Digital Asset Outflows Hit $1.7B as Investor Sentiment Deteriorates

Digital asset investment products recorded $1.7 billion in weekly outflows, marking a second consecutive week of net redemptions and pushing year-to-date flows to a net outflow of $1.0 billion, according to data from CoinShares.

The sustained selling pressure has contributed to a $73 billion decline in total assets under management (AuM) since the market’s peak in October 2025.

The latest figures point to a broad-based deterioration in sentiment across regions and assets, with outflows heavily concentrated in the United States and led by Bitcoin and Ethereum products.

Regional Flows Show US-Dominated Selling Pressure

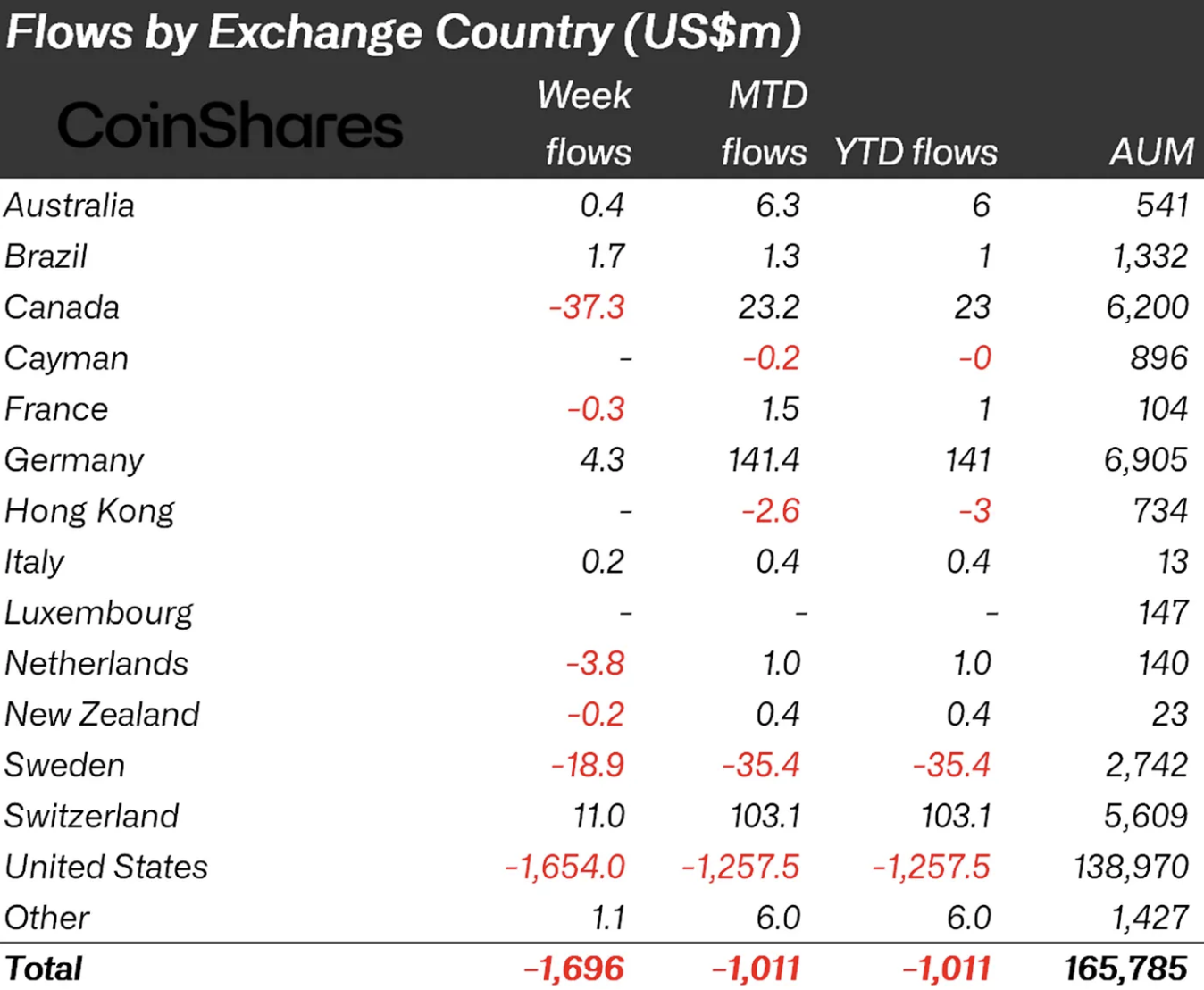

Outflows during the week were overwhelmingly concentrated in the United States, which accounted for $1.65 billionof the total redemptions. Negative sentiment was also evident in other major markets, including Canada, which recorded $37.3 million in outflows, and Sweden, which saw $18.9 million exit digital asset products.

Source: https://researchblog.coinshares.com/volume-271-digital-asset-fund-flows-weekly-report-5ef571b816e5

Source: https://researchblog.coinshares.com/volume-271-digital-asset-fund-flows-weekly-report-5ef571b816e5

By contrast, only very modest inflows were observed in Switzerland ($11.0 million) and Germany ($4.3 million), highlighting the lack of strong regional demand to offset US-led selling. Across exchange countries, weekly flows were broadly negative, reinforcing the view that the pullback is global rather than localized.

Bitcoin and Ethereum Lead Asset-Level Outflows

At the asset level, Bitcoin products experienced $1.32 billion in weekly outflows, making them the primary driver of the overall decline. Ethereum products followed with $308 million in outflows, confirming that selling pressure extended across the two largest digital assets.

Previously resilient altcoin products also saw renewed weakness. XRP recorded $43.7 million in weekly outflows, while Solana saw $31.7 million exit investment vehicles. Multi-asset products declined by $13.5 million, reflecting reduced appetite for diversified crypto exposure.

Despite the broad risk-off tone, Short Bitcoin products stood out, attracting $14.5 million in inflows during the week and posting a year-to-date increase in AuM of 8.1%, suggesting increased use of defensive or hedging strategies.

Provider Data Highlights Institutional De-Risking

Flows by provider further underscore institutional caution. iShares recorded $1.19 billion in weekly outflows, while Grayscale saw $300 million and Fidelity $197 million exit their products. ARK 21Shares also posted notable redemptions of $70 million for the week.

In contrast, ProFunds Group saw $139 million in weekly inflows, and Volatility Shares recorded $61 million, indicating selective positioning toward defensive or volatility-linked products rather than directional exposure.

Hype Products Offer a Narrow Bright Spot

While sentiment remained negative across most categories, Hype investment products emerged as a limited exception, recording $15.5 million in inflows. According to the provided commentary, these inflows were linked to heightened on-chain activity in tokenised precious metals, which temporarily attracted capital despite broader market weakness.

Market Interpretation

The combination of persistent US-led outflows, broad asset-level redemptions, and rising interest in short and defensive products suggests that investors are actively reducing risk rather than repositioning for immediate recovery. CoinShares attributes the shift to several overlapping factors, including a more hawkish US Federal Reserve leadership, cycle-related whale selling, and elevated geopolitical uncertainty.

Since the October 2025 highs, the cumulative impact has been a $73 billion contraction in digital asset AuM, reinforcing the extent of the ongoing de-risking phase.

The post Digital Asset Outflows Hit $1.7B as Investor Sentiment Deteriorates appeared first on ETHNews.

You May Also Like

‘One Battle After Another’ Becomes One Of This Decade’s Best-Reviewed Movies

Best Crypto to Buy as Saylor & Crypto Execs Meet in US Treasury Council