The Rise of the Web3 Neobank: A New Narrative for Crypto Payment Cards

Crypto finance is entering a new phase where banking looks nothing like traditional systems. The shift toward a Web3 neobank model is making everyday spending with a crypto payment card as effortless as online banking. These platforms fuse digital assets and fiat into one seamless interface, letting users manage crypto, stablecoins, and fiat side by side. These platforms also enable a global experience where users can have the same banking experience no matter where they are.

Table of Contents

- What Is Web3 Neobanking?

- How Are Web3 Neobanks Different?

- Key Features and Use Cases

- How Crypto Payment Cards Work

- Leading Examples of Web3 Neobanks

- Common Questions About Web3 Neobanks

- Summary

- About OnFinality

What Is Web3 Neobanking?

A neobank is a digital-only bank that operates entirely online without physical branches, offering services through apps and websites. They provide a range of financial services like accounts, loans, and payments, often with a focus on convenience, lower fees, and faster service compared to traditional banks. Web3 neobanks take this further by being crypto native. They often offer non custodial wallets, smooth fiat on ramps and off ramps, and instant spending backed by your on-chain funds.

Users can hold, spend, and earn with crypto inside one app. Many platforms integrate non custodial wallet options or multi sig setups so users keep control of their own keys. Others connect crypto balances directly to debit cards, allowing instant conversion at the point of sale.

The Web3 neobank experience includes:

- Stablecoin deposits

- Crypto and fiat accounts in one place

- Yield earning options

- Crypto payment cards for daily spending

- Wallet integration for on-chain activities

This model blends fintech convenience with Web3 freedom.

How are Web3 Neobanks different?

The demand for a crypto first banking experience is rising fast. There are many factors, some of them being:

- Control over assets: Web3 Neobanks helps users by giving them the options to manage their funds on their own. They can have funds in their own wallets and choose to spend without having restrictions on their account.

- Rise of Stablecoins: Stablecoins like USDC and USDT continue to dominate global crypto settlements and cross border payments. Their increasing adoption enables stablecoin debit cards that let users spend value instantly without bank intermediaries. This is specially beneficial for people present in unstable economies.

- Global Demand for Multi Currency Access: Remote work, cross border freelancing, and global business networks have created demand for multi currency crypto wallets with instant conversion and low fees.

- Ease of Banking: Users get the benefit of DeFi yield accounts integrated directly into their everyday spending enabling them to earn on their deposits. Also, Visa and Mastercard have expanded partnerships with Web3 providers, enabling millions of merchants worldwide to accept payments funded by crypto.

Key Features and Use Cases

Core Features

- Web3 wallet access for full asset control

- Stablecoin debit cards for global spending

- Fiat plus crypto balances in the same dashboard

- Defi yield accounts to earn on idle funds

- Multi currency crypto wallets with instant swaps

- Onchain payments through Visa or Mastercard integrations

- Cross chain transfers across supported networks

Use Cases

- Pay rent or groceries using a crypto payment card

- Earn staking rewards while maintaining liquidity for spending

- Receive payments in stablecoins but spend in local currency

- Borrow against crypto collateral and load spending balance instantly

- Run Web3 businesses with multi user corporate cards

How Crypto Payment Cards Work?

