Ethereum (ETH) Price: Can Bulls Hold $2,700 After $416 Million Liquidation Event?

TLDR

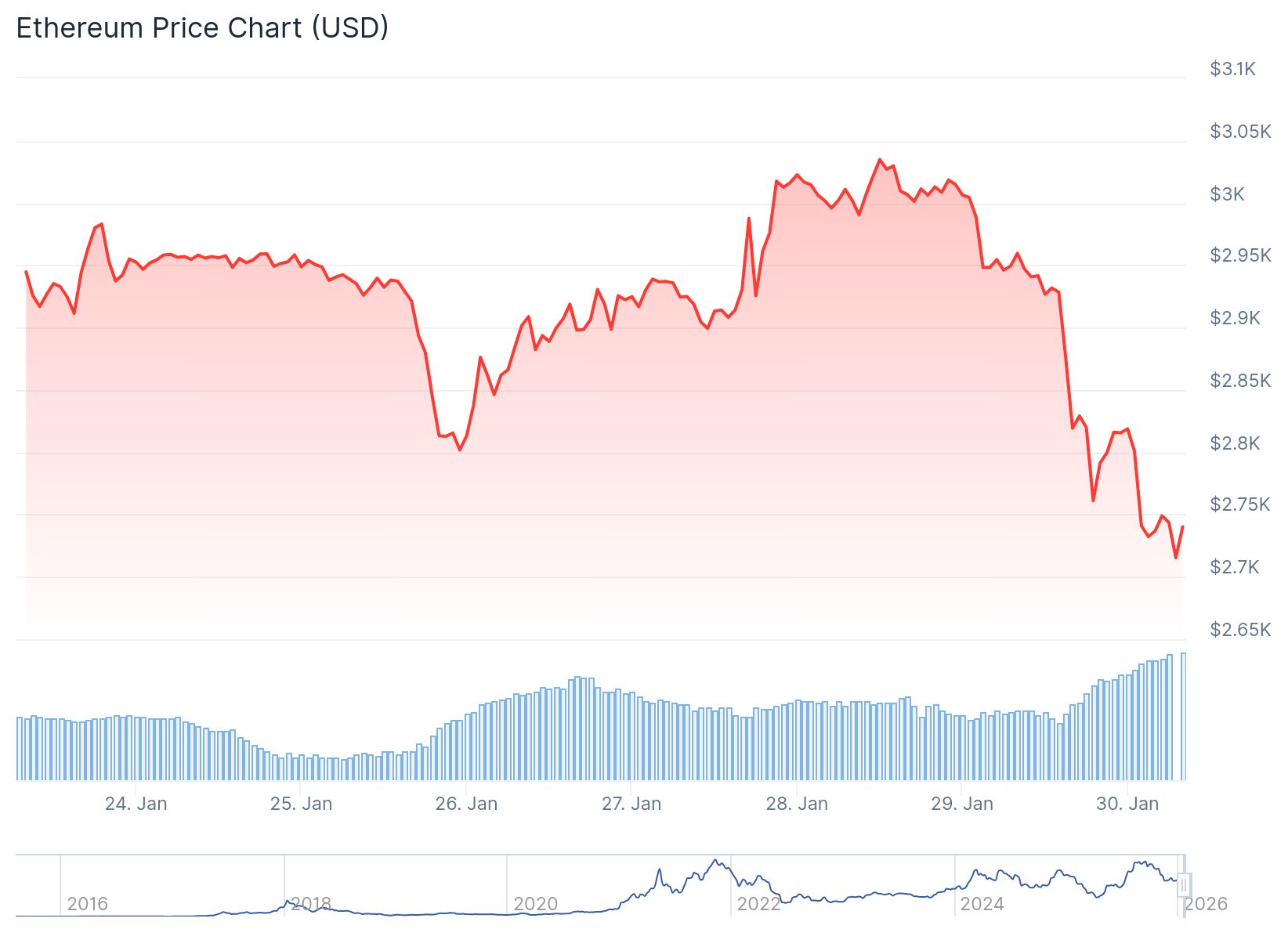

- Ethereum price dropped 10% after failing to break above $3,050, falling to a low of $2,680

- ETH is currently trading around $2,730 and struggling to hold the $2,700 support level

- The DAO Security Fund launched with over $200 million from unclaimed 2016 hack refunds to improve Ethereum security

- Over $416 million in Ethereum liquidations occurred in the past 24 hours, with $391 million in long positions

- Key resistance sits at $2,820 with a bearish trend line, while immediate support is at $2,700

Ethereum price experienced a sharp decline this week, dropping 10% after failing to maintain levels above $2,880. The cryptocurrency fell to a low of $2,680 before stabilizing around $2,730.

Ethereum (ETH) Price

Ethereum (ETH) Price

The price movement follows a rejection at the $3,050 resistance level. ETH broke below the $2,820 support zone and continued falling through $2,750.

Currently, Ethereum is trading below the $2,800 mark and the 100-hour Simple Moving Average. A steep bearish trend line has formed with resistance at $2,820 on the hourly chart.

The past 24 hours saw $416.8 million in liquidations across Ethereum positions. Long liquidations accounted for $391 million of this total, according to Coinglass data.

Source: Coinglass

Source: Coinglass

Bulls are now defending the $2,700 support level. The price briefly broke below this level before recovering slightly. The 23.6% Fibonacci retracement level from the recent decline provides minimal support.

The DAO Security Fund Initiative

Developer Griff Green announced the launch of The DAO Security Fund this week. The fund will use over $200 million in unclaimed funds from the 2016 DAO hack to support Ethereum security initiatives.

These funds were originally set aside to refund victims of the infamous 2016 hack. The value has grown from $6 million in 2016 to over $200 million today.

Green stated the fund will support security improvements including wallet user experience, incident response, Layer 2 and bridge security, and core protocol security.

The Ethereum Foundation’s “Trillion Dollar Security” initiative will guide funding rounds. Distribution will occur through quadratic funding, retroactive funding, and rank-choice voting mechanisms.

Technical Outlook

Immediate resistance for Ethereum sits at $2,765, followed by the key $2,820 level where the bearish trend line is positioned. The next major resistance is at $2,860.

A clear move above $2,860 could push the price toward $2,900 and potentially $3,000. However, if bulls fail to defend $2,700, the next support level is at $2,680.

A break below $2,680 could send Ethereum toward $2,625, which previously served as support during November’s price decline. Further downside targets include $2,550 and $2,500.

The Relative Strength Index is trending downward below neutral levels. The Stochastic Oscillator is in oversold territory, indicating strong bearish momentum but also suggesting a potential short-term reversal.

The fund will stake 70,500 ETH from an Extrabalance contract and 4,600 ETH from DAO and ETH tokens. Curators include Ethereum co-founder Vitalik Buterin, MetaMask’s Taylor Monahan, and Dappnode’s Pol Lanski.

The 2016 DAO hack resulted in a hard fork that split Ethereum into the main chain and Ethereum Classic. The DAO had raised about $150 million worth of ETH before the exploit occurred.

The post Ethereum (ETH) Price: Can Bulls Hold $2,700 After $416 Million Liquidation Event? appeared first on CoinCentral.

You May Also Like

Trump MAGA statue has strange crypto backstory

ABC Also Pulled Jimmy Kimmel’s Predecessor After Controversial Comments