Archaeology 2024: The top ten Bitcoin whales that "reappeared" in the world: the highest transfer exceeded 1,000 BTC, and the lowest cost was less than $1

Original article: Bitquery

Compiled by: Yuliya, PANews

In 2024, the Bitcoin blockchain once again brought an unexpected surprise - multiple Bitcoin wallets that had been inactive for more than a decade suddenly restarted. These wallets had been silent for many years, and suddenly transferred a large amount of Bitcoin, which aroused widespread attention and discussion in the cryptocurrency field. The market has a lot of speculation about why these wallets were reactivated, especially those involving large transactions.

As we enter 2025, these reactivated wallets not only remind the market of the long-term value of Bitcoin, but also highlight that the Bitcoin network can still bring unpredictable dynamics after many years. This article will focus on analyzing the top ten most influential Bitcoin whale wallet reactivation cases, deeply explore the multiple possible reasons behind these activities, and analyze how they can potentially affect market sentiment, pricing, and the dynamic development of the entire crypto ecosystem.

What is a dormant wallet?

Dormant wallets refer to Bitcoin addresses that have not had any transactions or fund transfers for a long time, usually for many years or even more than a decade. These wallets remain dormant for a long time, neither accepting new funds nor transferring assets.

When such wallets suddenly become active and move funds, there is a lot of interest in the market as to why they became active. This could be because the holder has recovered a lost private key, or because of a change in ownership, or because the holder has decided to take advantage of their accumulated Bitcoin wealth.

Such situations typically cause market volatility and can affect the price of Bitcoin, while also sparking speculation about the identity of the wallet holder and the story behind it.

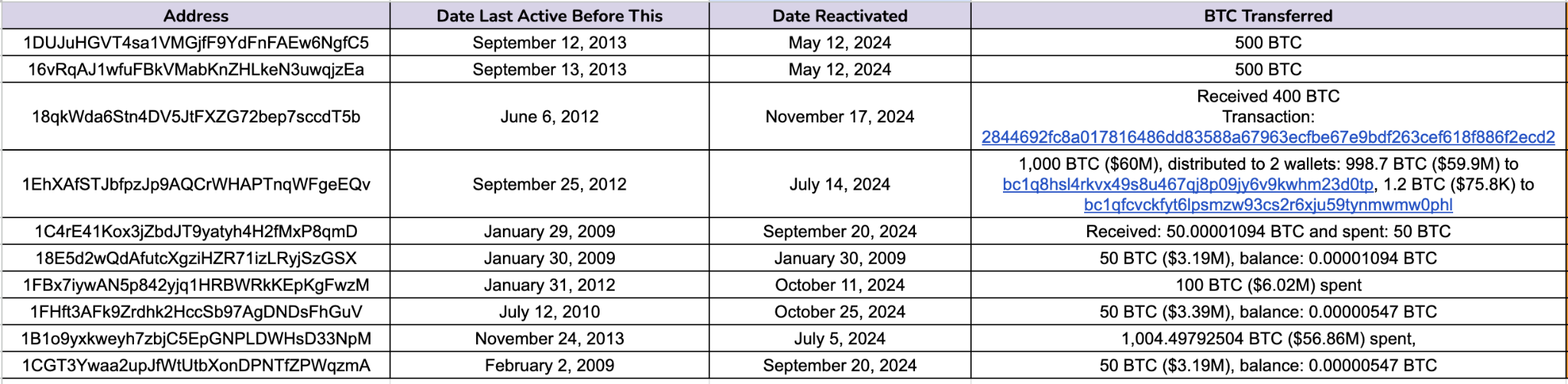

Analysis of Important Wallet Reactivations in 2024

In 2024, the market was highly concerned about the reactivation of multiple dormant Bitcoin wallets, which had remained dormant for more than a decade until they suddenly made large transactions last year.

The following are some of the most representative dormant wallet activation events in 2024, analyzed by transaction amount.

