Penguin Memecoin Surges Over $136M Market Cap After White House Post

The Nietzschean Penguin (PENGUIN) token, a memecoin launched on the Solana (CRYPTO: SOL) blockchain, surged by roughly 564% after a White House post on X featuring an image of the president and a penguin walking through the snow went viral. The move occurred despite a broader downturn in the memecoin sector, underscoring how social media moments can still move tiny cap assets on efficient, on-chain ecosystems. Before the post, PENGUIN carried a market capitalization of about $387,000; in the 24 hours that followed, trading volume surged to roughly $244 million, according to SolanaFloor. By the time this article was prepared, the token’s market cap was reported around $136 million, with a price near $0.13 per DexScreener data. The event drew comment from industry observers who say the episode signals renewed appetite for on-chain trading activity in niche crypto segments.

Disclosure: The information below is based on a press release or promotional material. Readers should verify key claims independently.

Key Takeaways

- PENGUIN’s price jumped about 564% following a viral White House post on X featuring a penguin image, illustrating how political imagery can impact meme assets.

- 24-hour trading volume spiked to roughly $244 million on SolanaFloor, highlighting a sudden influx of liquidity into a micro-cap token on the Solana network.

- Market capitalization rose from a sub-million figure to about $136 million at the time of reporting, while the price hovered near $0.13.

- The rally occurred amid a broader memecoin market downturn earlier in the year, contrasting with periods when meme tokens briefly outperformed traditional crypto sectors.

- Industry voices cautioned that on-chain activity and social-media buzz can drive outsized moves in low-cap tokens, even as the broader market remains range-bound.

- Analysts pointed to a continued interest in on-chain trading as a counterpoint to centralized hype, with Pump.fun’s platform involvement noted by investors and developers alike.

Tickers mentioned: $SOL

Sentiment: Neutral

Price impact: Positive. The rapid rally followed a viral social-media trigger, signaling a renewed appetite for active trading in niche memecoins.

Trading idea (Not Financial Advice): Hold. The move demonstrates volatility and speculative interest, requiring risk-aware positioning.

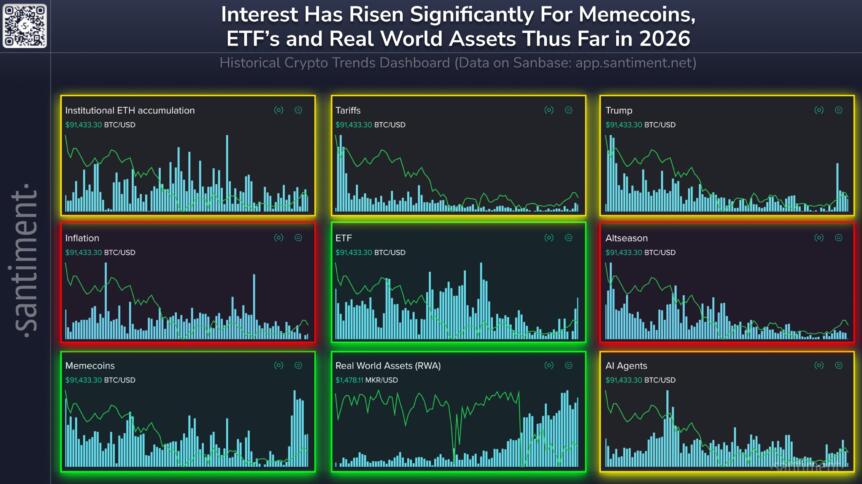

Market context: The episode sits within a wider pattern of memecoin volatility, where social momentum and on-chain liquidity can drive bursts of activity even as trend-following conditions remain mixed. In January 2026, memecoin total market capitalization rebounded by about 23% to top $47 billion, according to CoinMarketCap, after dipping in the preceding months, while social-media mentions intensified, as tracked by Santiment.

