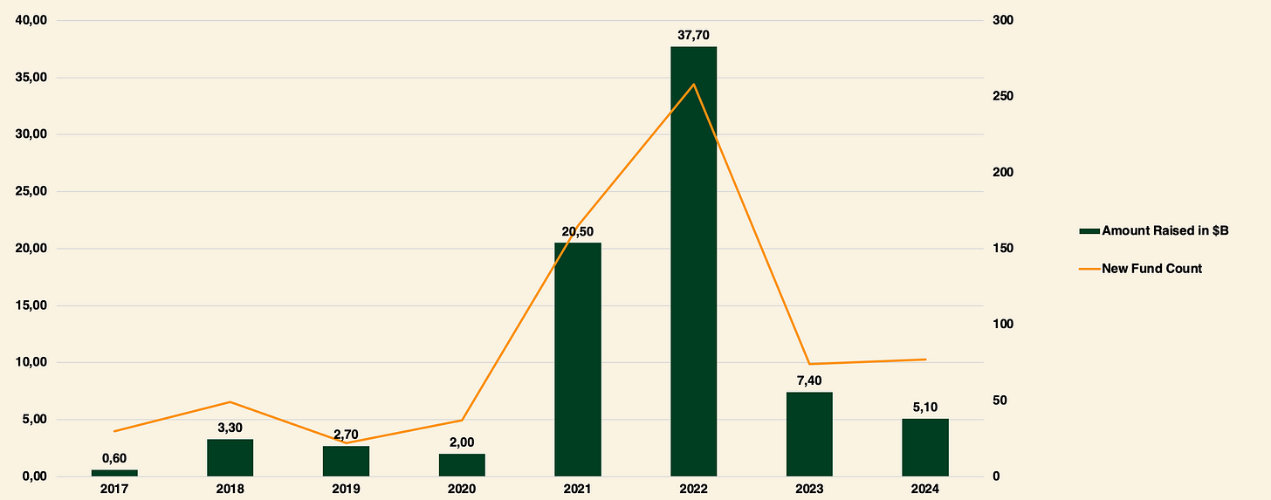

Crypto Venture Financing

Data from the Venture Capital Journal shows that venture capital fund fundraising in 2024 fell to a six-year low, with 865 funds raising a total of US$104.7 billion, a sharp drop of 18% from 1,029 funds raising US$128 billion in 2023.

Crypto venture financings remain under pressure due to macroeconomic and ongoing market volatility in 2022-2023. Allocators reduced their commitments to crypto venture funds, reflecting a shift from the bullish sentiment in 2021 and early 2022. Despite expectations of rate cuts in 2024, meaningful rate cuts did not occur until the second half of the year, and venture fund capital allocations have continued to decline quarter-over-quarter since Q3 2023.

Crypto Venture Financing 2017-2024

Fundraising for crypto venture capital funds was noticeably weak in 2024, with 79 new funds raising $5.1 billion, the lowest annual total since 2020. Although the number of new funds increased slightly year-on-year, the decline in allocator interest led to a significant reduction in fund size. Both the median and average fund sizes in 2024 fell to their lowest levels since 2017, highlighting the increasingly severe fundraising environment.

Turning to mid-cap funds

Historically, small funds (less than $100 million) have dominated crypto venture capital financing, reflecting the early stages of the crypto industry. However, since 2018, there has been a clear shift in the trend toward mid-sized funds (between $100 million and $500 million).

While large funds ($1 billion or more) experienced rapid growth between 2019 and 2022, they did not emerge in 2023 and 2024 due to the following challenges:

- Difficult deployment: Limited number of startups require large amounts of capital

- Valuation risk: Large investments push up valuations, increasing risks

Despite this, well-known funds such as Pantera Capital and Standard Crypto ($500 million) have remained active, expanding their scope to include areas beyond cryptocurrencies, such as AI. Notably, Pantera Fund V, the successor to Pantera Blockchain Fund IV, will raise its first fund on July 1, 2025, with a target of $1 billion.

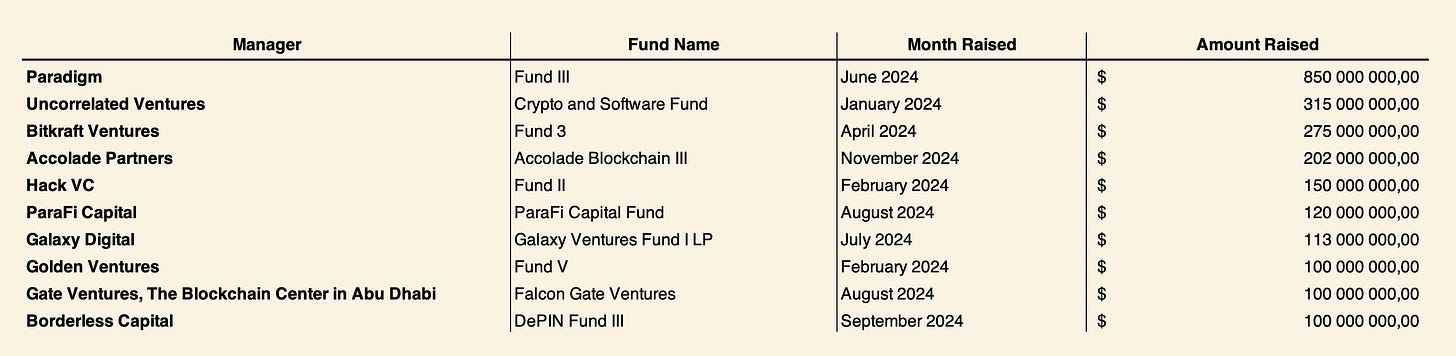

The table below summarizes the 10 funds that raised more than $100 million in 2024. The largest closed-end fund in 2024 was Fund III managed by Paradigm.

