Cryptos Stage Recovery But Prediction Markets Signal Extended Downturn

Following a weekend sell-off that briefly dropped values below $75,000 on Monday, Bitcoin has staged a modest recovery, trading at $78,989 as of Tuesday morning, up 1.7% over the past 24 hours, per Coinmarketcap data.

Ethereum and Solana have posted similar gains, rising 2.4% to $2,351 and 1.5% to $104, respectively. The total crypto market cap now stands at $2.65 trillion, reflecting a 1.19% increase despite heavy liquidations overnight.

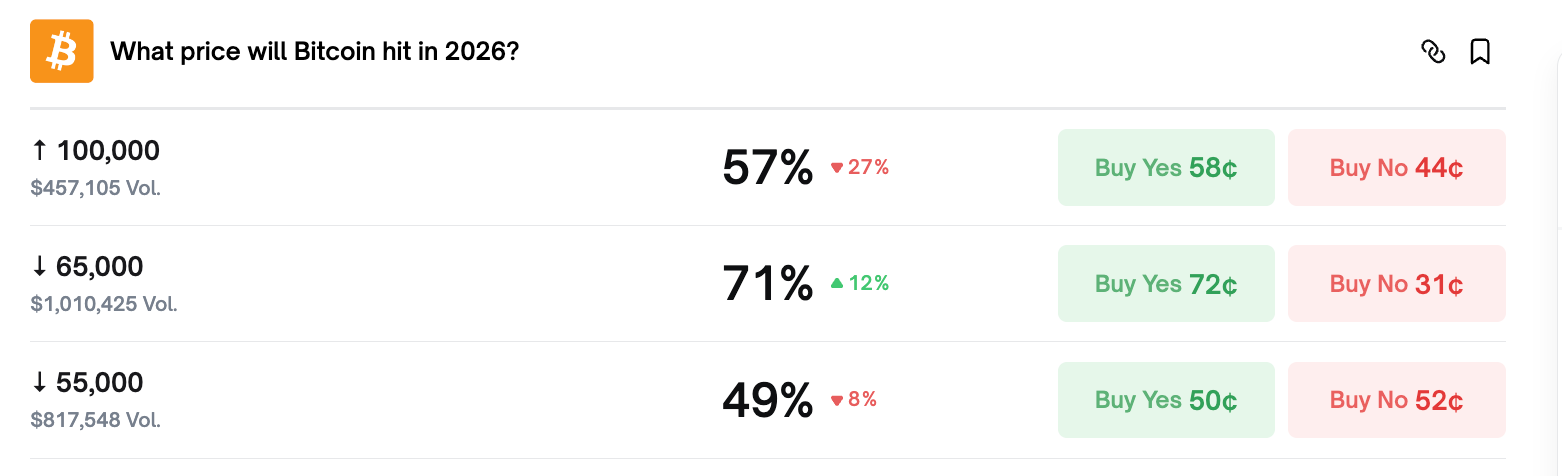

However, recent developments in prediction markets suggest the recovery may be short-lived, with traders maintaining an increasingly gloomy outlook for Bitcoin's near-term trajectory. On Monday, Polymarket recorded approximately $1 million in trading volume related to Bitcoin price predictions, with the probability of the cryptocurrency falling below $65,000 in 2026 surging to 71%. This represents a significant shift in market sentiment, as traders position themselves for what many now view as an inevitable correction even as prices edge higher.

Considerable bets were placed on Bitcoin's anticipated decline below $55,000 and its subsequent recovery to $100,000 by year's end, with estimated probabilities of 40% and 57%, respectively. The willingness of traders to simultaneously bet on both extreme downside and eventual recovery suggests market participants are preparing for significant volatility ahead.

The dramatic increase in bearish positions marks a notable change in market mood. Bitcoin has now erased all gains made following US President Donald Trump's victory in the November 2024 election, a period that had initially sparked optimism about crypto-friendly regulatory policies. The reversal has caught many investors off guard, particularly those who had banked on the new administration's stated support for digital assets.

Adding to concerns, Bitcoin prices briefly fell below $76,037 – the average acquisition cost for Strategy, the publicly traded company led by Michael Saylor that serves as the largest corporate holder of Bitcoin globally with over 500,000 BTC. This milestone, achieved for the first time since late 2023, raises questions about the sustainability of the aggressive accumulation strategy that has made Strategy synonymous with institutional Bitcoin investment.

Market analysts point to widespread pessimism about Bitcoin's prospects as a contributing factor to the recent cryptocurrency sell-off. Technical indicators are also flashing warning signs. According to data from CryptoQuant, Bitcoin dropped below its 365-day moving average in November 2025, a pattern that historically has signaled the beginning of more prolonged market downturns. This technical breakdown has accelerated selling pressure as algorithmic traders and momentum-based investors exit positions.

If Bitcoin does fall below $65,000 this year, it would directly contradict the forecasts of leading banks and financial institutions that had projected continued growth. Late last year, Grayscale Investments predicted that Bitcoin could exceed $126,000 by June 2026, citing increasing institutional interest and the prospect of more defined regulatory frameworks in the United States. Goldman Sachs and JP Morgan had similarly issued bullish outlooks, making the current downturn all the more surprising to traditional finance observers.

The bearish sentiment reflected in Polymarket's prediction markets comes as the platform itself faces mounting legal challenges. A recent court ruling from Nevada prohibited the platform's event contracts, citing concerns about illegal wagering activities. Tennessee and several other states have implemented similar regulatory actions, creating uncertainty about the platform's future operations in key markets.

These legal headwinds for Polymarket add another layer of complexity to interpreting the prediction market data, as reduced liquidity and geographic restrictions could be affecting the accuracy of probability assessments. Nevertheless, the consensus among remaining traders appears decidedly negative on Bitcoin's short-term prospects.

The current market dynamics present a stark contrast to the euphoria that characterized the crypto sector just months ago, raising fundamental questions about the sustainability of Bitcoin's long-term value proposition in an environment of tightening global liquidity and increased regulatory scrutiny.

You May Also Like

Fed Decides On Interest Rates Today—Here’s What To Watch For

While Shiba Inu and Turbo Chase Price, 63% APY Staking Puts APEMARS at the Forefront of the Best Meme Coin Presale 2026 – Stage 6 Ends in 3 Days!