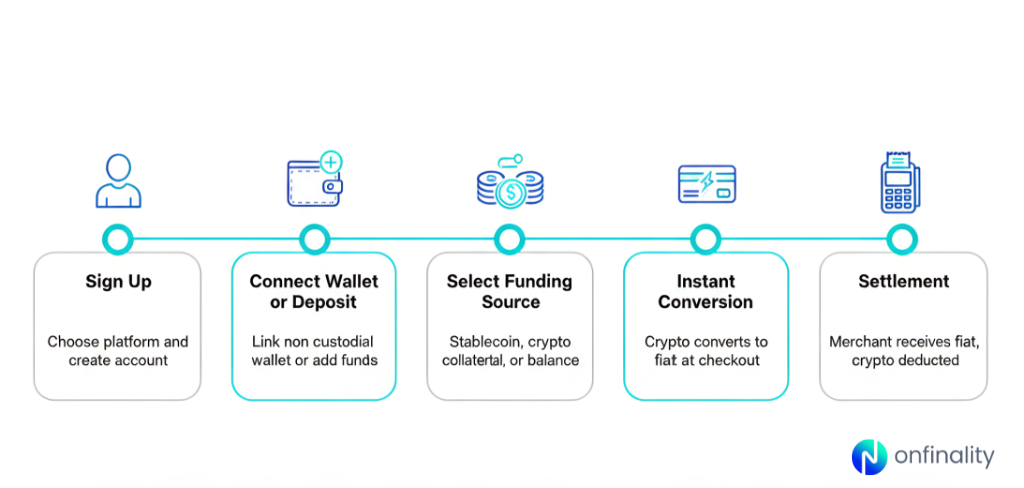

While each platform differs slightly, most Web3 neobanks follow a simple flow:

Step 1: Choose your NeoBank

Choose your banking provider and create and account and do KYC(depends on the platform)

Step 2: Connect Wallet or Deposit Funds

Connect a non custodial wallet or deposit fiat or stablecoins.

Step 3: Select Funding Source

Choose which asset funds the card: stablecoin, crypto collateral, or a pre-loaded balance.

Step 4: Payment Conversion

When users swipe their card, the platform instantly converts on-hain assets into fiat at the point of sale.

Step 5: Settlement and Fees

Merchants receive fiat and users see the crypto equivalent deducted from their wallet or vault.

Optional Features

- Borrowing against crypto without selling (Ether.fi, Moonwell)

- Auto reload from defi vaults

- ATM withdrawals using stablecoins

Leading Examples of Web3 Neobanks

Below is your existing content reorganised and lightly refined.

KAST

KAST offers stablecoin based accounts with virtual and physical cards for instant global spending. Users deposit USDC or other stablecoins and use the card like a normal Visa card. It also provides multi chain wallets and decentralized ID login.

Ether.fi

Ether.fi has expanded from Ethereum staking to a full DeFi neobank with a Visa card funded by crypto collateral. Users keep their ETH staked while spending in fiat.

Revolut

Revolut has evolved from a fintech neobank into a crypto friendly super app. Users can buy, sell, or hold over 130 assets and spend them instantly via debit card.

Crypto.com

Crypto.com provides debit cards with up to 5 percent cashback for users who stake CRO tokens. It supports 19 cryptocurrencies and over 20 fiat currencies for spending.

CypherHQ

Cypher is a non custodial wallet plus debit card that supports 500 plus tokens across 18 blockchains. Users remain in full control of funds while spending at over 40 million merchants.

Moonwell Card

Moonwell Card enables users to borrow against their crypto and spend globally without selling assets. It works with Apple Pay and Google Pay.

Common Questions about Web3 Neobanks

Are Web3 neobanks safe to use?

Most platforms use audited smart contracts, custodial and non custodial wallets, and regulatory compliance. Always review custody models and licenses.

Can I make onchain payments anywhere?

If the platform supports Visa or Mastercard, you can pay at most global merchants even though the value originates from crypto.

Do crypto payment cards trigger taxes?

Spending crypto may count as a disposal event in some countries. Users should check local tax rules.

Summary

A Web3 neobank blends the familiarity of a digital bank with the power of blockchain. With tools like crypto payment cards, stablecoin debit cards, defi yield accounts, and non custodial wallet access, users can spend, save, and earn entirely on-chain.

This financial model is unlocking a future where banking is global, open, and crypto native.

About OnFinality

OnFinality is a blockchain infrastructure platform that serves hundreds of billions of API requests monthly across more than 130 networks, including Avalanche, BNB Chain, Cosmos, Polkadot, Ethereum, and Polygon. It provides scalable APIs, RPC endpoints, node hosting, and indexing tools to help developers launch and grow blockchain networks efficiently. OnFinality’s mission is to make Web3 infrastructure effortless so developers can focus on building the future of decentralised applications.

App | Website | Twitter | Telegram | LinkedIn | YouTube

You May Also Like

Horror Thriller ‘Bring Her Back’ Gets HBO Max Premiere Date

While Shiba Inu and Turbo Chase Price, 63% APY Staking Puts APEMARS at the Forefront of the Best Meme Coin Presale 2026 – Stage 6 Ends in 3 Days!