Crypto VC Funds Raising More Than $100 Million by 2024

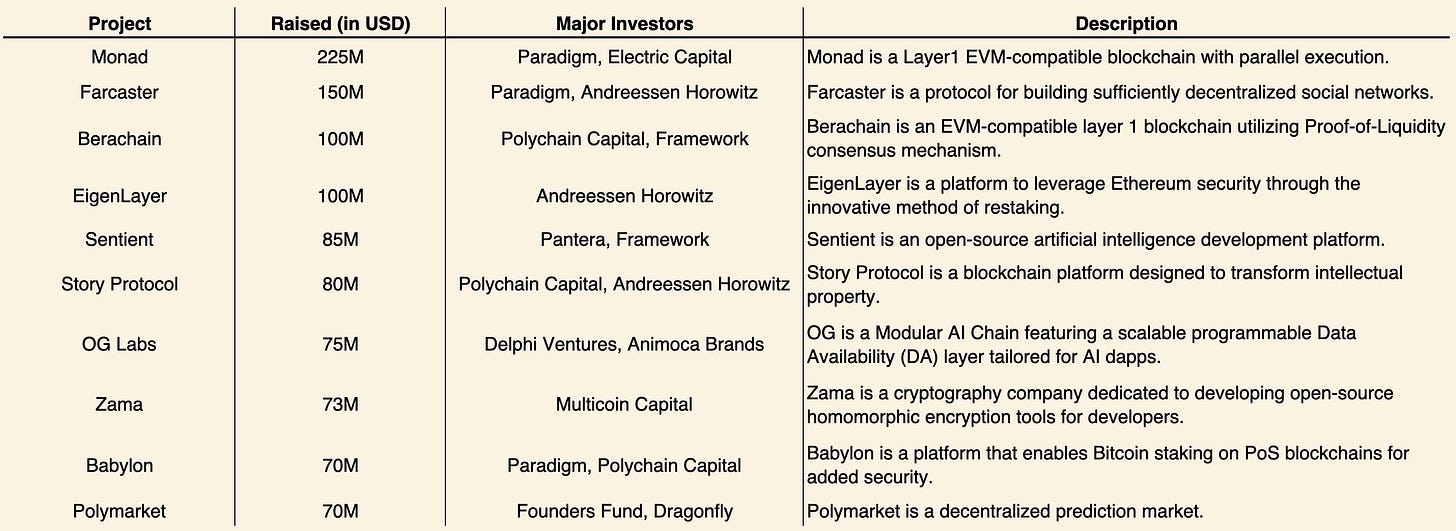

Investments to watch in 2024

Top 10 venture capital projects in 2024

- Monad: An EVM-compatible L1 blockchain that achieves a throughput of 10,000 transactions per second, with 1-second block times and single-slot finality. Its parallel transaction execution architecture ensures efficiency, making it a top choice for developers seeking speed and scalability.

- Farcaster: A social network that enables users to control their data. Its "fully decentralized" design allows interactions without network-wide approval, using a non-custodial social graph secured by Ethereum. Its flagship app, Warpcast, highlights its potential to redefine social media.

- Berachain’s Proof of Liquidity (PoL) consensus links network security with liquidity provision, allowing validators to stake liquid assets to enhance security while earning rewards. EVM compatibility simplifies the deployment of DeFi applications and consolidates Berachain’s role in the DeFi ecosystem.

- Story Protocol: Transforms intellectual property management through on-chain registration, automated licensing, and monetization through token-bound accounts that support ERC-6551. Leverages the Ethereum Virtual Machine and Cosmos SDK to give creators control and promote innovation.

- 0G Labs: Combining blockchain scalability with AI-driven processes, with a strong data availability layer and decentralized AI operating system (dAIOS). It leads the 2024 project financing record with $250 million in financing, surpassing Monad and consolidating its dominance in the AI-blockchain field.

- Polymarket: A decentralized prediction market that gained a lot of attention during the 2024 US presidential election, showcasing the potential for rapid Web3 adoption despite declining post-event metrics.

Blockchain infrastructure

- EigenLayer: Introducing a re-staking market to maximize the utilization of Ethereum’s staked assets, improving security and validator income.

- Babylon: Combines Bitcoin’s proof-of-work with a proof-of-stake blockchain, providing tamper-proof security and cross-chain interoperability.

Blockchain Services

- Sentient: Decentralizes AI applications by leveraging blockchain’s distributed network for scalable and private AI computation.

- Zama: Implementing homomorphic encryption for secure data processing on blockchains, ensuring privacy without sacrificing functionality.

Key trends for 2024 and beyond

AI integration, DeFi on Bitcoin, and specialized blockchains dominate the blockchain space. Projects such as 0G Labs and Sentient are leading the way in AI, while Babylon is strengthening Bitcoin’s role in DeFi. In the near future, Monad, Berachain, and Story Protocol are expected to launch their mainnets.

in conclusion

The 2024 crypto venture landscape shows cautious optimism, marked by a rebound in funding activity and growing institutional interest. The shift toward mid-sized funds and the continued dominance of emerging funds suggest that the industry is maturing and adapting to changing market dynamics. Despite a short-term decline in venture funding and longer fundraising cycles, the continued focus on early-stage ventures and emerging trends such as AI integration highlight a resilient ecosystem that is poised for future growth. Overall, the crypto industry shows underlying strength, suggesting that new momentum may be on the horizon.

Related reading: 2024 Financing Report: 1,259 financings, $9.615 billion, the overall market trend is similar to last year

You May Also Like

Best Crypto to Buy as Saylor & Crypto Execs Meet in US Treasury Council

BlackRock boosts AI and US equity exposure in $185 billion models