Optimism DAO Passes OP Buyback Proposal With 84% Approval – What’s Next?

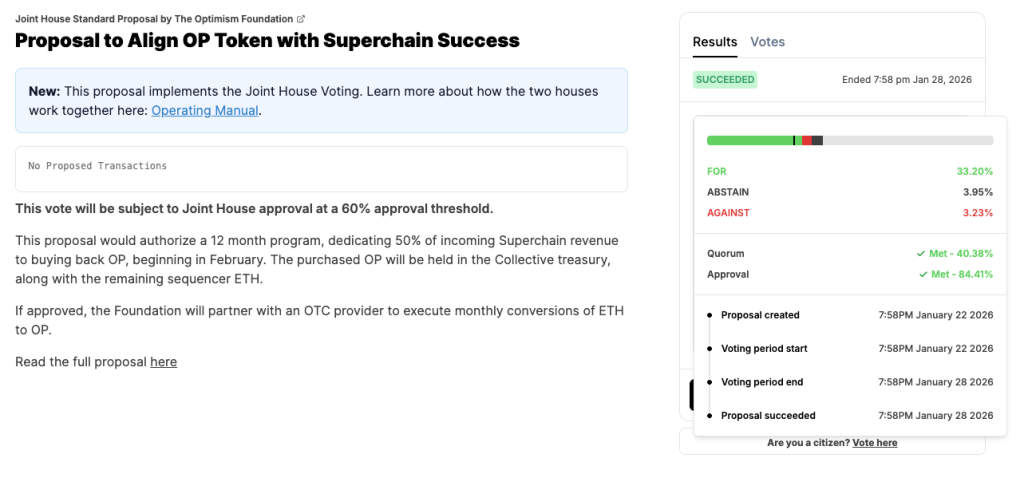

The Optimism Collective approved a proposal directing 50% of Superchain revenue toward monthly OP token buybacks with 84.4% support.

The 12-month program starting in February transforms OP from a pure governance token into one directly tied to sequencer revenue generated across Base, Unichain, Ink, World Chain, Soneium, and OP Mainnet.

Based on the 5,868 ETH collected over the past twelve months, the initiative would deploy approximately 2.7k ETH, or roughly $8 million at current prices, into open-market purchases executed through an OTC provider.

Purchased tokens flow back to the collective treasury, where they may eventually be burned, distributed as staking rewards, or deployed for ecosystem expansion as the platform evolves.

Source: Optimism

Source: Optimism

Revenue Mechanism Ties Token Demand to L2 Growth

The Foundation will partner with an OTC provider to execute monthly ETH-to-OP conversions within predetermined windows, regardless of price, beginning with January’s revenue in February.

According to the proposal, conversions pause if monthly revenue falls below $200,000 or if the OTC provider cannot execute under maximum allowable fee spreads, with any paused allocation rolling over to the following month.

All trades will be reported publicly through Optimism’s stats dashboard or the governance forum for transparency, with the Foundation publishing an execution dashboard tracking fills, pacing, pricing, and balances.

The remaining 50% of ETH revenue stays flexible for development, ecosystem growth, and shared infrastructure across the Superchain’s 30+ partners, reducing governance overhead that historically limited active treasury management.

While the program starts small, it scales with Superchain expansion, where every transaction across participating chains expands the buyback base and creates structural demand for OP tokens.

The mechanism operates on collected sequencer revenue from chains that contributed the full 5,868 ETH to a treasury managed by Optimism governance over the past year.

Foundation Sees Buybacks as First Step in Token Evolution

Optimism Foundation Executive Director Bobby Dresser framed the approval as a turning point for the token’s economic role.

“Governance approval of the buyback proposal marks an exciting first step in expanding the role of the OP token,” Dresser said.

“Optimism’s OP Stack is becoming the settlement layer for the next generation of financial systems, and this program will help align the OP token’s value with the success of the Superchain ecosystem.“

Speaking with Cryptonews, Dresser explained the strategic rationale behind the shift. “The goal of this proposal is to align the OP token directly with the success of the Superchain,” he said.

“Optimism earns real, growing revenue from Superchain usage, but historically, the OP token has only been used for governance. Buybacks create a direct link between Superchain demand and OP, making OP the shared instrument of the ecosystem.“

When asked what success looks like at the program’s conclusion, Dresser emphasized long-term infrastructure over short-term price action.

“Success to us means building an ecosystem that will last, which means putting the right infrastructure in place to create a new paradigm for Optimism and the OP token,” he said. “Ultimately, the governance community will decide if this should become a long-term mechanism.“

Implementation Begins Despite Governance Concerns

The proposal faced initial scrutiny from delegates concerned about bundling buyback authorization with expanded Foundation treasury discretion into a single vote.

GFXlabs urged splitting the two policy decisions, arguing that combining them prevented proper evaluation of each component and created risks that delegates might approve treasury management authority primarily because of expected price appreciation from buybacks.

Delegates also raised concerns about the OTC execution strategy, with critics arguing that off-chain purchases lack transparency, create corruption risks, and signal that Optimism cannot support basic trading activity on its own DeFi infrastructure.

Some community members proposed that on-chain execution would better align with the network’s decentralized ethos and provide necessary transparency to prevent potential conflicts of interest.

Despite these concerns, the proposal passed Special Voting Cycle #47 under Joint House approval at the required 60% threshold, clearing the way for immediate implementation.

Initial operations will be executed by the Foundation under predetermined parameters, eliminating discretion, with the mechanism potentially moving increasingly on-chain through Protocol Upgrade 18, which ensures all sequencer revenue from OP Chains gets collected without Foundation involvement.

Notably, the program comes as buyback mechanisms proliferate across crypto, though with mixed results.

Jupiter recently questioned whether to continue its $70 million buyback program after JUP fell nearly 90% from early-2024 highs, while Helium halted HNT buybacks despite generating $3.4 million in monthly revenue, with both projects finding that supply dynamics consistently overwhelmed demand.

You May Also Like

Cashing In On University Patents Means Giving Up On Our Innovation Future

Trump foe devises plan to starve him of what he 'craves' most