How Polymarket Simplifies Bitcoin and Ethereum Volatility Trading

This article was first published on The Bit Journal.

Bitcoin volatility once again captures the spotlight as Polymarket introduces a new way for traders to measure turbulence in 2026. The platform has launched contracts tied to volatility indexes, giving users a cleaner view of how intense market swings may become in the months ahead. This shift reflects a market searching for simpler, clearer ways to understand uncertainty.

According to the source, the two new contracts, titled “What will the Bitcoin Volatility Index hit in 2026?” and “What will the Ethereum Volatility Index hit in 2026?” went live at 4:13 PM ET. They use 30-day implied volatility indexes that track how sharply Bitcoin and Ethereum may move.

Volatility Signals Beneath Strong Price Levels

At launch, Bitcoin traded at $88,255.04 and Ethereum at $2,924.97, reflecting strong market interest. Even so, the volatility indexes show a more cautious tone.

Early trading on Polymarket prices a 35 percent chance that Bitcoin’s volatility index will double from 40 percent to 80 percent this year. Ethereum shows similar odds, with the index potentially rising from 50% to 90%.

These contracts settle only if a one-minute candle reaches or exceeds the target. A candle shows the open, high, low, and close within sixty seconds. Its body reflects price movement, while its wicks reveal momentary highs or lows. This structure matters because even a brief spike counts toward settlement.

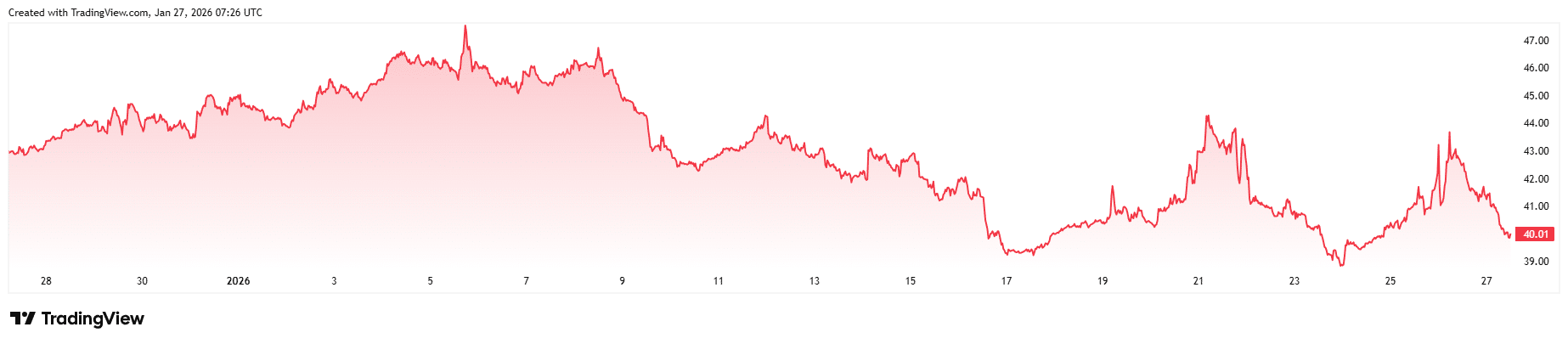

Source: Tradingview

Source: Tradingview

How Polymarket Reduces Complexity

Before these listings, volatility trading was often reserved for large institutions. They used multi-step options strategies and volatility futures to profit from expected turbulence. These tools demand advanced pricing models and large capital buffers.

Polymarket simplifies this world into a single decision. Traders buy “Yes” shares if they expect volatility to rise and “No” shares if they expect stability. This setup opens a space that once felt inaccessible, turning Bitcoin volatility into something anyone can understand. Industry leaders highlighted this shift in an online note shared through an independent research post, describing it as a meaningful step for crypto derivatives education.

A Market Shaped by ETF-Driven Dynamics

One key detail stands out in recent research. Since the launch of the United States spot exchange-traded funds two years ago, the correlation between Bitcoin volatility and its spot price has become negative.

This means that increases in volatility often come with short-term price drops rather than rallies. Analysts believe this pattern will play a larger role in 2026 as market liquidity shifts and traders adjust to faster institutional flows.

This changing relationship gives Bitcoin volatility greater value as a warning signal. It helps readers and analysts understand when sharp reactions may be hiding beneath calm surface prices.

Why These Indexes Matter for Students and Analysts

Prediction markets give users a chance to explore risk without complex tools. Developers argue that this improves DeFi’s educational reach. Financial students use volatility indexes to learn how markets react to stress.

Analysts see them as a cleaner way to measure emotion and uncertainty. Together, these groups treat Bitcoin volatility as more than a number. It becomes a shared language for reading behavior during unsettled periods.

Conclusion

Bitcoin volatility is now a key tool for understanding the emotional core of digital markets. Polymarket gives users a simple, structured way to test expectations and study turbulence.

As volatility becomes easier to follow, traders gain sharper insight into how markets breathe and react. In 2026, learning to read these signals may matter as much as following the price itself.

Glossary of Key Terms

Bitcoin volatility: A measure of how fast Bitcoin’s price rises or falls.

Implied volatility: A forecast of expected swings based on market data.

One-minute candle: A chart showing open, high, low, and close within sixty seconds.

Prediction market: A platform for trading outcomes of future events.

FAQs About Bitcoin Volatility

What affects Bitcoin volatility?

News, liquidity shifts, and active trader behavior drive turbulence.

Why does Polymarket offer volatility markets?

To give users simple access to volatility trading without complex tools.

How do “Yes” and “No” shares work?

“Yes” expects rising volatility, while “No” expects stability.

Do ETFs affect volatility?

Yes, recent studies show a negative link between spot price and volatility.

Sources/References

Coindesk

Volmex

Tradingview

Coinmarketcap

Read More: How Polymarket Simplifies Bitcoin and Ethereum Volatility Trading">How Polymarket Simplifies Bitcoin and Ethereum Volatility Trading

You May Also Like

TROPTIONS Corporation Announces Strategic Partnership with Luxor Holdings to Bridge Real-World…

Wanxiang A123 Unveils World’s First Semi-Solid-State Immersion Energy Storage System, Redefining Safety Standards