Why it matters

The episode matters because it illustrates the ongoing influence of social content on on-chain markets, even in highly niche segments of the crypto space. The PENGUIN rally shows that official or semi-official moments—like a White House post—can catalyze demand for a meme asset that operates on a layer-1 chain designed to support fast, low-cost transactions. The Solana (CRYPTO: SOL) ecosystem’s capacity to absorb a surge in liquidity for a micro-cap token underscores the network’s liquidity depth relative to its market cap, at least in brief spikes.

From a market structure perspective, the 24-hour trading volume of approximately $244 million is several orders of magnitude larger than the token’s pre-event market cap, highlighting how liquidity can surge in response to a viral cue. This kind of dissonance—tiny capitalization paired with outsized liquidity inflows—can generate rapid price discovery in a narrow window. Investors should note that such episodes often attract day traders and speculative funds that are willing to tolerate sharp pullbacks if the social narrative quiets. The broader memecoin cycle has been characterized by bursts of interest followed by consolidation, with later periods showing a divergence between hype-driven moves and fundamental utility.

The broader context for memecoins remains nuanced. While the sector enjoyed high-profile momentum in 2024, the year also saw a number of tokens retreat dramatically after initial surges. In early 2026, momentum re-emerged on social channels, aided by data firm Santiment’s tracking of social buzz, which can foreshadow shifts in risk appetite. The counterpoint to hype is often liquidity availability across on-chain venues, in which platforms like DexScreener help traders gauge liquidity conditions in near real time. The balanced view is that memecoins can offer rapid upside during favorable sentiment phases, but they also carry outsized downside when activity wanes or when regulatory or macro conditions turn negative.

The PENGUIN memecoin’s price action. Source: DEXScreener“Memecoins typically lead when risk appetite returns. The rebound in the Fear and Greed Index from extreme fear toward neutral reinforces this shift,” said Vincent Liu, chief investment officer at Kronos Research, in remarks compiled by Cointelegraph. The latest move in PENGUIN, then, can be read as a microcosm of how social signals and on-chain liquidity interact during bursts of speculative interest.

Social media interest in memecoins surged in January 2026. Source: Santiment

Social media interest in memecoins surged in January 2026. Source: Santiment

Memecoins show signs of life in 2026 after a disappointing year. The broader market narrative remains contingent on risk-on or risk-off sentiment, and the ability of social-media momentum to translate into durable demand remains undecided. The near-term trajectory for PENGUIN will hinge on whether liquidity can be sustained beyond the initial hype and whether broader liquidity conditions in the crypto market support continued participation in high-beta memecoin plays.

What to watch next

- Monitor whether the price and on-chain liquidity sustain after the initial spike, with updates from SolanaFloor and DexScreener.

- Watch for additional social-media signals on Santiment to assess whether the hype translates into lasting demand.

- Observe any official statements or developments from Pump.fun or related launchpads that could influence future memecoin launches on Solana.

- Track regulatory or macro shifts that could affect risk appetite in micro-cap memecoins and on-chain markets.

- Keep an eye on subsequent memecoin performance in early 2026 to determine if the January rebound represents a broader trend or a temporary blip.

Sources & verification

- White House post on X referenced in the initial surge narrative.

- SolanaFloor data for PENGUIN’s pre/post-event market activity and 24-hour trading volume.

- DexScreener data for price and market-cap context on the Solana network.

- CoinMarketCap’s January 2026 memecoin market-cap movement and overall memecoin sector context.

- Santiment’s tracking of social-media buzz around memecoins in January 2026.

What the story shows about the market

The PENGUIN episode illustrates how a mass-audience moment can inject liquidity into a micro-cap token on a fast, on-chain network. It also highlights the fragility of price discovery in memecoins, where a spike in social media attention can outpace fundamentals and trigger a rapid reallocation of capital. For traders and builders, the episode underscores both the potential for sudden upside and the risk of sharp reversals in highly speculative corners of the crypto market.

This article was originally published as Penguin Memecoin Surges Over $136M Market Cap After White House Post on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

Three dormant wallets, suspected to belong to the same entity, purchased 5,970 ETH eight hours ago.

NVIDIA Stock Price Analysis as OpenAI Issues Concerns About its Chips