High value transfer case (1,000+ BTC)

- 1. Address : 1EhXAfSTJbfpzJp9AQCrWHAPTnqWFgeEQv

Last active : September 25, 2012

Reactivation date : July 14, 2024

Transaction Hash : 26b443120d7eb8ea65ff9028d2285d57d258aabe742d4eae320f83ca856c6bd3

Total income : 1,000 BTC (about $12,000 at the time)

Total payout : 1,000 BTC (approximately $60 million at time of transfer)

Final balance : 0 BTC

analyze :

The wallet had been dormant since September 2012 until July 14, 2024, when it suddenly transferred 1,000 BTC to two new addresses. This suggests that the wallet holder may have regained access or decided to sell or reallocate assets. In terms of time, the wallet held Bitcoin at a price of about $12.06 per unit, which means the value of this transaction has increased by nearly 5,000 times. This transfer is considered a typical whale wallet transaction and may have a certain impact on market sentiment.

- 2. Address : 1B1o9yxkweyh7zbjC5EpGNPLDWHsD33NpM

Last active : November 24, 2013

Reactivation time : July 5, 2024

Transaction hash : 516b62b3a7317e519f80d4251cd58dc1aa55dbba40956658542f7a71069824c8

Total income : 1,004 BTC (about $737,000 at the time)

Total payout : 1,004 BTC (approximately $57 million at time of transfer)

Final balance : 0 BTC

analyze :

After lying dormant for 10.6 years, the wallet transferred all 1,004 BTC to a new address on July 5, 2024. The purchase cost of Bitcoin was about $731, and the transfer amount increased by nearly 78 times compared to the original cost. This may indicate that the holder plans to cash out, consolidate funds, or reallocate Bitcoin assets.

Medium value transfer use case (100-500 BTC)

- 3. Address : 16vRqAJ1wfuFBkVMabKnZHLkeN3uwqjzEa

Last active : September 13, 2013

Reactivation date : May 12, 2024

Transaction hash : e1c74b4d915589a5f14216d3f4587e54d6920d3885e289e54b8ae09099917760

Total income : 500 BTC (about $62,000 at the time)

Total expenditure : 500 BTC (approximately $30.45 million at the time of transfer)

Final balance : 0 BTC

analyze :

The wallet was reactivated after 10.7 years of dormancy, transferring 500 BTC, worth more than $30 million. Its initial funding came from the purchase of Bitcoin at a price of about $124 in 2013. The simultaneous activation of wallets suggests that this may be an operation of multiple addresses of the same holder, which may be used to merge or liquidate assets.

- 4. Address : 1DUJuHGVT4sa1VMGjfF9YdFnFAEw6NgfC5

Last active : September 12, 2013

Reactivation date : May 12, 2024

Transaction hash : a5d5e5139cb4c2b1833dfb428913a6560129f72252cec0173d730bdce99a0e1f

Total income : 500 BTC (about $62,000 at the time)

Total expenditure : 500 BTC (approximately $30.45 million at the time of transfer)

Final balance : 0 BTC

analyze :

This wallet was activated and completed transactions at the same time, showing a correlation with the 16vRqAJ wallet. This further proves that these addresses may belong to the same entity or individual, and decided to move assets synchronously when market conditions were favorable.

- 5. Address: 18qkWda6Stn4DV5JtFXZG72bep7sccdT5b

Last active: June 6, 2012

Reactivation date: November 17, 2024

Transaction Hash: 2844692fc8a017816486dd83588a67963ecfbe67e9bdf263cef618f886f2ecd2

Total income : 400 BTC (about $2,180 at the time)

Total expenditure: 399 BTC (about $27.17 million at the time of transfer)

Final balance: 1 BTC

Analysis: The wallet was reactivated after being dormant for 12 years, and most of the bitcoins were allocated to the new wallet and Bitstamp exchange, of which 299 BTC were transferred to the new wallet and 100 BTC were transferred to the exchange. From the initial purchase price to now, the value has increased by more than 12,000 times. The part transferred to the exchange may be used for cash, while the bitcoins retained in the new wallet may be held for a long time.

- 6. Address: 1FBx7iywAN5p842yjq1HRBWRkKEpKgFwzM

Last active : January 31, 2012

Reactivation date: October 11, 2024

Transaction hash: 7eb801033c9202dd8501c5b7492467f5342f6cf98d9686d45e6700a60e95cada

Total income: 100 BTC (about $551 at the time)

Total expenditure: 12 BTC (about $722,000 at the time of transfer)

Final balance: 88 BTC

analyze:

The wallet was reactivated after 12.7 years of dormancy and only part of its holdings were transferred, with 12 BTC (about $722,000) transferred to three new wallets in a ratio of 5 BTC, 5 BTC, and 2 BTC. In January 2012, when the price of Bitcoin was $5.51, the wallet was initially credited with 100 BTC (about $551), and then the value increased significantly. It is worth noting that the wallet still retains 88 BTC (about $5.28 million), indicating that this may be a strategic partial transfer rather than a complete liquidation.

Small fluctuations (>100 BTC)

- 7. Address: 1C4rE41Kox3jZbdJT9yatyh4H2fMxP8qmD

Last active: January 29, 2009

Reactivation time: September 20, 2024

Transaction hash: 8bee6dbdbc09253ffbe51e35a910ef39428fc2ca05aa39ce0f1adaebbf8f2cfe

Total income: 50.00001094 BTC (about $0.16 at the time)

Total expenditure: 50 BTC (approximately $3.19 million at the time of transfer)

Final balance: 0.00001094 BTC (~0.64 USD)

analyze:

This is an early miner wallet that received block rewards shortly after the creation of the Bitcoin network. After 15.7 years of inactivity, it was reactivated and almost all funds were transferred, leaving only a very small balance. From an initial value of $0.16 to $3.19 million, the reactivation of this wallet indicates that early miners may have taken strategic actions.

- 8. Address: 1CGT3Ywaa2upJfWtUtbXonDPNTfZPWqzmA

Last active: February 2, 2009

Reactivation time: September 20, 2024

Transaction hash: d52f4890ac3f0cf699e3187b08ba6376c4d6efbe53add15bbcc3b96b604ecec7

Total income: 50.00000547 BTC (about $0.06 at the time)

Total expenditure: 50 BTC (approximately $3.19 million at the time of transfer)

Final balance: 0.00000547 BTC (~0.32 USD)

analyze:

The wallet was activated after being dormant for 15.6 years, and almost all funds were transferred to a new address. As a wallet of an early participant in the Bitcoin network, its transfer behavior may be due to security considerations or cash needs. This transaction once again confirms that the activity of early Bitcoin holders in 2024 is increasing.

- 9. Address: 1FHft3AFk9Zrdhk2HccSb97AgDNDsFhGuV

Last active: July 12, 2010

Reactivation date: October 25, 2024

Transaction Hash: 86df0c812d1d72d32f1169bdf1216e5d3ed862f7dee91a3b5e77646c185419aa

Total income: 50.00000547 BTC (about $0.17 at the time)

Total expenditure: 50 BTC (about $3.39 million at the time of transfer)

Final balance: 0.00000547 BTC (~0.32 USD)

analyze:

The wallet became active again after 14.3 years, and the funds were dispersed and transferred to two new addresses. This decentralized transfer strategy may be for risk management or fund planning considerations.

- 10. Address: 18E5d2wQdAfutcXgziHZR71izLRyjSzGSX

Last active: January 30, 2009

Reactivation date: September 20, 2024

Transaction Hash: 6ce746e19b16f84abc6f5344225050a5b16e3d56aac72e0b7bd642c53c13716d

Total income: 50.00001094 BTC (about $0.31 at the time)

Total expenditure: 50 BTC (about $3.19 million at the time of transfer)

Final balance: 0.00001094 BTC (~0.64 USD)

Analysis: This early miner wallet was reactivated after being dormant for 15.6 years, and the main funds were transferred to a new wallet. The value increased from the initial $0.31 to $3.19 million. The transfer of funds may be due to multiple considerations, including preparing for cashing out or strengthening asset security.

Key insights

In 2024, similar phenomena occurred on the Bitcoin blockchain several times, with several long-dormant early wallets becoming active. These wallets received funds when Bitcoin was worth only a few cents, and now it has appreciated to millions of dollars, and each transfer has become a hot topic in the cryptocurrency market.

Looking at where these large transfers are going, we can see that some of the funds are going to new Bitcoin addresses, and a significant amount is being transferred to exchanges. These movements may indicate that the funds are about to be liquidated or redistributed. The reasons that prompted these early holders to take action may include regaining access to private keys, changes in ownership, or simply deciding to realize a return on investment after waiting for many years.

The awakening of these dormant wallets not only demonstrates the durability of Bitcoin as a store of value, but also reveals many interesting stories hidden in the early history of Bitcoin. Even after 15 years of development, the Bitcoin ecosystem is still full of amazing stories, and the activities of these early participants continue to influence the development of the current market.

You May Also Like

Cashing In On University Patents Means Giving Up On Our Innovation Future

Trump foe devises plan to starve him of what he 'craves' most